Allstate Renters Insurance Review: Pros & Cons, Pricing, and Features

Studenomics Score: 4.5 Out of 5 Stars

Advertiser Disclosure: Our content is free because we are supported by advertisers. If you click on links in this post, we may earn a commission.

We all know how frustrating it can be to find a renters insurance policy that you can trust and is easy-to-use. You have enough going on already.

You don’t want to spend days on the phone trying to find a renters insurance policy that makes sense for you.

You also don’t want to be stuck with a renters insurance policy that doesn’t work to protect you and your needs.

Luckily, Allstate Renters Insurance is known for a hassle-free claims system and simplifying the whole process of obtaining renter’s insurance.

Allstate Renters Insurance is an established company in strong financial health so that you also don’t have to worry about any issues with potential payout in the future.

We’re going to take a look at Allstate Renters Insurance to see if it’s worth signing up with this company for your renter’s insurance policy.

Highlights:

Overview:

Allstate is a publicly-traded insurance company that was originally founded in 1931. You can easily get a no-obligation quote online in minutes. Allstate has many digital tools that explain everything about renter’s insurance for you so that you’re never confused about what’s protected.

Known for:

- Offering a variety of insurance products with many opportunities for discounts.

- The famous slogan, “You’re in good hands.”

- Fast and simple claims process.

Financial Rating:

Rated A + for financial strength by A.M. Best

Who is Allstate Insurance?

The company was founded in 1931 by Robert Wood during The Great Depression to offer auto insurance. Wood was the President of Sears, Roebuck, and Co.

They started selling auto insurance policies by mail.

Allstate is now publicly traded and the company has become a household name in America. Allstate was ranked 79th in the Fortune 500 list of largest American companies by total revenue in 2019.

With over 45,000 employees, Allstate is a massive insurance company with a strong financial situation.

Allstate offers a variety of insurance products in all 50 states. You can find term life insurance, boat insurance, and renters insurance with Allstate so that you can simplify your finance by using one company for all of your insurance needs.

How Does Allstate Renters Insurance Work?

You’re probably wondering about how Allstate Renters Insurance works. We’ve gone through every popular insurance company to see how they operate from the customer end.

Allstate Renters Insurance is very easy to use with many digital tools that simplify the whole insurance process.

You can obtain a no-obligation renters insurance quote online from Allstate to see what the rates are like. You can customize your insurance policy to your budget and your needs.

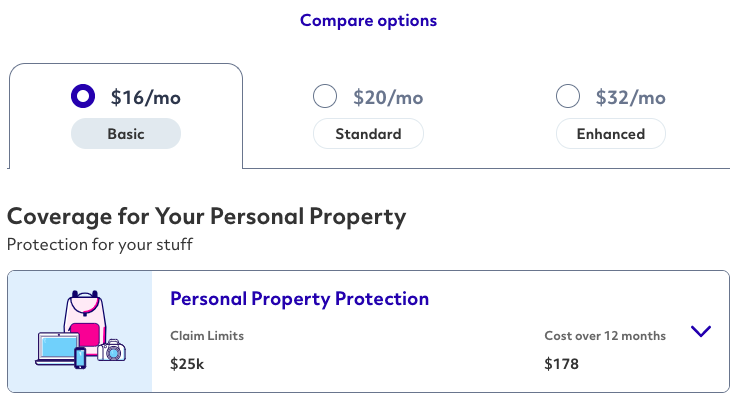

The image below is what you see when you go to obtain your personalized quote.

Bundle and Save Up to 50%

Save up to $850/year by bundling renters with car insurance. Quick Online Quotes. Compare & Save 50% on: Auto, Motorcycle, Home, Condo, & Renter.

It's free to apply!

Is Allstate Renters Insurance Good?

We looked through the Allstate Renters Insurance policy, we searched for other reviews, and we checked forums to see if Allstate offered good insurance.

We were able to determine that Allstate Renters Insurance is good. The company makes it very easy to obtain a quote and to file a claim. They also offer insurance products in every state so you don’t have to worry about losing coverage if you move.

Is Allstate Renters Insurance legit?

After going through reviews, customer feedback, and research, we’ve discovered that Allstate Renters Insurance is very legit. The company has many online resources to explain everything about renters insurance so that you’re never confused.

The image below shows you the tools that Allstate offers...

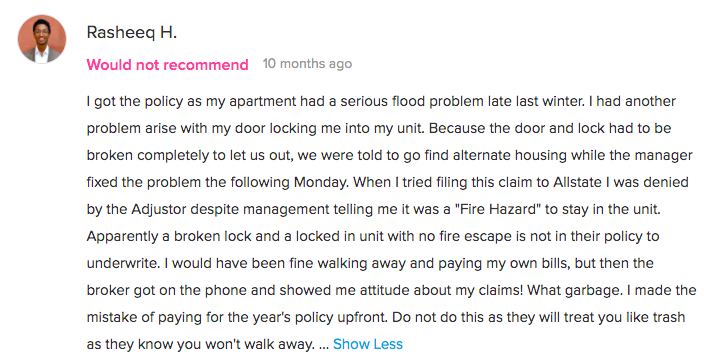

The only issue that we could find online with Allstate was that the customer service didn’t have the best reviews out there.

The polices also don’t have the lowest rates compared to competitors. On the flip side, there are many opportunities for discounts with Allstate (multi-policy discount, retiree discounts, safe home discounts, and a few other options).

Our editor's scores for Allstate for pricing, customer service, policy options, and financial stability:

Studenomics Score: 4.5 Out of 5 Stars

PRICING SCORE: 4 Out of 5

How Much Does State Farm Renters Insurance Cost?

We take costs very seriously when it comes to reviewing an insurance policy because we’re aware that finances can be tight these days.

We shopped around for Allstate Renters Insurance quotes to see what the prices were like in different states so that we could give an accurate answer as to the cost of Allstate Renters Insurance.

Renters Insurance Starting at $5/month

No brokers, no paperwork, get a policy in seconds. Zero Hassle, zero paperwork, zero worry. Join now! Starting at $5/month.

It's free to apply!

How Much Is Allstate Renters Insurance?

As with any insurance policy, the price will vary based on your situation and what discounts you qualify for.

If you bundle your insurance, you’re going to be able to gain some decent savings here. If you have the right safety measures in place and have a clean record, then you’ll also be able to save money.

Allstate Renters Insurance Quotes

We went through the process of obtaining a renters insurance quote so that you don’t have to. We were pleasantly surprised to discover that you can do everything online without having to speak to anyone on the phone or being told to go into a store.

Allstate will ask you the basic questions about your personal information and the unit.

Here are a few other questions to think about:

- What type of building is it?

- Is this your primary residence?

- Do you operate a business?

- What type of security does the unit have?

What does Allstate Renters Insurance cost?

New York City: $16/month for the basic plan with $25,000 in personal property coverage, $100,000 in personal liability, and $1,000 to guest medical bills.

San Francisco: $11/month for the basic plan with $15,000 in personal property coverage, $100,000 in personal liability protection, $1,000 to guest medical bills.

According to Allstate, the average monthly cost of renters insurance is about $16 so you’re bound to find a policy around that rate depending on what you’re looking for.

The image below is an example of what a quote looks like for NYC...

Pro Renters Insurance Tip

Renters insurance doesn't just cover the replacement of your belongings, but also protects you if someone gets hurt on your property. Limits usually start at $100,000.

Is Allstate Worth The Cost?

We want to ensure that you get your money’s worth when you sign up for an insurance policy.

We found that Allstate Renters Insurance is worth the money because you have enough protection for a low cost with a company that’s financially strong.

The good news is that you can save money on your insurance policy with some basic security features. Adding a burglar alarm or storm shutters can help you bring the cost down.

You can also bundle your Allstate Renters Insurance with any other insurance policy that you’re looking for.

Can I Bundle My Allstate Renters Insurance With My Auto Insurance?

One of the main benefits of using Allstate is that the company offers insurance for pretty much anything. You can bundle your renters insurance policy with auto insurance with Allstate.

Studenomics Pricing Score: 4 out of 5

Bundle and Save Up to 50%

Save up to $850/year by bundling renters with car insurance. Quick Online Quotes. Compare & Save 50% on: Auto, Motorcycle, Home, Condo, & Renter.

It's free to apply!

CUSTOMER SERVICE SCORE: 4 Out of 5

How is State Farm's Reputation for Service?

We search through many resources to gather more informaton abt Allstate as a company.

BBB Rating: A+

Number of Ratings: 223

Glassdoor Rating: 57% would recommend

Number of Ratings: 5,300

Reddit Sentiment: Good

Number of Comments: Minimal. We were able to find customers who weren’t impressed with Allstate auto insurance. The Renters Insurance side seems to be performing better.

Notable Quote Against Allstate from Super Money:

This one review was very negative about Allstate.

Notable Quote For Allstate Insurance:

The team over at Finder had the following to say about State Farm Renters Insurance:

“Allstate keeps a decent list of coverage for your basic needs and then some. Its biggest benefits include steep discounts for bundling with car insurance, staying claim-free or enjoying retirement over age 55. The company also reaches the second top spot for market share, showing that many people choose it for their home insurance needs.”As always, we go through Reddit to see what regular people had to say abut State Farm Renters Insurance.

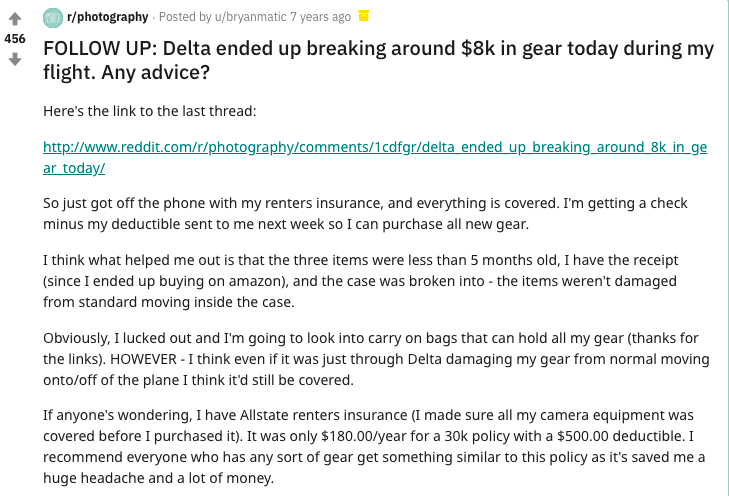

A detailed search of the phrase, “Renters Insurance Allstate Reddit” helped us find this interesting review.

User @bryanmatic had their equipment damaged on a plane and then had everything covered by Allstate Renters Insurance.

As you can see, Allstate Renters Insurance is trusted and used by many around the nation so you don’t have to worry about that.

Renters Insurance Starting at $5/month

No brokers, no paperwork, get a policy in seconds. Zero Hassle, zero paperwork, zero worry. Join now! Starting at $5/month.

It's free to apply!

How Do You File a Allstate Renters Insurance Claim?

How can you file a claim with Allstate Renters Insurance?

Here are your two options for filing a claim:

Call 1-800-ALLSTATE.

Log into your account online or use the mobile app.

Contact your local agent.

Allstate is known for offering a simple and easy claims process. You can file a claim 24/7. Allstate also has over 14,000 claim team members that work in this department and most claims are handled within 14 days.

Once you file a claim online, here’s what you need to do:

Protect your property from any further damage.

Document the damages/losses in writing and take some pictures.

Wait for your Allstate agent to contact you about your coverage limits.

Wrap up the process with your agent and wait for your payment.

Studenomics Customer Service Score: 4 out of 5

POLICY OPTIONS SCORE: 5 Out of 5

What Does Allstate Renters Insurance Cover?

You’re likely wondering about the coverage with Allstate Renters Insurance. The official website goes into detail about how much coverage you get.

Here’s what’s covered with your Allstate Renters Insurance policy...

Personal property coverage.

Allstate Renters Insurance will replace your personal possessions (after you pay the deductible) on all covered losses.

The four most common perils that are typically covered by an Allstate Renters Insurance policy are:

Theft.

Fire and smoke.

Vandalism.

Flooding caused by a plumbing issue.

The basic plan starts at $25,000 worth of coverage. You can spend a few extra dollars per month for $30,000 or $50,000 worth of protection here.

Family liability protection.

What’s this? According to the official website:

“Helps pay for covered damages that you're legally obligated to pay, such as bodily injury and property damage lawsuits.”

In other words, you’re covered legally in the event that there’s a legal situation involving something that happened to a guest while visiting you.

Guest medical protection.

A basic plan has $1,000 worth of coverage to help pay for the medical bills of any visitor that experiences a covered loss while visiting you.

Additional living expenses.

This refers to any hotel bills and other expenses incurred when you can’t live in your unit. You’ll be covered by your renter’s insurance policy.

Bundle and Save Up to 50%

Save up to $850/year by bundling renters with car insurance. Quick Online Quotes. Compare & Save 50% on: Auto, Motorcycle, Home, Condo, & Renter.

It's free to apply!

What Isn’t Covered By My Policy

What’s not covered by your Allstate Renters Insurance Policy?

Damage caused by earthquakes, floods, and sewage backup isn’t usually covered.

You’re going to want to look into what kind of protection you need based on where you live.

You can pay extra for identity theft protection. This would help cover expenses like legal process, lost wages, and anything else resulting from identity theft.

It’s important that you look over your policy to ensure that you have enough coverage.

For example, it may seem that $25,000 is enough for personal property coverage, but your possessions may be more valuable than you originally thought.

This also means that your coin collection or expensive jewelry may not be covered with a basic policy.

A few other items that may not be covered by your policy are:

Business property. You may want to look into additional coverage if you operate a home business.

Flood insurance. You may have to pay extra if you live in an area prone to flooding.

Can I Add My Roommate?

Are you looking to add a roommate to your insurance policy? When you fill out the questions for a no-obligation renter’s insurance quote with Allstate, it’s important that you mention how many people are living in the unit with you full-time. You may have to spend more money to cover a roommate.

Highlights |  Lemonade | State Farm |  Progressive |

|---|---|---|---|

Cost | Starting at $10/mo | Starting at $5/mth | Starting at $$$ |

Personal Property Coverage (Starts At:) | $20,000 | $ | $ |

A.M. Best Rating (Financial Strength) | A+ | A+ | A+ |

BBB Rating | A | A | A |

Claims Process | Excellent | xyz | xyz |

Best for: | Customized Policies | Customer Service | Lowest Cost |

Studenomics Rating | 4.5 Stars | 4.6 Stars Read Full Review | 4.6 Stars Read Full Review |

Studenomics Policy Options Score: 5 out of 5

Renters Insurance Starting at $5/month

No brokers, no paperwork, get a policy in seconds. Zero Hassle, zero paperwork, zero worry. Join now! Starting at $5/month.

It's free to apply!

FINANCIAL STRENGTH SCORE: 5 Out of 5

What is Allstate's Financial Rating?

Allstate Insurance scored very well when it came to finances. The company has an A.M Best score of A+. They’re also a publicly-traded company so the finances are transparent.

You don’t have to worry about any payout issues with Allstate Renters Insurance.

Studenomics Financial Strength Score: 5 out of 5

"The process was very smooth and they deposited the money in my account in less than 3 days."

Ayman A. - BBB Review

Pros and Cons of Allstate Renters Insurance?

Every renter’s insurance policy comes with its strengths and weaknesses. In the interest of a transparent review, we want to share the pros and cons of Allstate Renters Insurance.

What are the pros and cons of Allstate Renters Insurance?

Pros:

Cons:

Those are the pros and cons that we want you to think about when it comes to Allstate Renters Insurance.

Does Allstate Offer Insurance In My State?

Allstate currently offers insurance in all 50 states. You can obtain auto insurance, renters insurance, term life insurance, and a variety of other insurance products.

The good news is that if you move, you know that you’ll still be covered by Allstate.

You can also check the best renters insurance rates by state using the map below.

How to Cancel?

How can you cancel your Allstate Renters Insurance policy?

You can easily cancel through the mobile app, online or by calling customer service. You don’t have to worry about struggling to get out of your contract if you were to decide to leave.

Take Action

That’s our review of Allstate Renters Insurance. Allstate Renters Insurance is available in all 50 states and you’re going to be insured by a well-established company.

You can easily obtain a no-obligation quote in minutes with just a few clicks to find the ideal renter’s insurance policy for your unique situation.

You don’t have to stress about filing a claim either as the process is simple.

Renters Insurance Starting at $5/month

No brokers, no paperwork, get a policy in seconds. Zero Hassle, zero paperwork, zero worry. Join now! Starting at $5/month.

It's free to apply!

I am currently in the process of obtaining an attorney to help me get allstate to pay my renters insurance claim. They are trying to apply limits to my personal property which was in my Kia when it was stolen? These limits should not apply. They are just looking for any reason to not pay this claim. If you are considering allstate for any of your insurance needs ….don’t!