Roost Renters Insurance Review: Pros & Cons, Pricing, and Features

Studenomics Score: 3 Out of 5 Stars

Advertiser Disclosure: Our content is free because we are supported by advertisers. If you click on links in this post, we may earn a commission.

We all know what it’s like to be on the hunt for the perfect renter’s insurance policy to ensure that you're covered. You want a policy that comes with a peace of mind.

I think you’ll agree with me that a renters insurance policy should protect you and your personal belongings without costing you a fortune.

Roost Renters Insurance promises to give you the peace of mind that you deserve with convenient options and reliable service.

This is why we’re going to review Roost Renters Insurance. We want to see if this renters insurance company is ideal for your situation and if they can back up the claims of convenience.

Highlights:

Overview:

Roost Renters Insurance is available through a specific group of property managers using the online portal.

Known for:

- Coverage is provided for water damages.

- Available in all 50 states.

- Every policy comes with replacement cost coverage.

Financial Rating:

Roost Renters Insurance isn't rated for financial strength by A.M Best. The company is backed by companies that are.

Who is Roost Renters Insurance?

Who is Roost Renters Insurance as a company?

In our research, we couldn't find much about Roost since they only work with property managers who use the Appfolio software.

Appfolio is the parent company of Roost and they offer online services for property managers.

Your rental unit has to be in the Appfolio database for you to purchase a renter's insurance policy. As a result of this, there isn't much information available to the public about Roost Renters Insurance.

According to the official website of Appfolio, here's what they had to say about the software:

"AppFolio offers two tiers of mobile property management software that allows residential, commercial, student housing, and community association property managers to more effectively market, manage and grow their business efficiently with AppFolio Property Manager and AppFolio Property Manager PLUS."

We're going to take a deep dive into the renter's insurance policies that are offered by Roost Renters Insurance.

ROOST CONTACT INFO

Website: www.roostrentersinsurance.com

Phone: (844) 788-0877

Address (Appfolio): 50 Castilian Dr.

Goleta, CA 93117

How Does Roost Renters Insurance Work?

Roost Renters Insurance is extremely unique when it comes to a renters insurance policy.

Normally, you go to the website of a renter's insurance company to obtain your renter's insurance quote. In this case, you have to go through your property manager. Your property manager has to be using the Appfolio software.

If you qualify, you can obtain a quote from Appfolio. The good news is that you can put a bunch of roommates under one policy. The bad news is that you can't find a renters insurance quote online.

While the website is very basic, you can still see what renters insurance covers when you sign up Roost.

Bundle and Save Up to 50%

Save up to $850/year by bundling renters with car insurance. Quick Online Quotes. Compare & Save 50% on: Auto, Motorcycle, Home, Condo, & Renter.

It's free to apply!

Is Roost Renters Insurance Good?

We always do our best to conduct a thorough investigation of every renters insurance company that we review. With minimal public information available about the company we decided to look at Roost Renters Insurance and the Appfolio property management software that's used by them.

What we liked is that Roost allows you to cover your roommates (saving you money), that they provide coverage for water damage, and that you can replacement cost value coverage on your prized possessions.

According to the official website:

"With Roost, you'll also receive Replacement Cost Value (RCV) coverage, which pays the cost to replace your items with new ones. Roost Renters Insurance is dedicated to offering you convenient options, reliable service, and robust coverage."

Is Roost Renters Insurance legit?

Our goal is to discover if every renters insurance company that we cover is legit or not.

We look at the pricing, customer service, policy options, and the financials of the company.

Let's see what we were able to find about Roost Renters Insurance and Appfolio.

Our editor's scores for our Roost Renters Insurance Review pricing, customer service, policy options, and financial stability:

Studenomics Score: 3 Out of 5 Stars

PRICING SCORE: 2 Out of 5

How Much Does Roost Insurance Cost?

It wouldn’t be fair to write a Roost Renters Insurance review without looking at the price of an insurance policy.

We regret to inform you that it's challenging to obtain a quote through the website since you must be a property manager using the Appfolio software.

The fact that you can save money with many tenants under one policy was helpful. However, we try to be fully transparent when writing a renters insurance review.

Renters Insurance Starting at $5/month

No brokers, no paperwork, get a policy in seconds. Zero Hassle, zero paperwork, zero worry. Join now! Starting at $5/month.

It's free to apply!

How Much Is Roost Renters Insurance?

When going over Roost Renters Insurance, we couldn't find any public quotes. We did find conversations about Roost Renters Insurance, but we couldn't nail down any specifics when it comes to actual numbers and figures.

Roost Renters Insurance Quotes.

We normally would share Roost Renters Insurance quotes here. In the case of Roost Renters Insurance, you're going to have to speak with your property manager.

Pro Renters Insurance Tip

Renters insurance doesn't just cover the replacement of your belongings, but also protects you if someone gets hurt on your property. Limits usually start at $100,000.

Is Roost Renters Insurance Cost Worth It?

Should you sign up with Roost Renters Insurance?

It depends on your situation. We found Roost to be ideal for the following folks:

- College students living together.

- Those who need renters insurance for landlord requirements.

- Anyone looking for water damage protection.

There are cheaper renters insurance companies out there so you're going to want to look around for a few quotes before you sign up with Roost Renters Insurance.

Can I Bundle My Roost Renters Insurance With My Auto Insurance?

The bad news is that Roost Renters Insurance doesn't offer auto insurance so you would have to find a separate policy here.

Studenomics Pricing Score: 2 out of 5

Bundle and Save Up to 50%

Save up to $850/year by bundling renters with car insurance. Quick Online Quotes. Compare & Save 50% on: Auto, Motorcycle, Home, Condo, & Renter.

It's free to apply!

CUSTOMER SERVICE SCORE: 3 Out of 5

How is Roost's Reputation for Service?

We looked through Glassdoor, BBB, and Reddit to see what regular people had to say about Roost Renters Insurance.

We scored a 3 here because there isn't much available on Roost Renters Insurance and Appfolio had many complaints against them.

We also didn't like the fact that there's no number to contact for customer service and you have to email.

The following scores are for Appfolio since that's the software company that property managers use for Roost Renters Insurance.

BBB Rating: A-

Number of Ratings: 1. (34 customer complaints)

Glassdoor Rating: 93% would recommend

Number of Ratings: 558

Reddit Sentiment: Neutral

Number of Comments: There weren't many discussions about Roost.

Roost Renters Insurance Reddit Feedback

We always look through Reddit to see what your regular customers have to say about the renters insurance policies and how the renters insurance company operates.

We searched for the phrase, "Roost Renters Insurance Reddit" to see what we could find.

Here's one discussion that stuck out...

This conversation reminded us that many college students will likely be using Roost Renters Insurance since they want to save money. You can really save a lot of paperwork and hassle by putting your roommates under one policy.

Notable Quote From Value Penguin against Roost Renters Insurance:

"Roost Renters Insurance give you standard coverage with guaranteed replacement cost coverage included, but its lack of transparency and poor customer satisfaction reviews make it hard to recommend."

We discovered a similar problem in looking for information on Roost Renters Insurance. We wish that the company was more transparent with its renters insurance policies.

Renters Insurance Starting at $5/month

No brokers, no paperwork, get a policy in seconds. Zero Hassle, zero paperwork, zero worry. Join now! Starting at $5/month.

It's free to apply!

How Do You File a Roost Renters Insurance Claim?

Let's say that something happens and you have to file a renter's insurance claim with Roost Renters Insurance, what's the process like?

You have a few options when it comes to filing a renters insurance claim with Roost Renters Insurance:

- Go online through the portal here (https://msimga.com/).

- Call (844) 788-0877.

- Speak with your property manager.

Please remember to contact your landlord and the police when a situation occurs so that you have the proper paperwork in case it's needed from you.

If there's a theft, you're going to need a police report so that you have your paperwork in check.

Studenomics Customer Service Score: 3 out of 5

POLICY OPTIONS SCORE: 3 Out of 5

What Does Roost Renters Insurance Coverage Include?

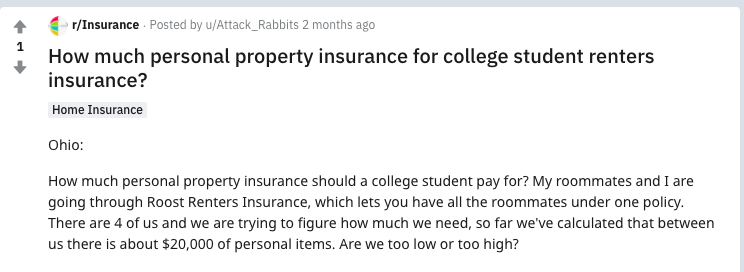

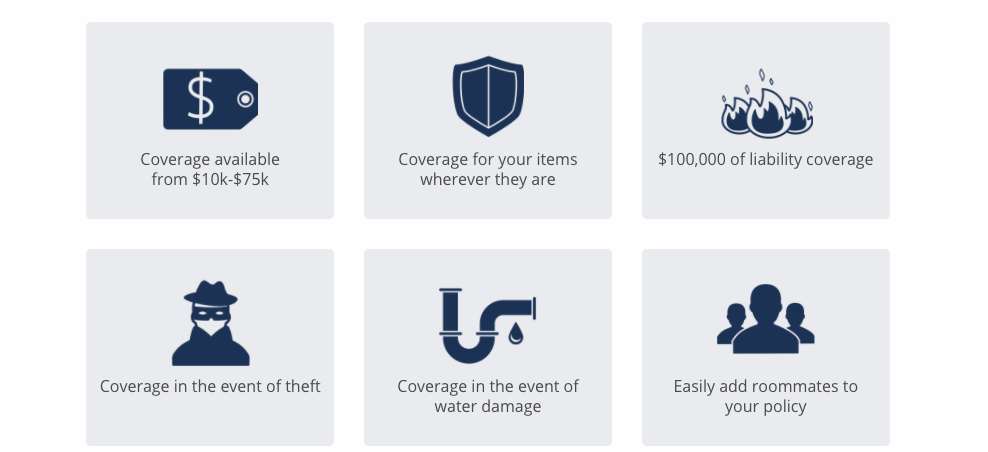

What exactly does Roost Renters Insurance cover? While the website doesn't go into detail, we were able to find some information here.

Here's what's covered with your Roost Renters Insurance policy:

Personal property coverage.

Your personal items (everything from your laptop to couch) are protected from any covered theft or damages. The coverage ranges from $10,000 to $75,000.

Personal liability coverage.

You're protected in the event that someone were to sue you or if you had to deal with a legal situation due to a covered loss. You have personal liability up to $100,000 in protection.

Loss of use coverage.

If you can't live in your unit due to a covered loss, you would have your temporary living costs covered.

According to the official Roost Renters Insurance website:

"Yes, Roost Renters Insurance provides coverage of additional living expenses as a result of a covered loss. This coverage is important if you need to live in a temporary location due to damage to your home."

Additional coverage.

Roost Renters Insurance also provides replacement cost coverage, water damage coverage, and you could add your roommates to your renters insurance policy.

The graphic below is a piece from the actual website, where you could see what comes with your renters insurance policy.

Bundle and Save Up to 50%

Save up to $850/year by bundling renters with car insurance. Quick Online Quotes. Compare & Save 50% on: Auto, Motorcycle, Home, Condo, & Renter.

It's free to apply!

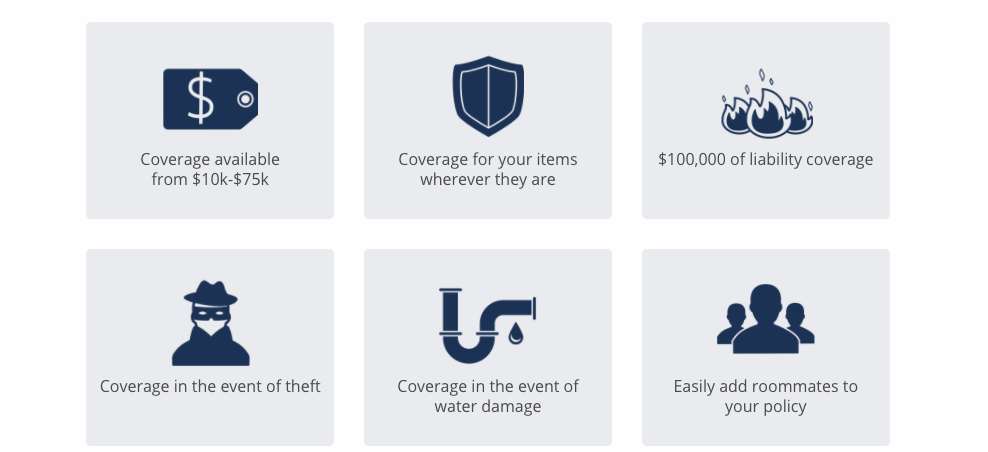

What Isn’t Covered By My Roost Renter's Insurance Policy?

Now that you know what’s covered with your Roost Renters Insurance policy, it's important to see what isn't covered.

Here's what you have to look into when you speak with your property manager:

- Running a business from home isn't typically covered.

- There will be limits on jewelry and electronics.

- Not all natural disasters are covered.

As always, we suggest that you go over your renters insurance policy to see if you need any modifications based on your unique situation.

The graphic below shows an example of what's covered and what's not covered with your Roost Renters Insurance policy.

Can I Add My Roommate?

Are you looking to add your roommate to your renter's insurance policy?

We have good news here. You can have a bunch of roommates under one renter's insurance policy with Roost.

Studenomics Policy Options Score: 3 out of 5

Renters Insurance Starting at $5/month

No brokers, no paperwork, get a policy in seconds. Zero Hassle, zero paperwork, zero worry. Join now! Starting at $5/month.

It's free to apply!

FINANCIAL STRENGTH SCORE: 4 Out of 5

What is Roost's Financial Rating?

We always look at the financial strength of a renter's insurance company because we want you know that you're going to be covered in the future if you were to file a claim.

While Roost doesn't have an A.M Best score, we were able to find out that Millennial Specialty Insurance has a score of A+.

Why does this matter? According to Roost:

"Roost Renters Insurance policies are serviced by Millennial Specialty Insurance, LLC (doing business in California as Millennial Insurance Agency, LLC), a leading provider of HO4 renters insurance products for the multi-family housing market."

This means that Roost Renters Insurance is backed by an established company.

Studenomics Financial Strength Score: 4 out of 5

Pros and Cons of Roost Renters Insurance?

We browsed around to try to see what the pros and cons of Roost Renters Insurance are. Here's what we were able to come up with.

Pros:

Cons:

Those are the pros and cons that we want you to think about before deciding to use Roost Renters Insurance.

Does Roost Offer Insurance In My State?

The good news is that it looks like Roost Renters Insurance is offered in all 50 states. If your property manager uses the Appfolio software, then you could obtain a Roost Renters Insurance quote.

You can also check the best renters insurance rates by state using the map below.

How can you cancel Roost Renters Insurance?

Let's say that your situation changes and you want to cancel your Roost Renters Insurance policy. How can you do this?

You have two options if you want to cancel your Roost Renters Insurance at any point:

- Email at [email protected]

- By phone at (844) 788-0877.

Final thoughts on Roost Renters Insurance...

That’s our review of Roost Renters Insurance. We really wish that we could add more information in here because Roost looks promising, but the company simply doesn't share enough information online.

If you're looking for amazing customer service or renters insurance quote comparisons, you're going to want to look elsewhere.

Roost Renters Insurance seems to be ideal for anyone who has an applicable property manager and is looking to share a renter's insurance policy with their roommates.

Renters Insurance Starting at $5/month

No brokers, no paperwork, get a policy in seconds. Zero Hassle, zero paperwork, zero worry. Join now! Starting at $5/month.

It's free to apply!

Your company is disgusting my girlfriends daughters apartment part down you don’t even answer your emergency phone numbers more than 30 hours after the fire. This young girl is homeless and you’re taking on no responsibility of your job a complaint will be filed with the state insurance commission.

I’m sorry to hear that. Please let us know how it ended up being resolved.