AAA Renters Insurance Review: Pros & Cons, Pricing, and Features

Studenomics Score: 4.5 Out of 5 Stars

Advertiser Disclosure: Our content is free because we are supported by advertisers. If you click on links in this post, we may earn a commission.

We all know what it’s like to struggle to find the perfect renter’s insurance policy. You want something that’s ideal for your situation without costing you a fortune.

You're probably wondering, 'Does AAA have renters insurance?'

AAA Renters Insurance may be the perfect company for you if you’re looking to bundle your auto and renters insurance together with comprehensive coverage.

Renters Insurance AAA promises hassle-free claims and rock-solid insurance policies.

We took a detailed look at AAA Renters Insurance Quotes to provide a proper review.

Keep on reading for our AAA Renters Insurance Review...

Highlights:

Overview:

AAA has been offering insurance products and other services since 1902. The membership perks are very helpful for drivers.

Known for:

- Being around for over a century.

- Exclusive membership perks.

- Hassle-free claims and reliability.

Financial Rating:

AAA is rated A for financial strength by A.M Best.

Who is AAA?

The American Automobile Association (AAA) Insurance has been around since 1902 serving members across the nation.

AAA is a not-for-profit member association serving over 60 million members across North America with unique perks ranging from roadside assistance to insurance.

AAA offers a variety of insurance products (life, auto, property, and travel) across North America.

They're actually mainly known for their 24/7 roadside assistance. I've personally been bailed out a few times by them when my car wouldn't start.

This is why we wanted to see what Triple AAA Renters Insurance was like.

AAA CONTACT INFO

Website: www.aaa.com

Phone: 833-425-0320

Address: 000 Aaa Dr, Lake Mary, FL Heathrow, Florida 32746 United States

How Does AAA Renters Insurance Work?

AAA is known for its membership perks, but the company has also expanded into various insurance offerings.

You may be wondering if it’s worth trusting them with your insurance needs.

The good news is that you don't have to be a member to obtain a quote.

Bundle and Save Up to 50%

Save up to $850/year by bundling renters with car insurance. Quick Online Quotes. Compare & Save 50% on: Auto, Motorcycle, Home, Condo, & Renter.

It's free to apply!

Is AAA Renters Insurance Good?

We looked over the policy options and were pleasantly surprised.

We were also impressed by how helpful the official website is with renters insurance coverage.

The helpful website is a huge advantage because we understand how stressful it can be to shop around for renter's insurance.

You want to know that you're getting a fair policy that won't cost you a fortune.

Is AAA Renters Insurance legit?

Is AAA Renters Insurance Legit? We looked through reviews and financial information to see if the company offered what they said they did.

According to the official website:

“AAA has provided reliable insurance coverage for decades, with agents who work with you to settle claims quickly and completely. We offer personalized renters insurance quotes, so you get the policy you need for an affordable price, typically $100 to $300 per year.”

Let’s take a look at their finances and what the reviews say to see if they can back that claim up.

Our editor's scores for our AAA Renters Insurance Review pricing, customer service, policy options, and financial stability:

Studenomics Score: 4.5 Out of 5 Stars

PRICING SCORE: 4 Out of 5

How Much Does AAA Insurance Cost?

We know how important the cost and value is when you’re deciding on which renters insurance company to work with. This is why we looked through the costs for you.

Renters Insurance Starting at $5/month

No brokers, no paperwork, get a policy in seconds. Zero Hassle, zero paperwork, zero worry. Join now! Starting at $5/month.

It's free to apply!

How Much Is AAA Renters Insurance?

How much is AAA Renters Insurance? They claim that you can obtain a policy for an annual rate of $100-300.

The obvious issue with obtaining renters insurance quotes is that there are many factors involved with your rate (discussed later).

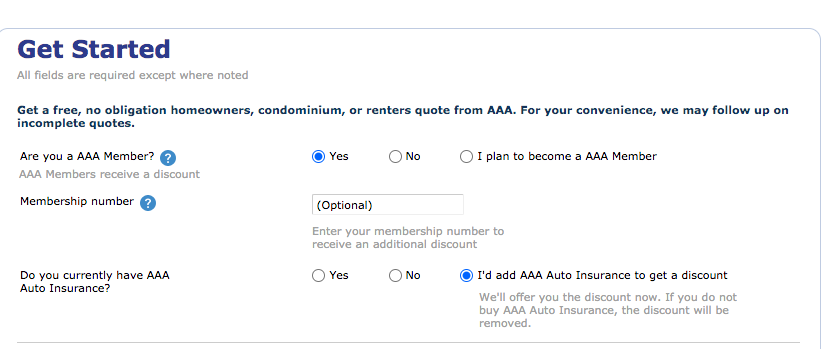

This will be the screen that you see me when you apply for a quote. As you can see, membership is encouraged.

AAA Renters Insurance Quotes.

We looked into obtaining quotes to see what the rates are like across North America.

You’ll be prompted with your membership status. You don’t have to be a member to get a quote.

Renters insurance AAA will ask about the following:

- Any claims you've made in the last few years.

- If you have any dangerous animals.

- If you’re close to costal waters.

- If you conduct any business.

- If there’s a fire hydrant near you.

- If you want to bundle insurance.

The only reason that we can't give them a perfect 5 for pricing is because you have to apply for a quote and then wait for a local agent to contact you. We understand that some people would like a quicker process.

The good news is that an agent will call you immediately. After applying for a quote, I had a phone call within an hour with a customized policy.

Pro Renters Insurance Tip

Renters insurance doesn't just cover the replacement of your belongings, but also protects you if someone gets hurt on your property. Limits usually start at $100,000.

Is The AAA Renters Insurance Cost Worth It?

Is AAA Renters Insurance worth the cost?

The basic policy will come with $15,000 in personal property coverage and $500,000 in personal liability so that’s a decent amount of protection. This is more than what you would typically find since many insurance companies start at $10,000.

You can also change your deductible between $200-500. The goal is to find a policy and price point that suits your lifestyle.

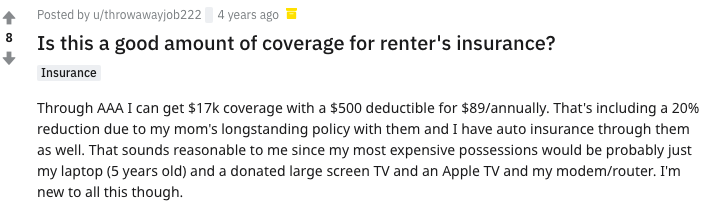

This one Renters Insurance AAA comment on Reddit regarding the pricing stuck out to us when looking around.

This AAA Renters Insurance Reddit user was able to take advantage of discounts and get renter's insurance for only $89. That works out to be less than $8/month.

While there are definitely cheaper options out there, we would say that AAA is worth the cost.

If you drive and want to become a member, AAA is definitely worth the cost as you'll have 24/7 service. We all know someone who has been bailed out by AAA.

Can I Bundle My Renters Insurance AAA With My Auto Insurance?

The good news is that AAA home renters Insurance specializes in auto insurance so it’s actually encouraged that you bundle your insurance by becoming a member.

Studenomics Pricing Score: 4 out of 5

Bundle and Save Up to 50%

Save up to $850/year by bundling renters with car insurance. Quick Online Quotes. Compare & Save 50% on: Auto, Motorcycle, Home, Condo, & Renter.

It's free to apply!

CUSTOMER SERVICE SCORE: 5 Out of 5

How is AAA's Reputation for Service?

We looked through Glassdoor, BBB, and Reddit to see what regular people had to say about AAA Insurance. In our experience, these are the best indicators of how a company actually operates.

We mainly gave Renters Insurance AAA a 5 for customer service because they have local agents across North America that will be there to assist you.

We also found many glowing reviews about the service online from regular folks.

BBB Rating: A+

Number of Ratings: Scattered (the company has branches and agents around North America)

Glassdoor Rating: 46% would recommend

Number of Ratings: 1.5k

Reddit Sentiment: Positive

Number of Comments: We were able to find many positive discussions about AAA as a company.

AAA Renters Insurance Reddit Feedback

We searched up AAA Renters Insurance Reddit to see what kind of feedback we could find from regular folks who were discussing this insurance brand.

Here's one Reddit AAA Renters Insurance conversation that stuck out...

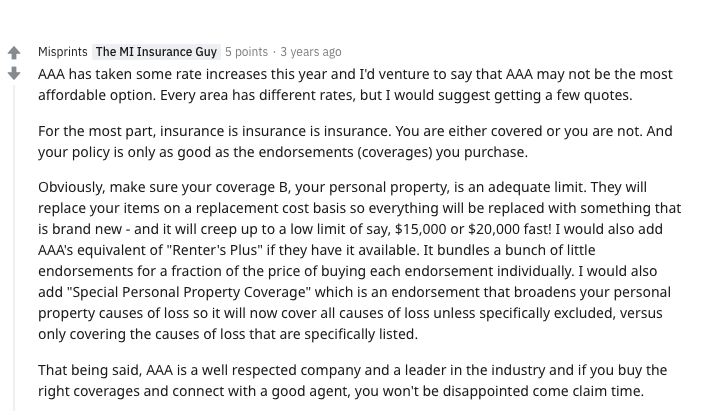

This comment summarizes what we often stress about renters insurance. You have to shop around since insurance varies depending on your living situation.

It looks like many people have had positive experiences with AAA.

Notable Quote From Benzinga about AAA Insurance Renters:

"When it comes to getting the best products for the lowest price, look to the masses. AAA knows the power of numbers. Using its numbers knowledge, AAA flexes its muscle to get its members the best coverage for the lowest rate. When it comes to covering your personal property, covering your assets and protecting your finances, AAA is kingpin. And being one of the gang is a benefit."

Renters Insurance Starting at $5/month

No brokers, no paperwork, get a policy in seconds. Zero Hassle, zero paperwork, zero worry. Join now! Starting at $5/month.

It's free to apply!

How Do You File a AAA Renters Insurance Claim?

How do you file a claim with AAA Renters Insurance? The steps are clearly outlined by the official AAA Insurance Renters page

Notify your landlord and the authorities of any losses/damages.

Contact your insurance agent to see if you’re covered. You should have your policy number and information about the incident.

Write down all of your losses. What was damaged or stolen?

Complete the claims form along with any receipts that you may have.

Submit your claims form.

You’ll be notified by an agent of the next steps to take here.

If you have any problems you can always use the general AAA Renters Insurance Phone Number at (833) 425-0320.

Studenomics Customer Service Score: 5 out of 5

POLICY OPTIONS SCORE: 5 Out of 5

What Does AAA Renters Insurance Coverage Include?

Bundle and Save Up to 50%

Save up to $850/year by bundling renters with car insurance. Quick Online Quotes. Compare & Save 50% on: Auto, Motorcycle, Home, Condo, & Renter.

It's free to apply!

What Isn’t Covered By My AAA Renter's Insurance Policy?

It’s important to know what’s not covered by your renter’s insurance so that you don’t find yourself in a financial mess.

Damage caused by flooding isn’t covered by your standard policy. You have to speak with an agent to add this.

You’ll also likely have to purchase additional AAA Renters Insurance coverage for an Earthquake.

Finally, we always urge you to look into your personal property coverage to ensure that you have enough protection for your situation.

Can I Add My Roommate?

Your roommate will have to get their own renters insurance policy to ensure that they’re protected.

Highlights | Lemonade | State Farm |   Progressive |

|---|---|---|---|

Cost | Starting at $8/mth | Starting at $5/mth | Starting at $13/mth |

Personal Property Coverage (Starts At:) | $15,000 | $10,000 | $20,000 |

A.M. Best Rating (Financial Strength) | A | N/A | A+ |

BBB Rating | A+ | B+ | A |

Claims Process | Hassle-free | Excellent | Good |

Best for: | Membership perks | Quick online purchasing | Lowest Cost |

Studenomics Rating | 4.5 Stars | 4.75 Stars Read Full Review | 4.6 Stars Read Full Review |

Cell | Cell | Cell | Cell |

Studenomics Policy Options Score: 5 out of 5

Renters Insurance Starting at $5/month

No brokers, no paperwork, get a policy in seconds. Zero Hassle, zero paperwork, zero worry. Join now! Starting at $5/month.

It's free to apply!

FINANCIAL STRENGTH SCORE: 4 Out of 5

What is AAA's Financial Rating?

AAA Insurance scored well when it came to financial strength. The company has an A.M Best score of A.

What this means is that they have the ability to meet their insurance obligations. This isn't surprising since AAA is established across North America while many other companies are only available in America.

AAA has been around for over a century and is a well-respected player in the insurance game.

The company has a series of agents across North America to serve its members.

Studenomics Financial Strength Score: 4 out of 5

Pros and Cons of AAA Renters Insurance?

There's no such thing as the perfect renter's insurance policy.

For example, while being known for its roadside assistance, AAA Renters Insurance coverage varies depending on the region that you live in.

What are the pros and cons of AAA Renters Insurance?

Pros:

Cons:

Those are the pros and cons that we want you to think about before deciding to use AAA Renters Insurance.

Does AAA Offer Insurance In My State?

You're in luck because AAA currently offers insurance in all 50 states and every province in Canada.

You can also check the best renters insurance rates by state using the map below.

How can you cancel?

Let's say that your situation changes and you need to cancel your AAA home Renters Insurance. How do you go about doing this?

- You can cancel over the phone by contacting 1-877-387-8378.

- You can reach out to your local agent.

- You can't cancel online at this time.

We suggest that your new renter's insurance policy is activated before you cancel so that you have coverage.

Take Action

That’s our review of AAA Renters Insurance. If you’re looking to become a member for the perks and to bundle your insurance, then this might be the perfect insurance plan for your situation.

You can enjoy the perks of roadside assistance from a company known for being reliable across North America.

Renters Insurance Starting at $5/month

No brokers, no paperwork, get a policy in seconds. Zero Hassle, zero paperwork, zero worry. Join now! Starting at $5/month.

It's free to apply!