Geico Renters Insurance Review: Pros & Cons, Pricing, and Features

Studenomics Score: 4.25 Out of 5 Stars

Advertiser Disclosure: Our content is free because we are supported by advertisers. If you click on links in this post, we may earn a commission.

We all know what a struggle it can be to find an inexpensive renters insurance policy that doesn’t hassle you when it comes time to file a claim.

Geico is known for promising low renters insurance rates and we know how important these are right now with everything going on in the world.

This is why we wanted to provide a Geico Renters Insurance Review for you.

In this Geico Renters Insurance Review we’re going to look at how much renters insurance costs, what kind of renters insurance coverage you get, and if the renters insurance policy is worth what you pay for it.

Highlights:

Overview:

Geico has been offering a variety of insurance products nationwide since 1936. The company is in excellent financial standing.

Known for:

- Offering low rates for insurance products.

- Popular commercial with the Geico mascot.

- Being an established insurance provider across the nation.

Financial Rating:

Geico is rated A++ for financial strength by A.M Best.

Who is Geico?

Did you know that Geico is the second-largest auto insurer in the nation behind State Farm?

GEICO (Government Employees Insurance Company) was started in 1936 and has been offering a variety of insurance products across the nation since then. GEICO is also a wholly owned subsidiary of Berkshire Hathaway.

You’ve likely seen the commercial with the Geico mascot announcing, "Fifteen minutes could save you 15% or more on car insurance.”

We’ve all seen the Geico commercials about auto insurance, but we don’t hear much about Geico Renters Insurance. This is why we wanted to review this aspect of Geico.

GEICO CONTACT INFO

Website: www.geico.com

Phone: (855) 834-1574

Address: 5260 Western Avenue

Chevy Chase, MD 20815

How Does Geico Renters Insurance Work?

Geico Renters Insurance protects you and your finances the moment that you enrol in a renter's insurance policy.

As you can see with the image below, when you look for a renter's insurance quote online, you can find out what's covered and what's not protected.

The good news is that you know what will be protected by your renter's insurance policy so you don't have to guess.

Here's what's covered with your renters insurance policy so that you don't have to stress (more on exact coverage later in this review)...

Bundle and Save Up to 50%

Save up to $850/year by bundling renters with car insurance. Quick Online Quotes. Compare & Save 50% on: Auto, Motorcycle, Home, Condo, & Renter.

It's free to apply!

Is Geico Renters Insurance Good?

Is this good renters insurance? We looking over Geico Renters Insurance, we found ourselves wondering if the renters insurance was legit.

We were impressed with the low rates and the entire process of obtaining a renters insurance quote.

The official website goes into detail when it comes to the coverage offered and then the company is quick to send a follow-up email with more information about your renters insurance quote.

We did find the the introductory policies were rather basic but that also depends on your budget and how much coverage you're looking for.

We did find that many users were complimentary of the mobile apps, the claims process, and policy prices.

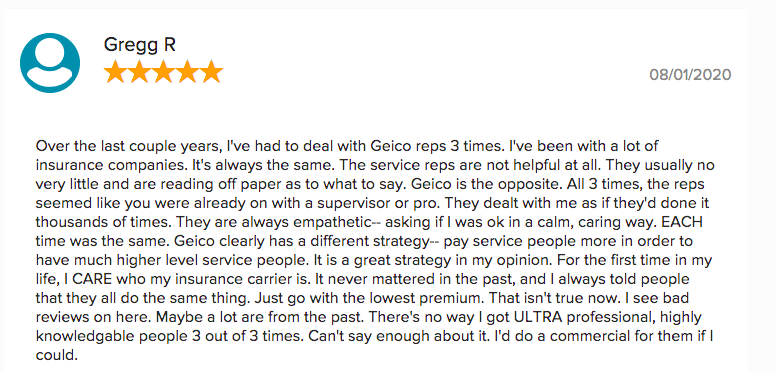

This one comment below from the BBB website captures a satisfied customer.

Is Geico Renters Insurance legit?

When looking over a renters insurance company, we look at a variety fo factors to see if the company is legit.

For the next few sections we're going to look at what customers have to say about Geico Renters Insurance, what the policies cover, what the policies don't cover, the financial strength of the company, and a few other factors.

Our editor's scores for Geico Renters Insurance for pricing, customer service, policy options, and financial stability:

Studenomics Score: 4.25 Out of 5 Stars

PRICING SCORE: 4 Out of 5

How Much Does Geico Renters Insurance Cost?

How much is Geico Renters Insurance?

We know that you’re thinking about that right now. We couldn’t provide a fair renter’s insurance review without looking at the cost.

We went through the process to see how renters insurance works here.

When looking for renters insurance quotes, you can easily obtain a quote from Geico.

Renters Insurance Starting at $5/month

No brokers, no paperwork, get a policy in seconds. Zero Hassle, zero paperwork, zero worry. Join now! Starting at $5/month.

It's free to apply!

How Much Is Farmers Renters Insurance?

We looked over a few reviews and comments to see what people were saying about how much is Geico Renters Insurance. We also obtained a few quotes just to get an accurate picture.

You can obtain a renters insurance quote from Geico’s official website.

Here’s what you get asked about when you look for a renter’s insurance quote:

- Birthday and zip code.

- If you have Geico auto insurance.

- The amount of people living with you.

- The type of unit you live in.

- Does your lease require you to have renter’s insurance?

- How did you hear about Geico?

Please note that the questions may also vary on the location of your unit.

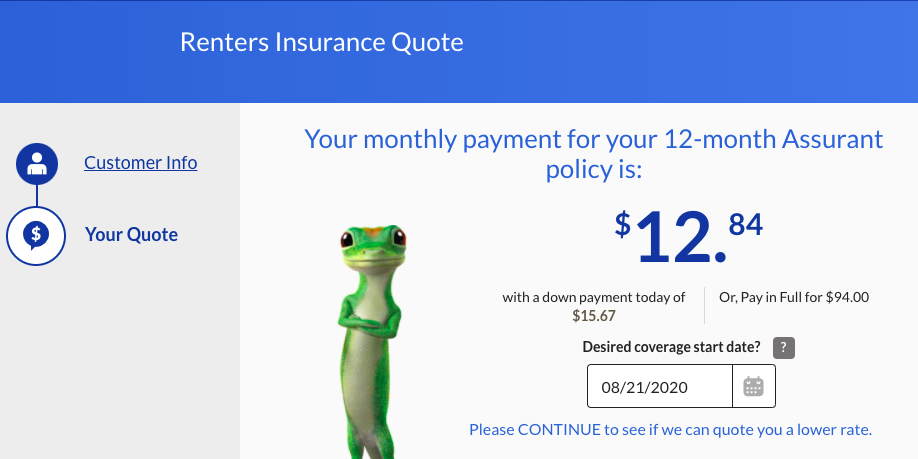

Geico Renters Insurance Quotes.

We obtained a few Geico Renters Insurance quotes just to be able to provide you with an accurate picture of what the rates are like.

The image below captures a basic renter's insurance policy in NYC.

As you can see, you can begin your coverage the very next day a at fair rate.

That $12.84/month policy comes with the following renter's insurance coverage in NYC.

Type of coverage | Coverage amount |

|---|---|

Personal property coverage | $10,000 |

Loss of use coverage | $2,000 |

Personal liability coverage | $100,000 |

Medical to others | $1,000 |

Deductible | $500 |

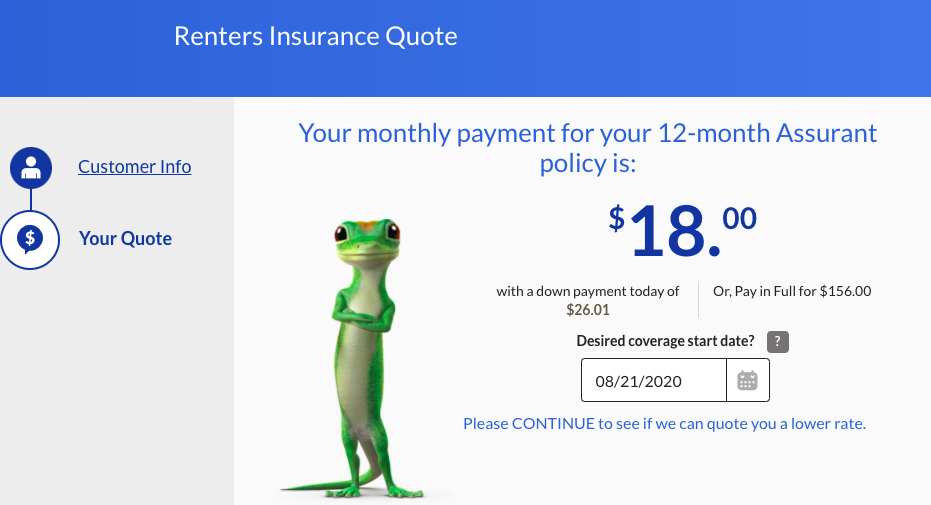

How are the rates in San Francisco?

As you can see, you can pay upfront for $156.

Here's your renter's insurance coverage amounts with Geico Renters Insurance in San Francisco...

Type of coverage | Coverage amount |

|---|---|

Personal property coverage | $15,000 |

Loss of use coverage | $3,000 |

Personal liability coverage | $100,000 |

Medical to others | $1,000 |

Deductible | $500 |

It should also be noted that Geico adds coverage in for damage of property to others at $500 with a basic renter's insurance policy.

Pro Renters Insurance Tip

Renters insurance doesn't just cover the replacement of your belongings, but also protects you if someone gets hurt on your property. Limits usually start at $100,000.

Is Geico Renters Insurance Worth The Cost?

We always try to look at the cost and value of a renter's insurance policy.

After looking through Geico Renters Insurance quotes we determined that this insurance policy is worth the cost.

We observed in NYC that a $500 deductible would get a monthly premium of $12.84. If you were to reduce your deductible to $100, the monthly premium would only go up to $13.50

One interesting benefit of Geico Renters Insurance is that you can pay upfront and save money.

When we were emailed the Geico Renters Insurance quote, we had the option to pay for the year in one shot. The price was $94.

Can I Bundle My Geico Renters Insurance With My Auto Insurance?

The good news is that Geico encourages you to bundle your insurance policies together to save money.

Studenomics Pricing Score: 4 out of 5

Bundle and Save Up to 50%

Save up to $850/year by bundling renters with car insurance. Quick Online Quotes. Compare & Save 50% on: Auto, Motorcycle, Home, Condo, & Renter.

It's free to apply!

CUSTOMER SERVICE SCORE: 4 Out of 5

How is Geico's Reputation for Service?

We looked through Glassdoor, BBB, and Reddit to see what real customers had to say about Geico Renters Insurance.

We always do this in our reviews because we want to present the full picture of what's happening.

BBB Rating: A+

Number of Ratings: 411

Glassdoor Rating: 57% would recommend

Number of Ratings: 3,400

Reddit Sentiment: Neutral

Number of Comments: We couldn't find many discussions about Geico Renters Insurance. We noticed that many folks were discussing the prices.

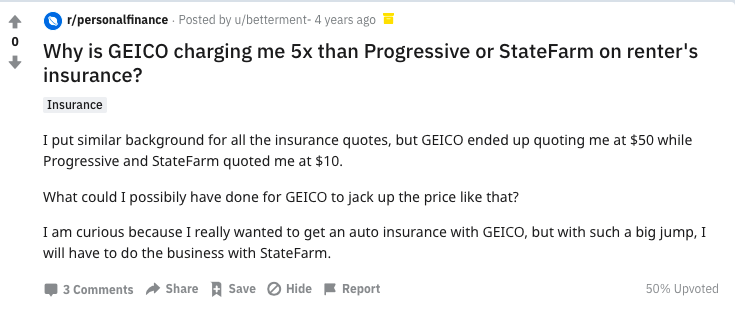

Geico Renters Insurance Reddit Feedback

In our research, we've discovered that the best feedback is available by searching up Geico Renters Insurance Reddit to see what regular folks are saying about the company.

This one person below was upset with a Geico Renters Insurance price change.

Then we found this one Reddit user who was rather impressed with the low renter's insurance rate that they obtained with Geico.

Notable Quote From The Simple Dollar Against Geico Renters Insurance:

“Geico renters insurance can be a good option if you want bare bones coverage for a fair price or already have another type of insurance with Geico."

Renters Insurance Starting at $5/month

No brokers, no paperwork, get a policy in seconds. Zero Hassle, zero paperwork, zero worry. Join now! Starting at $5/month.

It's free to apply!

How Do You File a Geico Renters Insurance Claim?

Let’s say that something were to happen and you have to file a claim, how do you go about this?

The good news is that Geico gives you multiple options for filing a claim that promise to be hassle-free.

Here’s how you can file a Geico Renters Insurance claim:

- Log in through their website.

- Call the appropriate number to file the claim over the website.

If you click this link, you can find all of the information that you need to file a renter’s insurance with Geico.

The good news is that you can file a renter's insurance claim 24/7 with Geico.

Studenomics Customer Service Score: 4 out of 5

POLICY OPTIONS SCORE: 4 Out of 5

What Does Geico Renters Insurance Cover?

What does your Geico Renters Insurance policy cover?

Personal property coverage.

This coverage applies to your personal property (furniture, kitchen table, personal items, and so on) that could be damaged or stolen by a covered loss.

It’s important that you calculate the dollar amount of your personal items so that you have enough personal property coverage.

Loss of use coverage.

This coverage will protect you financially if you can’t live in your own unit due to a covered loss. Your living expenses (restaurant bills, hotel bills, and other living expenses) would be covered.

Personal liability coverage.

This coverage is your financial protection for yourself and your family against any potential lawsuits or legal costs associated with accidental injuries or property damages that may occur.

This would protect you if someone would try to sue you after falling on your sidewalk as an example.

Medical payment to others.

This renters insurance coverage is designed to help with avoiding liability issues because the medical care of an injury that occurs on your property will be covered immediately.

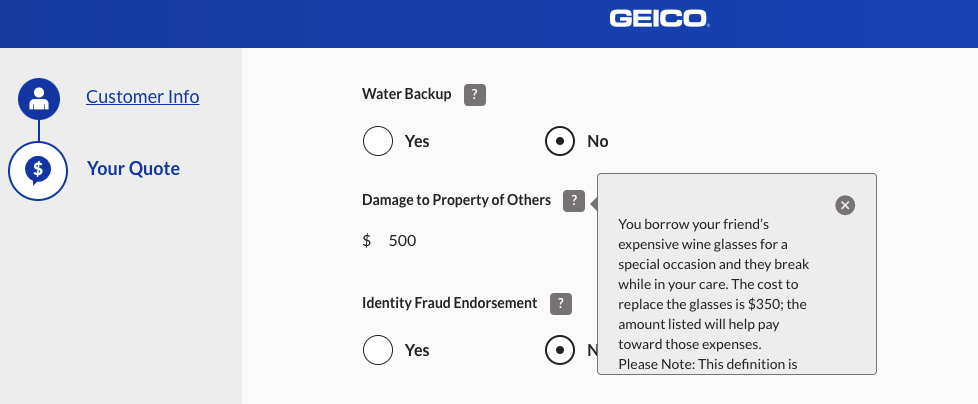

Damage to property of others.

This is a unique coverage available to Geico Renters Insurance. If you borrow something from a friend and damage it/it gets stolen, you’re going to be covered up until a certain limit.

Bundle and Save Up to 50%

Save up to $850/year by bundling renters with car insurance. Quick Online Quotes. Compare & Save 50% on: Auto, Motorcycle, Home, Condo, & Renter.

It's free to apply!

What Isn’t Covered By My Geico Renters Insurance Policy?

Now that you know what Geico Renters Insurance covers, it’s important to know what’s not covered with your policy.

Here’s a disclaimer from the official Geico website when you obtain a renter’s insurance quote:

“Your policy does not include coverage for flood and earthquake, and includes special limits for theft of items such as jewelry, watches and furs. For a complete list of exclusions and limitations please refer to your policy.”

You also have to pay extra for identity fraud endorsement. The image below captures what the renters' insurance quote page looks like so that you customize your policy based on your needs.

Can I Add My Roommate?

Can you add a roommate to your Renters Insurance Farmers policy?

Yes. When you apply for a quote, you’re asked about how many unrelated people live to you. They do this to see if you have anyone else to add. You likely have to pay an extra fee to add unrelated folks to your policy (as is the standard).

Highlights | Lemonade | State Farm |   Progressive |

|---|---|---|---|

Cost | Starting at $12/mth | Starting at $5/mth | Starting at $13/mth |

Personal Property Coverage (Starts At:) | $10,000 | $10,000 | $20,000 |

A.M. Best Rating (Financial Strength) | A++ | N/A | A+ |

BBB Rating | A+ | B+ | A |

Claims Process | Multiple options | Excellent | Good |

Best for: | Low rates | Quick online purchasing | Lowest Cost |

Studenomics Rating | 4.25 Stars | 4.75 Stars Read Full Review | 4.6 Stars Read Full Review |

Studenomics Policy Options Score: 4 out of 5

Renters Insurance Starting at $5/month

No brokers, no paperwork, get a policy in seconds. Zero Hassle, zero paperwork, zero worry. Join now! Starting at $5/month.

It's free to apply!

FINANCIAL STRENGTH SCORE: 5 Out of 5

What is Geico's Financial Rating?

Geico scored an A++ rating from A.M Best which is very rare for an insurance company. This is the highest possible score that a company could earn.

The reason that we gave Geico a 5 here is because they have a strong financial standing. The company is an established powerhouse in the insurance industry and they won't have any financial issues in the foreseeable future.

Studenomics Financial Strength Score: 5 out of 5

Pros and Cons of Geico Renters Insurance?

Every renter’s insurance policy comes with positives and negatives.

What are the pros and cons of Geico Renters Insurance?

Pros:

Cons:

Does Geico Offer Insurance In My State?

Geico currently offers insurance in all 50 states.

You can also check the best renters insurance rates by state using the map below.

How can you cancel?

Let's say that something happens and you want to cancel your Geico Renters Insurance.

How do you cancel your policy?

You have to call Geico at 1-800-841-1587 and speak with an agent to cancel your policy.

Please keep in mind that you won't be covered so it's important that you looking for a new renter's insurance policy before you cancel one.

Take Action

That's our review of Geico Renters Insurance with all of the possible information that we could find.

We found that the renters insurance rates were very fair across the country. The coverage may be average, but you're trusting your money with a financially strong company.

Renters Insurance Starting at $5/month

No brokers, no paperwork, get a policy in seconds. Zero Hassle, zero paperwork, zero worry. Join now! Starting at $5/month.

It's free to apply!