State Farm Renters Insurance Review: Pros & Cons, Pricing, and Features

Studenomics Score: 4.5 Out of 5 Stars

Advertiser Disclosure: Our content is free because we are supported by advertisers. If you click on links in this post, we may earn a commission.

We know that it can be difficult to find a renters insurance policy that offers you the perfect coverage that you need for your lifestyle on a budget that you can afford.

State Farm Renters Insurance Review

It turns out that State Farm Renters Insurance has policies that you can customize on any budget so that you and your personal belongings are always covered.

Are you considering insuring yourself with State Farm Renters Insurance? We dug deep to see what we can find out more about State Farm Renter’s Insurance. Keep on reading to see our reviews of the State Farm Insurance Renters Insurance.

Highlights:

Overview:

A huge insurance company founded in 1922 with solid pricing across the nation.

Known for:

- Being available nationwide with an established history of being an insurance powerhouse.

- Low rates for policies that can be easily customized.

Standard policies offer extensive coverage (personal property coverage starts at $20,000).

Financial Rating:

Rated A ++ for financial strength by A.M. Best

Who is State Farm Insurance?

State Farm has been offering insurance products (all types of insurance all the way to financial services) since 1922.

The company has over 18,000 agents and 56,000 employees.

in 2019, State Farm was ranked 36th in the Fortune 500 list based on revenue.

STATE FARM CONTACT INFO

Website: www.StateFarm.com

Phone: (800) 782-8332

Address: One State Farm Plaza, Bloomington, IL 61710

How Does State Farm Renters Insurance Work?

“Does State Farm have renters insurance?”

Many readers have asked if State Farm offers renters insurance.

You’ve likely heard of State Farm since the company is pretty much a household name at this point. You may even associate State Farm with auto insurance. However, State Farm Insurance Renters Insurance is also available.

State Farm may be known for its auto insurance, but the company also offers other types of insurance if you’re looking for an insurance bundle to simplify your life.

Before we go any further, you’re likely wondering one important detail about State Farm.

How does State Farm Renters Insurance work?

If you’re looking for renters insurance, you can apply online for a renter’s insurance quote with State Farm Renter’s Insurance.

The company will instantly give you a quote (more on this later) and you can customize your policy until you find the right insurance plan for your budget and situation.

Bundle and Save Up to 50%

Save up to $850/year by bundling renters with car insurance. Quick Online Quotes. Compare & Save 50% on: Auto, Motorcycle, Home, Condo, & Renter.

It's free to apply!

Is State Farm Renters Insurance Good?

State Farm Renters Insurance is available nationwide with customizable policies.

You can find a renters insurance policy that suits your needs.

State Farm Renters Insurance will protect your personal property, your personal liability, and provide you with loss of use coverage so that you can stay in a hotel if you can’t live in your unit for an insured loss.

On that note…

Is State Farm Renters Insurance legit?

State Farm has been around since 1922 and the company often receives high reviews in studies (more on this later) conducted with customers.

You can find State Farm insurance in every single state so if you were to move you wouldn’t have to worry about finding a new insurance company.

Our editor's scores for State Farm Company for pricing, customer service, policy options, and financial stability:

Studenomics Score: 4.5 Out of 5 Stars

PRICING SCORE: 5 Out of 5

How Much Does State Farm Renters Insurance Cost?

The important question for you here revolves around how much State Farm Renters Insurance costs.

We know how expensive life already is. This is why we always factor in the price when it comes to reviewing renter’s insurance.

Renters Insurance Starting at $5/month

No brokers, no paperwork, get a policy in seconds. Zero Hassle, zero paperwork, zero worry. Join now! Starting at $5/month.

It's free to apply!

How Much Is State Farm Renters Insurance?

How much is State Farm Renter’s Insurance? It’s difficult to give a one-size-fits-all answer because renters insurance varies totally on the situation.

Here’s what you should remember about the price of State Farm Renters Insurance from the official website:

“And finally, remember is located will play an important role in determining your renters insurance rates. Prices will vary based on your state, city and neighborhood. Safer locations might mean lower rates, so renting in a low-crime area near a fire station might save you money. Your rates will also reflect the .”

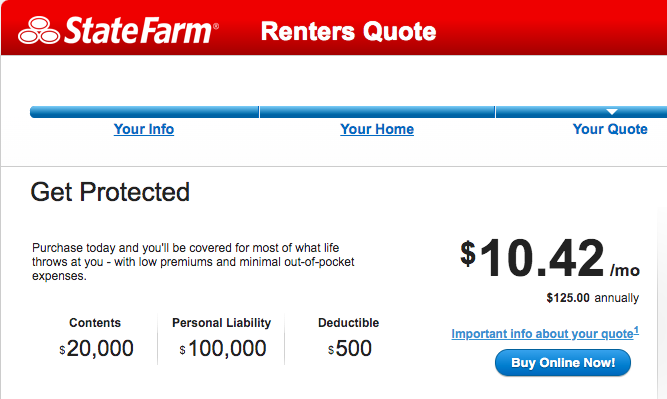

State Farm Renters Insurance Quotes

We ran through different addresses and scenarios to find you a sample of how State Farm Renters Insurance quotes so that you know what you’re getting into here.

Here are two quick examples of renters insurance State Farm quotes:

- $10.42/month in NYC, New York.

- $11.83/month in San Francisco, California..

You can apply for a State Farm Renter’s Insurance quote online. Here are a few fields that you’re going to have to fill out to obtain your State Farm Renters Insurance quote:

- Your name.

- Address.

- Birthday.

- Policy start date.

- Email (so they can send you the quote).

- Phone Number.

- Information about how many people live in the unit full-time.

- Is any business done in the unit?

- The coverage amount for your personal property value (starting at $20,000) that you would like.

- Questions about safety features (fire alarm, deadbolt locks, fire extinguishers, sprinkler system, and burglar alarms).

- Insurance history (your claims and the name of your previous property insurer).

Once you fill all of this information in, you’ll get a State Farm Renter’s Insurance quote instantly.

The quote will also be emailed to you. You can then customize your policy depending on how much coverage you would like.

On top of increasing your liability coverage, you can also increase your coverage limits for expensive art and jewelry.

You can even select an option to have an agent contact you to discuss your coverage and policy.

It’s alst important to note that every single factor (security of your home, amount of people living in the unit, and so on) will impact the price of your policy.

Pro Renters Insurance Tip

Renters insurance doesn't just cover the replacement of your belongings, but also protects you if someone gets hurt on your property. Limits usually start at $100,000.

Is State Farm Worth The Cost?

State Farm Renters Insurance is worth the cost mainly because you can customize your policy to match your needs.

The best part of State Farm is that you can bundle your insurance plans with them. You can combine auto insurance, life insurance, boat insurance, and your renters insurance with them.

Bundling your insurance makes State Farm worth the cost since you can your insurance under one payment.

Can I Bundle My State Farm Renters Insurance With My Auto Insurance?

As we have mentioned in this review, you can bundle your State Farm Renters Insurance with your auto insurance and receive deep discounts.

Studenomics Pricing Score: 5 out of 5

Bundle and Save Up to 50%

Save up to $850/year by bundling renters with car insurance. Quick Online Quotes. Compare & Save 50% on: Auto, Motorcycle, Home, Condo, & Renter.

It's free to apply!

CUSTOMER SERVICE SCORE: 4 Out of 5

How is State Farm's Reputation for Service?

Add reviews, Glassdoor, BBB, Reddit - These are always indicative of customer service. Add their score and total number of reviews. For Reddit, it will be overall sentiment.

BBB Rating: A

Number of Ratings: 216

Glassdoor Rating: 51% would recommend

Number of Ratings: 9,400

Reddit Sentiment: Neutral

Number of Comments: Minimal

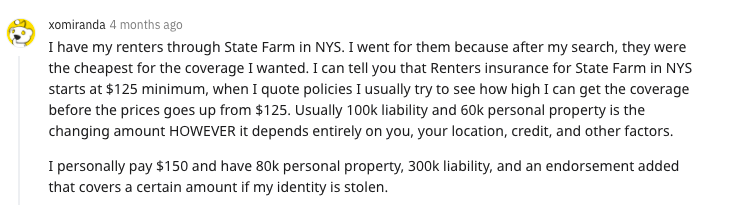

Notable Quote Against State Farm Company:

“Recently had a rental car broken into and a bag stolen from me that included my car keys. It costs me $200 to replace the volkswagen key and remote unlock fab. I talked with my State Farm renters insurance who said they won't cover "car parts" of which the key is included. The exact language is they won't cover "any engine or motor propelled vehicle or machine, including the parts, designed for movement on land."

Other users were quick to point out that car parts aren’t covered. The reason that we are sharing this is because it’s important to look over your policy.

You also want to ensure that your claims are worth paying the deductible.

What are the State Farm Renters Insurance reviews like? We looked around to see what other blogs and writers had to say about State Farm Renters Insurance.

Notable Quote For State Farm Company:

As always, we go through Reddit to see what regular people had to say abut State Farm Renters Insurance.

A detailed search of the phrase, “Renters Insurance State Farm Reddit” helped us find this interesting review.

As you can see, State Farm Renters Insurance is trusted and used by many around the nation so you don’t have to worry about that.

Renters Insurance Starting at $5/month

No brokers, no paperwork, get a policy in seconds. Zero Hassle, zero paperwork, zero worry. Join now! Starting at $5/month.

It's free to apply!

How Do You File a State Farm Renters Insurance Claim?

How do you file a claim on your State Farm Policy? You first need to do the following:

- Report any losses or damages to your landlord.

- File a police report if necessary.

- Hold on to your receipts if you have to live in a hotel for a bit.

- Review your policy to see if you’re covered.

Hopefully, you never have to file a claim with State Farm Renters Insurance, but if you do, here’s how you can file a claim:

- Use the State Farm mobile app to start your claim.

- Fill out the key information about your claim.

- Wait to hear from State Farm as they review your claim.

Filing a claim with State Farm Renters Insurance is a fairly easy process.

You can initiate your claim on your mobile app so that you don’t have to worry about being on the phone for hours.

Studenomics Customer Service Score: 4 out of 5

POLICY OPTIONS SCORE: 4.5 Out of 5

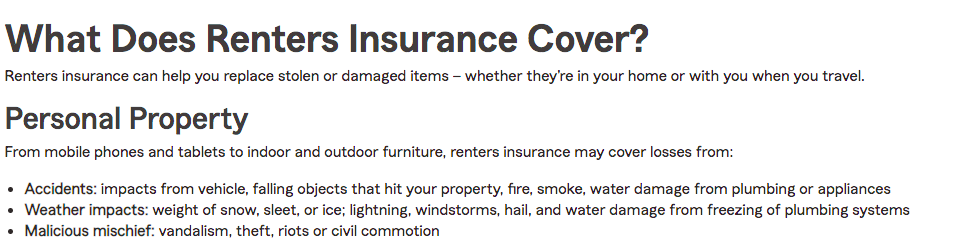

What Does State Farm Renters Insurance Cover?

What’s the State Farm Renters Insurance coverage like? What’s covered?

Your personal property.

State Farm Renters Insurance will cover your personal property (anything from tablets to clothing) in the event of a loss from accidents, weather impacts, and malicious impacts.

The official website goes into great detail about what kind of coverage you have here.

As you can see, you have plenty of coverage for your personal property with State Farm Renters Insurance coverage.

You can customize the amount of coverage that you have based on your budget or the amount that your valuables are worth.

Liability coverage.

Your personal liability is covered in the event that you get sued or have any legal issues due to a covered issue.

Liability coverage also extends to any damages to property or people that you’re responsible for.

If someone were to get injured at your place, their medical bills would be covered.

Loss of use coverage.

If you can’t live in your place due to an insured loss, you can be put up in a hotel where your meals are covered along with other possible expenses related to the new living situation.

You can also add pet medical coverage if you have pets. There are also other options for State Farm Renters Insurance coverage that we discuss in here later.

Bundle and Save Up to 50%

Save up to $850/year by bundling renters with car insurance. Quick Online Quotes. Compare & Save 50% on: Auto, Motorcycle, Home, Condo, & Renter.

It's free to apply!

What Isn’t Covered By My Policy

What isn’t covered by your State Farm Renters Insurance policy? Let’s look at what State Farm Renters Insurance doesn’t cover:

- Damage done to the actual structure of the unit. Your landlord needs insurance for the building, roof, and siding.

- Water damage caused by a flood or any underwater damage.

- Damage caused by Earth movements (earthquakes and so on).

As you go through your renter’s insurance policy it’s important to know what isn’t covered and if it’s critical to you based on the community that you live in.

For example, you may feel the need to add flood protection if you live in an area prone to flooding.

When obtaining your State Farm Renter’s Insurance quote, you can find additional coverages for a premium.

You can pay for additional liability coverage, identity restoration, Earthquake damage, additional business property, and incidental business liability.

You may want to look into the business liability options if you work from home or run a small business.

When looking for a quote, it’s important to put in all of the important information so that you find the right renter’s insurance policy for you.

Can I Add My Roommate?

Yes, you can add your roommate to your State Farm Renters Insurance policy. You must provide the full information when you obtain your renters insurance quote.

Highlights |   Lemonade | State Farm |   Progressive |

|---|---|---|---|

Cost | Starting at $10/mo | Starting at $5/mth | Starting at $13/mth |

Personal Property Coverage (Starts At:) | $20,000 | $10,000 | $20,00 |

A.M. Best Rating (Financial Strength) | A+ | N/A | A+ |

BBB Rating | A | B+ | A+ |

Claims Process | Excellent | Very simple | Excellent |

Best for: | Customized Policies | Low cost | Lowest Cost |

Studenomics Rating | 4.5 Stars | 4.6 Stars Read Full Review | 4.6 Stars Read Full Review |

Studenomics Policy Options Score: 4 out of 5

Renters Insurance Starting at $5/month

No brokers, no paperwork, get a policy in seconds. Zero Hassle, zero paperwork, zero worry. Join now! Starting at $5/month.

It's free to apply!

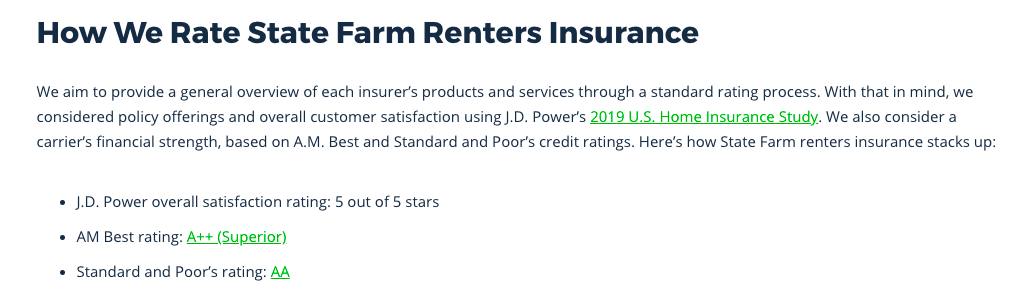

FINANCIAL STRENGTH SCORE: 5 Out of 5

What is State Farm's Financial Rating?

State Farm Insurance has an A.M Best score of A++.

This is the highest possible rating that can be given to a company and it signifies strong financial health.

This means that you can trust the financial structure of State Farm Renters Insurance.

Ranked second highest in the country in a J.D Power study.Studenomics Financial Strength Score: 5 out of 5

"The process was very smooth and they deposited the money in my account in less than 3 days."

Ayman A. - BBB Review

Pros and Cons of State Farm Renters Insurance?

As with every renters insurance policy, you’re going to find positives and negatives. It’s only fair that we look at both sides so that you know what you’re getting into.

What are the pros and cons of State Farm Renters Insurance?

Pros:

Cons:

Those are the pros and cons that we want you to think about when it comes to State Farm Renters Insurance.

Does State Farm Offer Insurance In My State?

The good news here is that State Farm offers insurance in your state because the company is nationwide. You can find an agent near you easily.

You can also check the best renters insurance rates by state using the map below.

How to Cancel?

How can you cancel your State Farm Renters Insurance policy? You can easily do so by contacting your agent or using the website.

Take Action

That’s everything you could want to possibly know about State Farm Renters Insurance Reviews.

If you’re looking for a customizable renter’s insurance policy that fits your budget and needs, State Farm Renters Insurance is for you.

State Farm has been around for a long time and the company offers many different insurance products nationwide.

Renters Insurance Starting at $5/month

No brokers, no paperwork, get a policy in seconds. Zero Hassle, zero paperwork, zero worry. Join now! Starting at $5/month.

It's free to apply!