Assurant Renters Insurance Review: Pros & Cons, Pricing, and Features

Studenomics Score: 4.6 Out of 5 Stars

Advertiser Disclosure: Our content is free because we are supported by advertisers. If you click on links in this post, we may earn a commission.

Are you on the hunt for renters insurance? We took a look at Assurant Renters Insurance to see if this is the ideal renter’s insurance policy for your current needs.

Assurant Renters Insurance Review

Assurant Renters Insurance offers personal property protection and personal liability coverage like most other companies that offer renters insurance.

Assurant Renters Insurance also offers extra pet protection for those with pets and protection from involuntary unemployment if you couldn’t pay your rent after losing your job.

Keep on reading to find out more about Assurant Renters Insurance.

Highlights:

Overview:

A well-established insurance company founded in 1892 with options for low deductibles and extensive pet coverage.

Known for:

- Easy to apply online for a quote.

- Options for a low deductible.

- You can customize your insurance policy to your needs.

Financial Rating:

Rated A+ for financial strength by A.M. Best

Who is Assurant Insurance?

Assurant has been offering insurance products since 1892. They went public in 2004 and are based out of New York City. They currently rank 315 on the Fortune 500 list for the largest publicly traded companies in the nation.

Assurant knows that life happens where you rent and they want to make renters insurance easy.

We wanted to review Assurant because they're an established insurance provider in the industry.

ASSURANT CONTACT INFO

Website: www.Assurant.com

Phone: (800)-358-0600

Address: One Chase Manhattan Plaza, 41st Floor, New York, New York 10005

How Does Assurant Renters Insurance Work?

When dealing with a large insurance company, there are many obvious questions that come to mind.

Does Assurant have renters insurance available?

Yes, the company has been offering insurance in general for over a century and they have a renter's insurance wing which we will be exploring in this review.

Bundle and Save Up to 50%

Save up to $850/year by bundling renters with car insurance. Quick Online Quotes. Compare & Save 50% on: Auto, Motorcycle, Home, Condo, & Renter.

It's free to apply!

Is Assurant Renters Insurance good?

When looking at a renters insurance policy, we look at what the available coverage is (personal property and personal liability) along with the costs (deductible vs monthly premium).

Is Assurant Renters Insurance legit?

The one thing that stuck out to us about this renter’s insurance policy is that you can have some unique add-ons in qualified states that you won’t find with any other policy.

Here are a few extras that you can pay for with Assurant Renters Insurance:

- Rent protection. If you lose your job, you don’t have to worry about losing your residence. Your rent will be covered as you focus on the next step.

- Pet damage. Do you have a pet? You have extra protection to cover any damages caused by your pet.

- Water sewer backup. Not many insurance companies offer protection against water sewage flooding.

- Earthquakes. This will be essential only in some states.

- Identity fraud expense. This will cover any expenses related to identity theft.

Is Assurant Renters Insurance good? Yes.

Is Assurant Renters Insurance legit? Yes.

Keep on reading to find out more about what this renter insurance policy covers.

Our editor's scores for ABC Company for pricing, customer service, policy options, and financial stability:

Studenomics Score: 4.6 Out of 5 Stars

PRICING SCORE: 5 Out of 5

How Much Does Assurant Renters Insurance Cost?

How much does Assurant Renters Insurance cost?

When trying to find the ideal renter’s insurance company, it’s important that you factor in the costs since you’re likely not looking to spend too much money on this.

We went over a few quotes and articles so that you don’t have to worry about doing the research on your own.

Renters Insurance Starting at $5/month

No brokers, no paperwork, get a policy in seconds. Zero Hassle, zero paperwork, zero worry. Join now! Starting at $5/month.

It's free to apply!

How Much Is Assurant Renters Insurance?

It appears that Assurant Renters Insurance costs a bit more than the average renters insurance policy.

According to Value Penguin, the average renter’s insurance policy costs about $16/month.

You may pay a few dollars more with Assurant Renters Insurance.

On the flip side, you may have more coverage that means more to you (pet and unemployment protection) with Assurant.

Assurant Renters Insurance Quotes

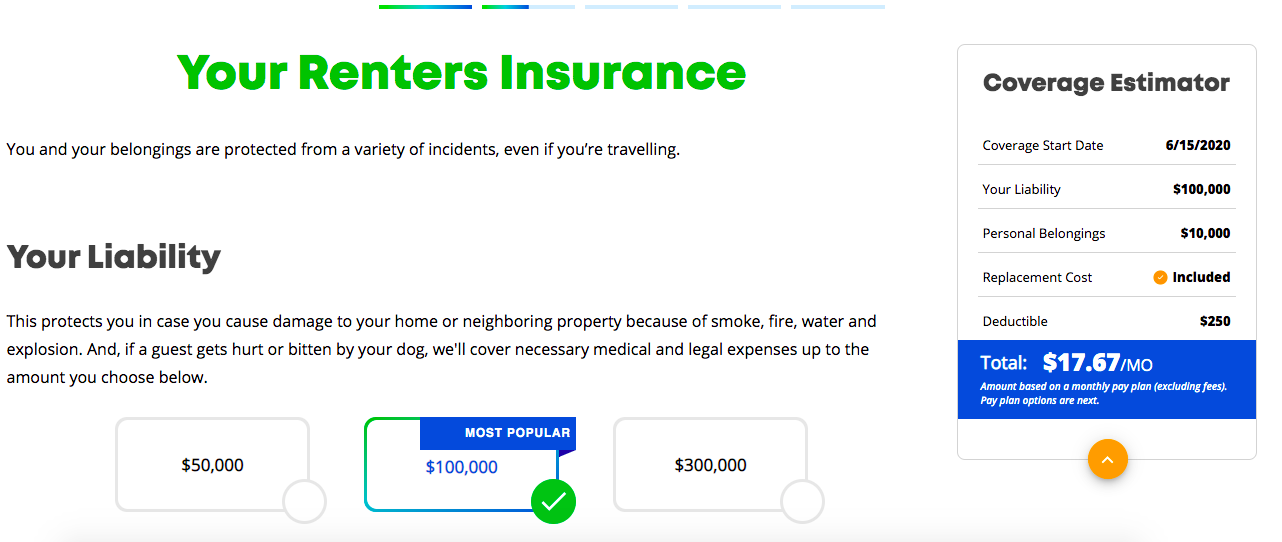

To give you a clear overview of how much renters insurance costs, we’ve obtained quotes. Here’s a Assurant Renters Insurance quote based on one person living in a condo in Texas.

Here are two quick examples of renters insurance Assurant quotes:

- $12.50 in NYC.

- $25.92 in Dallas, Texas.

As you can see from this Assurant Renters Insurance quote, the replacement cost is included and you have $100,000 worth of liability with the basic plan.

Pro Renters Insurance Tip

Renters insurance doesn't just cover the replacement of your belongings, but also protects you if someone gets hurt on your property. Limits usually start at $100,000.

Is Assurant Worth The Cost?

This begs the obvious question.

Is Assurant Renters Insurance worth the cost?

Most people shop for personal insurance completely based on price, like they’re buying lumber or socks.

That in itself is foolish because they’re buying a complex risk transfer mechanism like it’s a commodity.

You get what you pay for when it comes to renters insurance.

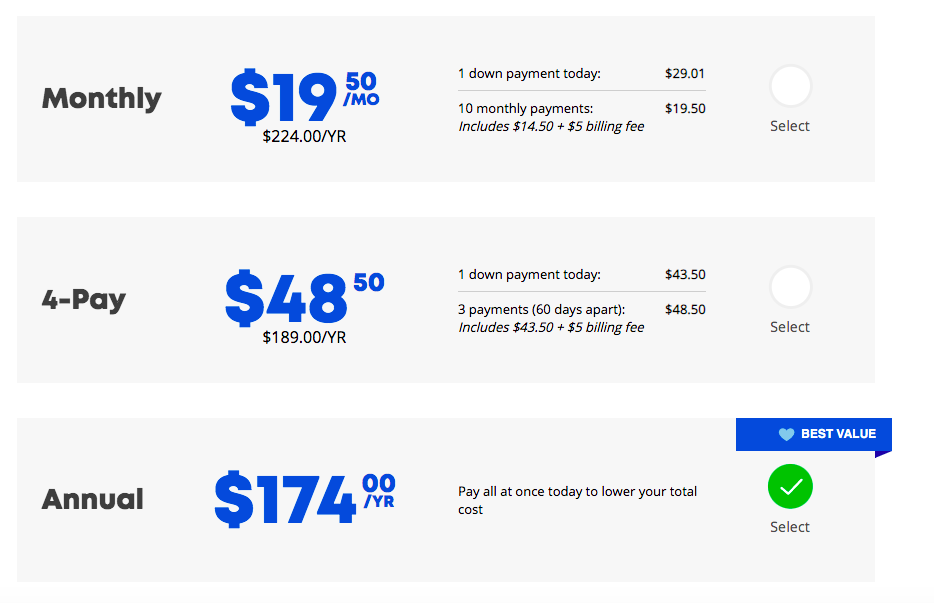

Another benefit of Assurant Renters Insurance is that they have payment plans.

This screenshot below capture how you can get a discount by paying for the full year.

Can I Bundle My Assurant Renters Insurance With My Auto Insurance?

You can bundle your Assurant Renters Insurance with auto insurance from GEICO. This insurance bundle will allow you to save a few dollars.

The cost of Assurant Renters Insurance will depend on how much protection you need.

This is why we want you to take a realistic look at your situation before you sign up for a renter’s insurance policy.

Studenomics Pricing Score: 5 out of 5

Bundle and Save Up to 50%

Save up to $850/year by bundling renters with car insurance. Quick Online Quotes. Compare & Save 50% on: Auto, Motorcycle, Home, Condo, & Renter.

It's free to apply!

CUSTOMER SERVICE SCORE: 4 Out of 5

How is Assurant's Reputation for Service?

Add reviews, Glassdoor, BBB, Reddit - These are always indicative of customer service. Add their score and total number of reviews. For Reddit, it will be overall sentiment.

BBB Rating: B+

Number of Ratings: 216

Glassdoor Rating: 62% would recommend to a friend.

Number of Ratings: 1,700

Reddit Sentiment: Neutral

Number of Comments: Many comments across different threads

We looked around to see what others had to say about Assurant Renters Insurance.

The team at Benzinga left the following review…

Notable Review Favoring Assurant Company

Most Assurant Renters Insurance reviews will be quick to point out the additional coverage that comes with Assurant.

The one common negative seems to be apparent customer service issues.

Assurant Renters Insurance Review Reddit

We always look through Reddit to see what regular folks are saying about the company.

Here’s what we found when we searched the phrase, “Renters Insurance Assurant Reddit.”

RCV= replacement cost value. This means that you get the full value of the item at today’s rate without factoring in deprecation.

How Do You File An Assurant Renters Insurance Claim?

How can you file a claim on your Assurant Renters Insurance policy?

You can file your Assurant claim online or on the phone call 800-358-0600.

An agent should contact you within 24 hours to go over your claim and your coverage.

Studenomics Customer Service Score: 4 out of 5

Renters Insurance Starting at $5/month

No brokers, no paperwork, get a policy in seconds. Zero Hassle, zero paperwork, zero worry. Join now! Starting at $5/month.

It's free to apply!

POLICY OPTIONS SCORE: 5 Out of 5

What Does Assurant Renters Insurance Cover?

What’s the Assurant Renters Insurance coverage like?

We looked around to see what the coverage is like so that you know what you’re spending your money on. Our research shows that Assurant Renters Insurance offers more protection than most other policies out there.

What’s the exact Assurant Renters Insurance coverage?

Assurant Renters Insurance protects your personal belongings, unit, and personal liability.

According to the official Assurant Renters Insurance website, here’s what they cover:

“Your renters insurance policy covers damage to your home or neighboring property for any accidents caused by fire, water, smoke or explosion. But we also protect your belongings for even more reasons.”

What are the even more reasons considered?

Fire, lightning, smoke, explosion, theft, vandalism, falling objects, ice, pipe bursts, freezing, vehicles, aircraft, volcanic eruption, and civil commotion.

As we mentioned earlier, you can purchase additional protection with your Assurant Renters Insurance coverage policy.

Here are a few other add-ons that you can purchase with your renters insurance policy in some states:

- Flood damage. You’ll have a place to stay if you can’t stay in your unit due to flooding.

- Food spoilage. If the power goes out and your food is spoiled, you’ll have your food replaced. This could be a huge saving if you had a stocked fridge.

- Bed bugs. Your renters insurance policy would pay for the costs of hiring an exterminator, a place for you to live while you can’t stay in your unit, and the damaged belongings.

We couldn’t find these levels of coverage with any other renter’s insurance policy out there. Assurant Renters Insurance coverage is top notch when you’re looking for the highest level of protection possible for you and your finances.

What Isn’t Covered By My Policy?

We’ve looked at what’s covered with Assurant Renters Insurance, now it’s time to look at what’s not covered. As with any renters insurance company, there are limits to your personal property coverage.

What isn’t covered by your Assurant Renters Insurance policy?

Your personal property limit may start at $10,000. What this means is that your expensive items like your jewelry and art won’t be covered.

You’re going to have to purchase additional riders. How do you do this?

- Get an appraisal.

- Snap a picture of the item(s).

- Fill out a form.

- Print, sign and mail.

It’s important to go over your policy to see what’s cover and what isn’t covered based on where you live. As you know, every state is different and every community is unique.

A study on renters insurance that was released by Assurant, shared some interesting information about the perceptions of renters insurance.

“The survey found that 81% of respondents with insurance didn’t know that a rug ruined by an overflowing toilet is covered, while 84% were unaware that a guest tripping and breaking ankle in their apartment is also covered.”

It’s on you to double-check your policy to see if you have the coverage that you need.

Can I Add My Roommate?

Do you have a roommate that you would like to add to your renters insurance policy?

The good news is that you can add your roommate to your Assurant Renters Insurance at no additional cost. You just have to write their name down when you sign up for your policy.

You can save some good money here because most companies require you to purchase a separate policy for a roommate.

Highlights | Lemonade |   State Farm |   Progressive |

|---|---|---|---|

Cost | Starting at $12/mth | Starting at $10/mth | Starting at $13/mth |

Personal Property Coverage (Starts At:) | $10,000 | $20,000 | $20,000 |

A.M. Best Rating (Financial Strength) | A+ | A+ | A+ |

BBB Rating | A+ | A | A+ |

Claims Process | Excellent | Excellent | Excellent |

Best for: | Comprehensive coverage | Customized policies | Insurance bundling |

Studenomics Rating | 4.6 Stars | 4.6 Stars Read Full Review | 4.6 Stars Read Full Review |

Every renters insurance company is unique. Assurant doesn't have the lowest cost or the best customer service. They do offer low deductibles and flexible policies.

Studenomics Policy Options Score: 5 out of 5

Renters Insurance Starting at $5/month

No brokers, no paperwork, get a policy in seconds. Zero Hassle, zero paperwork, zero worry. Join now! Starting at $5/month.

It's free to apply!

FINANCIAL STRENGTH SCORE: 5 Out of 5

What is Assurant's Financial Rating?

When it comes time to make a claim, here's where you need your insurance company to step up.

They need to have the money to pay out a claim. The best way to determine if a company is financially stable and able to meet its ongoing claims obligations is by checking their financial rating and comparing it to other insurance companies.

Add A.M. Best score and examples from other companies.

Studenomics Financial Strength Score: 5 out of 5

"The process was very smooth and they deposited the money in my account in less than 3 days."

Ayman A. - BBB Review

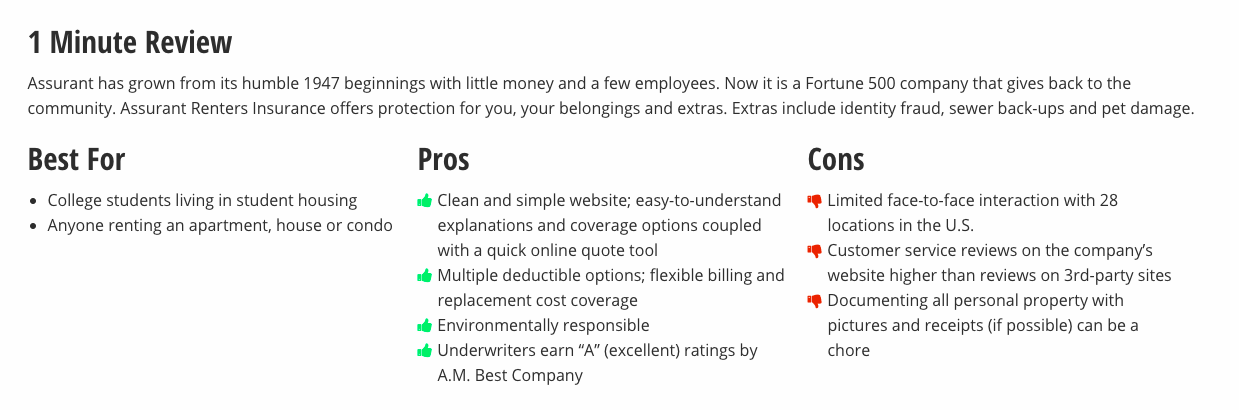

Pros and Cons of Assurant Renters Insurance?

There’s no such thing as the perfect renter’s insurance company. We want to ensure that you get the most for your money, so we will show you the positives and the negatives.

Pros:

Cons:

What are the pros of Assurant renter’s insurance?

- You find additional coverage that no other renters insurance company offers.

- Lower deductibles. Assurant has deductibles options available that you won’t anywhere else (the $100 and $250 options).

- Pet protection for those with pets.

- You can add your roommate to your Assurant policy at no extra cost.

What are the cons of renters insurance Assurant?

- Higher rates than the average company.

- The customer service reviews aren’t the best according to online reviews.

It’s important to look at what your situation requires. Adding a roommate at no extra cost, the loss of employment protection, and pet protection, could make Assurant Renters Insurance ideal for your situation.

Does Assurant Offer Insurance In My State?

You might be wondering if Assurant offers renters insurance in your state. When you apply for a quote, you’re going to find out in seconds. Assurant Renters Insurance is offered in all 50 states.

You can also check the best renters insurance rates by state using the map below.

How to Cancel?

If your finances or if your situation changes, you can cancel your Assurant Renters Insurance policy.

Just call 1-(800)- 432-8612 to get started. You can’t currently cancel your policy online.

Take Action

That’s our Assurant Renters Insurance review.

The extra pet protection and the rent protection if you’re involuntarily out of work make this a unique renters insurance company.

You can also save money by sharing a policy with a roommate.

Renters Insurance Starting at $5/month

No brokers, no paperwork, get a policy in seconds. Zero Hassle, zero paperwork, zero worry. Join now! Starting at $5/month.

It's free to apply!