American Family Renters Insurance Review: Pros & Cons, Pricing, and Features

Studenomics Score: 4 Out of 5 Stars

Advertiser Disclosure: Our content is free because we are supported by advertisers. If you click on links in this post, we may earn a commission.

We all know what it’s like to look for the perfect renter’s insurance policy. You want something that’s ideal for your situation without costing you a fortune since you already have enough expenses to think about.

I think you’ll agree with me that you want a renters insurance policy that will cover your belongings without any stress. American Family Renters Insurance promises to offer easy and convenient renters insurance. They even claim that you can obtain a renters insurance policy for about $15/month.

This is why we’re going to review American Family Renters Insurance. We want to see if they really have plans that can be customized at a fair rate.

Highlights:

Overview:

American Family Insurance has been offering insurance products and other services since 1927.

Known for:

- They offer 24/7 phone support.

- You can easily obtain a renters insurance quote online.

- They offer multiple discounts to help you save money.

Financial Rating:

American Family Insurance is rated A+ for financial strength by A.M Best.

Who is American Family Insurance?

Who is American Family Renters Insurance as a company? They’ve been offering insurance products since 1927 and are based out of Madison, Wisconsin. American Family Insurance employs over 11,000 employees and is a Fortune 500 company.

American Family Insurance offers a variety of insurance products (everything from auto to boat insurance) and other levels of financial protections (credit monitoring, life insurance, travel insurance, and so on).

According to the official website,

"We give you your own dream champion. No matter how your life changes, you can feel confident you’ll have the support of an American Family Insurance agent — your very own dream champion — on every step of the way. "

We're going to take a deep dive into the renter's insurance policies that are offered by American Family Insurance.

AMERICAN FAMILY CONTACT INFO

Website: www.amfam.com

Phone: 1-800-MYAMFAM

Address: 6000 American Pkwy

Madison, WI 53783

How Does American Family Renters Insurance Work?

You can obtain an American Family Renters Insurance quote in minutes online.

If you manage to customize your renter's insurance quote and are satisfied with the price, then you can sign up for American Family Renters Insurance.

American Family Renters Insurance protects you and your belongings the moment that you enrol in a policy. You’ll be covered. The coverage that you get depends on the policy that you sign up.

When we explored the website, we were pleasantly surprised to find out lots of helpful information on renters insurance and what renters insurance covers.

That image shows that American Family Renters Insurance is willing to take the time to explain what renters insurance covers and doesn't cover. This is important because when you're looking for a renter's insurance policy, you may not know what to expect and what you're getting for your insurance premium.

Bundle and Save Up to 50%

Save up to $850/year by bundling renters with car insurance. Quick Online Quotes. Compare & Save 50% on: Auto, Motorcycle, Home, Condo, & Renter.

It's free to apply!

Is American Family Renters Insurance Good?

We’re going to look at the financials and the actual prices of quotes. For now, we can safely say that American Family Renters Insurance is good and deserves a look.

This one line on the official website stuck out to us:

“Life is unpredictable -- dreams can be sidetracked in many different ways. But you can count on us to have your back and help get things back to normal.”

Is American Family Renters Insurance legit?

We aim to discover if a renters insurance company is legit when we cover them. We look at the pricing, customer service, policy options, and the financials of the company.

Let’s take a look at their finances and what the reviews say to see if they can back that claim up that they offer convenient renter's insurance at a fair rate.

Our editor's scores for our American Family Renters Insurance Review pricing, customer service, policy options, and financial stability:

Studenomics Score: 4 Out of 5 Stars

PRICING SCORE: 4 Out of 5

How Much Does American Family Insurance Cost?

It wouldn’t be fair to write a American Famly Renters Insurance review without looking through a few quotes to see what the coverage is like in a few states.

We always go through the process of obtaining a quote so that you know what it’s like and what the pricing is like.

Renters Insurance Starting at $5/month

No brokers, no paperwork, get a policy in seconds. Zero Hassle, zero paperwork, zero worry. Join now! Starting at $5/month.

It's free to apply!

How Much Is American Family Renters Insurance?

When going over the official American Family Renters Insurance, we noticed that they mention a policy roughly goes for $15/month.

We wanted to go through official quotes to get some real life examples for you.

American Family Renters Insurance Quotes.

We're going to share American Family Renters Insurance quotes in this section. We always try to find quotes from a few states just to get you a rough range.

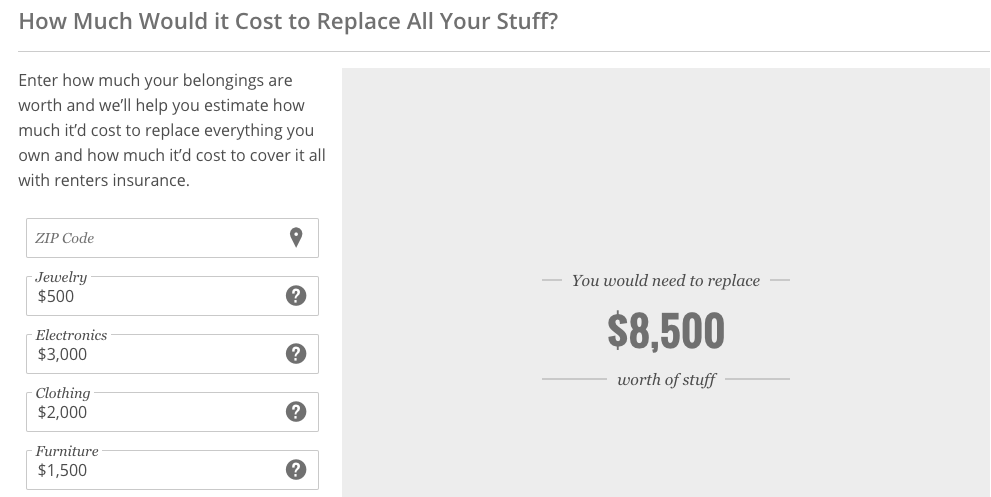

The good news is that American Family helps you figure out exactly how much coverage you need. This helpful calculator below helps you determine EXACTLY how much coverage you need so that you don't have too much or not enough coverage.

As you can see, you can find out exactly how much personal property coverage you need with your renter's insurance plan.

Pro Renters Insurance Tip

Renters insurance doesn't just cover the replacement of your belongings, but also protects you if someone gets hurt on your property. Limits usually start at $100,000.

Is American Family Renters Insurance Cost Worth It?

In looking for American Family Renters Insurance quotes, we discovered that there are many ways in which you save money. Here are a few options for discounts:

- Auto pay.

- Bundle and save.

- Smart home discount.

With that being said, is American Family Renters Insurance worth it?

We have to say that it is. You can customize your policy, earn discounts, and have the proper protection for yourself and your belongings.

It’s also helpful to work with a company that explains the entire process for you so that you know what you’re getting into with your renters insurance plan.

Can I Bundle My Renters Insurance American Family With My Auto Insurance?

The good news is that American Family encourages insurance bundling. The official website claims that you could save 29% on your auto coverage and 15% on your renters insurance coverage.

Studenomics Pricing Score: 4 out of 5

Bundle and Save Up to 50%

Save up to $850/year by bundling renters with car insurance. Quick Online Quotes. Compare & Save 50% on: Auto, Motorcycle, Home, Condo, & Renter.

It's free to apply!

CUSTOMER SERVICE SCORE: 4 Out of 5

How is American Family's Reputation for Service?

We looked through Glassdoor, BBB, and Reddit to see what regular people had to say about American Family Insurance. In our experience, these are the best indicators of how a company actually operates.

We scored a 4 here because we found many complaints about American Family Insurance on the BBB website. The company had 227 complaints and we couldn't score a perfect 5.

BBB Rating: A

Number of Ratings: 48

Glassdoor Rating: 58% would recommend

Number of Ratings: 1.1k

Reddit Sentiment: Neutral

Number of Comments: We were able to find many different discussions about American Family Renters Insurance.

American Family Renters Insurance Reddit Feedback

We always look through Reddit and other forums to see what regular customers have to say about the renters insurance policies. We searched for the phrase, "American Family Renters Insurance Reddit" to see what would pop up.

This person brought up an interesting point about customer complaints. It's always easier to find negative comments compared to praise since most people just expect their insurance policy to be there for them when they need it.

Notable Quote From The Simple Dollar about American Family Insurance:

"American Family stands out from competitors in a few areas. For example, its 24/7 claims support service helps ensure you’re never left stressing over your belongings or claims details on your own. American Family also offers the MyAmFam app, which helps customers keep track of their premiums, file claims, manage their policy details and more."

Renters Insurance Starting at $5/month

No brokers, no paperwork, get a policy in seconds. Zero Hassle, zero paperwork, zero worry. Join now! Starting at $5/month.

It's free to apply!

How Do You File a American Family Renters Insurance Claim?

Let's say that something happens and you have to file a renter's insurance claim with American Family, what do you do?

You have a few options when it comes to filing a renters insurance claim with American Family:

- Call 1-800-MYAMFAM (692-6326) to speak with an agent.

- Log in to your account (https://myaccount.amfam.com/login)

- Use the MyAmFam mobile app.

Which information are you going to need to file a renters insurance claim with American Family?

- The date and the time of the event.

- Any photos of the damages.

- A quick description of what happened.

As always, please remember to contact your landlord and the police when a situation occurs so that you have the proper paperwork. If there's a theft, you're going to need a police report.

Studenomics Customer Service Score: 4 out of 5

POLICY OPTIONS SCORE: 3 Out of 5

What Does American Family Renters Insurance Coverage Include?

What exactly does American Family Renters Insurance cover?

We couldn't score higher here because American Family Renters Insurance just isn't offered in enough states.

One thing that impressed us was how the website actually explains real-life scenarios where renters insurance kicks in.

Here’s an example:

“If your friend walks across your freshly-washed kitchen floor, slips, and breaks a leg, your renters insurance would help pay for his/her medical bills.”

Let’s take a look at the standard American Family Renters Insurance coverages:

Renters Property Protection.

“Our personal property coverage helps you with the costs of replacing your things should they be damaged by fire, theft, water damage and other covered losses.”

As with any renter’s insurance policy, your possessions will be protected from covered losses.

Renters Personal Liability.

Liability coverage would pay for damages to others, legal fees, and medical costs among the many other expenses that could impact your personal liability.

Loss of use coverage.

If your unit becomes, inhabitable due to a covered loss, your insurance policy would cove your hotel stay along with any other reasonable expenses.

As you can tell from our previous reviews and detailed writing on renters insurance, most policies will generally provide similar coverage with minor variations depending on your situation and where you live.

The one variable that changes is the amount of coverage that you need based on the value of your personal property. The American Famly Renters Insurance website has a handy calculator that helps you figure out how much coverage you need based on how much stuff you own.

Please keep in mind that you can connect with an AmFam agent to go over your renter’s insurance policy so that you know exactly what’s covered.Bundle and Save Up to 50%

Save up to $850/year by bundling renters with car insurance. Quick Online Quotes. Compare & Save 50% on: Auto, Motorcycle, Home, Condo, & Renter.

It's free to apply!

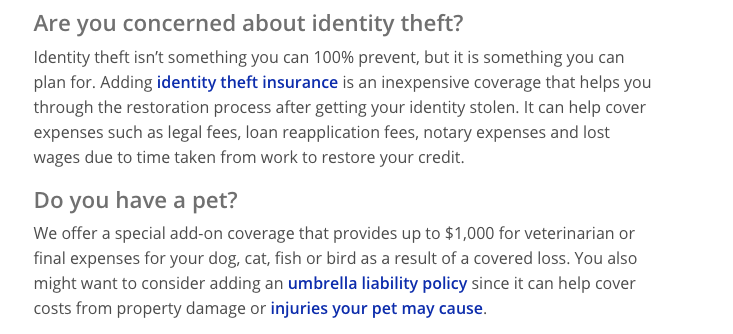

What Isn’t Covered By My American Family Renter's Insurance Policy?

Now that you know what’s covered with your American Family Renters Insurance policy, it’s important to look at what’s not covered so that you can be prepared just in case.

Here are items that may not be covered with your American Family Renters Insurance:

- Your pets.

- Any business that you run out of your property.

- Identity theft.

- Jewelry over a certain amount.

The image below captures exactly what additional levels of coverage you can purchase.

Can I Add My Roommate?

Do you have roommate who you want to add to your renter’s insurance policy?

Here’s the official word from the American Family Renters Insurance page:

“Because they're not insured under your renters policy, they do not get the property or liability coverage that you do. They'll need to purchase their own coverage to protect their stuff. We can help them with that, though!”

Highlights | Lemonade | State Farm |   Progressive |

|---|---|---|---|

Cost | Starting at $5/mth | Starting at $5/mth | Starting at $13/mth |

Personal Property Coverage (Starts At:) | $10,000 | $10,000 | $20,000 |

A.M. Best Rating (Financial Strength) | A+ | N/A | A+ |

BBB Rating | A | B+ | A |

Claims Process | Hassle-free | Excellent | Good |

Best for: | 24/ 7 support | Quick online purchasing | Lowest Cost |

Studenomics Rating | 4 Stars | 4.75 Stars Read Full Review | 4.6 Stars Read Full Review |

Cell | Cell | Cell | Cell |

Studenomics Policy Options Score: 3 out of 5

Renters Insurance Starting at $5/month

No brokers, no paperwork, get a policy in seconds. Zero Hassle, zero paperwork, zero worry. Join now! Starting at $5/month.

It's free to apply!

FINANCIAL STRENGTH SCORE: 5 Out of 5

What is American Family's Financial Rating?

We always look at the financial strength of a renter's insurance company because we want to ensure that they're going to be able to meet their obligations. We also don't want you to be stuck with a company that won't be able to cover future insurance claims.

American Family Renters Insurance scored an A.M Best score of A+ so we gave them a 5 here for financial strength. The score indicates that American Family is a strong company with the financial resources to cover claims.

Studenomics Financial Strength Score: 5 out of 5

Pros and Cons of American Family Renters Insurance?

There's no such thing as the perfect renter's insurance policy as you may have discovered by now.

For example, while American Family is known for 24/7 phone support, the company also doesn't offer renters insurance in every state.

What are the pros and cons of American Family Renters Insurance?

Pros:

Cons:

Those are the pros and cons that we want you to think about before deciding to use American Family Renters Insurance.

Does American Family Offer Insurance In My State?

When we looked for American Family Renters Insurance quotes, we discovered that they don’t offer insurance in every state.

The good news is that American Family Renters Insurance has partnered with other insurance companies.

You can also check the best renters insurance rates by state using the map below.

How can you cancel?

Let's say that your situation changes and you need to cancel your AAA home Renters Insurance. How do you go about doing this?

You have to call 1-800-MYFAMAM to speak with your agent about the situation.

We suggest that you find a new renter's insurance policy before you cancel one because you don't want to go too long without coverage.

Final thoughts on American Family Renters Insurance...

That’s our review of American Family Renters Insurance. We found the website to be very helpful in how they explained everything about renter's insurance so that you're not confused.

We would like if the company offered renter's insurance policies in more states though. We believe that you have enough information in here to decide if you should use American Family Renters Insurance to protect you and your belongings.

Renters Insurance Starting at $5/month

No brokers, no paperwork, get a policy in seconds. Zero Hassle, zero paperwork, zero worry. Join now! Starting at $5/month.

It's free to apply!