USAA Renters Insurance Review: Pros & Cons, Pricing, and Features

Studenomics Score: 4.75 Out of 5 Stars

Advertiser Disclosure: Our content is free because we are supported by advertisers. If you click on links in this post, we may earn a commission.

I think that you’ll agree with us that you want a renters insurance policy that you can trust.

You don’t want to have to worry about being hassled when you file a claim or trying to find an affordable option for renter’s insurance when you already have enough bills piling up.

We’re going to look at USAA Renters Insurance to see why they're one of the best in the industry.

After looking through many differenter renter’s insurance companies, we can confirm that you definitely need to consider using USAA due to their comprehensive policies and excellent financial standing.

This review of USAA Renters Insurance is going to look at the pros and cons of using them along with detailed analysis of the entire company so that you have enough information to know if you should trust USAA with your insurance needs.

Highlights:

Overview:

Founded in 1922, USAA has a long history of offering insurance products across the nation. USAA is well-respected for its exceptional coverage and policy options.

Known for:

- Comprehensive coverage that you won’t find anywhere else (even Earthquakes are covered).

- Helpful customer service agents.

- Innovative technology.

Financial Rating:

Rated A++ (superior) for financial strength by A.M. Best. This is one the highest rating that we’ve seen for any renters insurance company.

Who is USAA Insurance?

USAA was founded in 1922 by 25 U.S military members who wanted to help insure each others’ automobiles. These members of the U.S Army started this small organization to help each other out.

USAA now has a net worth of over $31 billion and is one of the financially strongest insurance companies in the nation.

Despite not being eligible to enrol here, we had to review USAA because we’ve heard many positive things about the insurance products that they offer.

USAA CONTACT INFO

Website: www.usaa.com

Phone: 800-531-USAA (8722)

Address: 9800 Fredericksburg Rd

San Antonio, TX 78288-0001

How Does USAA Renters Insurance Work?

Are you confused about how USAA renters insurance works?

USAA is a unique insurance company in the sense that it’s designed for members of the military service and their families. So not just anyone can enrol for an insurance plan with USAA.

How does one become eligible for insurance with USAA?

According to the official website:

“Generally, USAA membership is open to active, retired, and separated veterans with a discharge type of ‘Honorable’ from the U.S. military and their eligible family members.”

You can go through the list to see who’s eligible for insurance with USAA.

Why is this this case? Why does one have to be eligible for USAA insurance products?

“Our eligibility rules reflect USAA’s primary mission…to be the provider of choice for the U.S. military community and their immediate families. This does not reflect USAA’s opinion concerning the desirability or insurability of other family members but rather, a decision to focus our resources on the current eligibility groups.”

Bundle and Save Up to 50%

Save up to $850/year by bundling renters with car insurance. Quick Online Quotes. Compare & Save 50% on: Auto, Motorcycle, Home, Condo, & Renter.

It's free to apply!

Is USAA Renters Insurance Good?

USAA Renters Insurance is very good if you're eligible. It's very rare that you find this level of coverage and customer support out of an insurance company.

You can rest knowing that your personal propety is covered no matter where you are and you don't have to worry about paying extra for certain levels of coverage.

Is USAA Renters Insurance legit?

After going through reviews, customer feedback, and research, we’ve discovered that USAA renters insurance is indeed very legit. You can’t go wrong with a company that has been around for almost an entire century.

One quick glance at the official website and you’ll immediately notice that USAA has exceptional insurance coverage.

For example, a standard policy offers Earthquake and flood protection. This may not seem like much, but you usually have to pay extra for this coverage with every other insurance company.

We dig further into the coverage that USAA offers throughout this review.

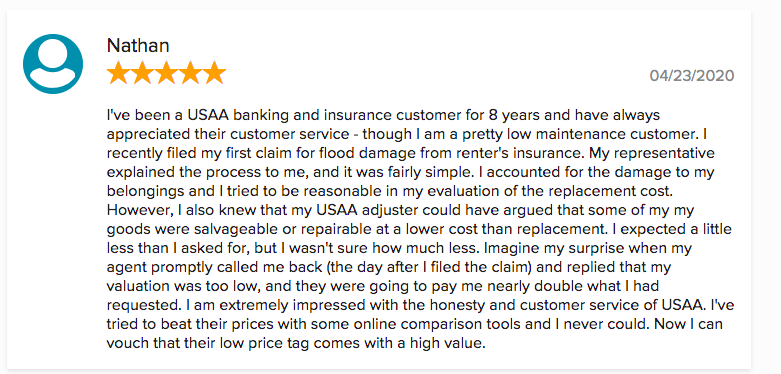

Here's one review from the BBB website that stuck out to us during our research.

Our editor's scores for USAA for pricing, customer service, policy options, and financial stability:

Studenomics Score: 4.75 Out of 5 Stars

PRICING SCORE: 4 Out of 5

How Much Does USAA Renters Insurance Cost?

We always look at the cost of a renters insurance policy to ensure that you’re not overpaying since we realize how sensitive price can be these days with everything that’s going on in the world.

Renters Insurance Starting at $5/month

No brokers, no paperwork, get a policy in seconds. Zero Hassle, zero paperwork, zero worry. Join now! Starting at $5/month.

It's free to apply!

How Much Is USAA Renters Insurance?

According to our research, a renters insurance policy can begin at $12. We look through many forums and reviews where we discovered that folks weren’t complaining about the price of renters insurance with USAA.

Here are a few factors that will impact the rate of your renter’s insurance:

Your claims history.

Where you live.

The type of unit you live in.

Security measures in place at your unit.

The deductible that you choose.

USAA Renters Insurance Quotes

We usually try to obtain quotes for renters insurance from different states. Since we’re not eligible for USAA insurance, we relied on what regular folks were saying about USAA Renters Insurance in forums.

Pro Renters Insurance Tip

Renters insurance doesn't just cover the replacement of your belongings, but also protects you if someone gets hurt on your property. Limits usually start at $100,000.

Is USAA Worth The Cost?

You get your money's worth with USAA due to the fact that they have policies available worldwide and they offer more coverage than you would typically find.

You can find a cheaper alternative depending on where you live and if you're willing to look around for quotes.

Can I Bundle My USAA Renters Insurance With My Auto Insurance?

The good news is that you can bundle your USAA auto insurance with renters insurance to obtain a discount. This will simplify your life and allow you to work with one company for all of your insurance needs.

Studenomics Pricing Score: 4 out of 5

Bundle and Save Up to 50%

Save up to $850/year by bundling renters with car insurance. Quick Online Quotes. Compare & Save 50% on: Auto, Motorcycle, Home, Condo, & Renter.

It's free to apply!

CUSTOMER SERVICE SCORE: 5 Out of 5

How is USAA's Reputation for Service?

We looked through Glassdoor, BBB, and Reddit to see what the customer service reviews were like. We find that these are often indicative of the actual level of service that one should expect.

BBB Rating: B+

Number of Ratings: 508

Glassdoor Rating: 65% would recommend

Number of Ratings: 3,200

Reddit Sentiment: Positive

Number of Comments: We were able to find many candid conversations about USAA insurance products.

USAA Renters Insurance Reddit Feedback.

One of the best places to find real customer information about a company is Reddit.

When we searched up USAA Renters Insurance Reddit, we found some interesting results that we have to share with you.

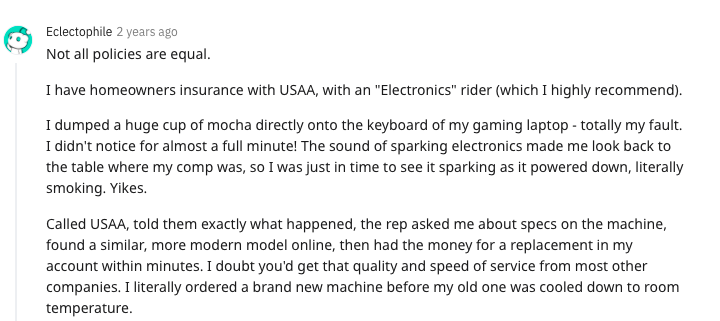

This user below had the following experience with USAA Renters Insurance.

We noticed many similar positive experiences with USAA Renters Insurance.

Common Criticism Against USAA:

Many folks were quick to bring up how they weren't eligible for USAA Renters Insurance.

In the aforementioned USAA Renters Insurance Reddit conversation, we found this one negative comment:

“Mine's less than $15/mo through USAA. Might have been a little less before I moved out here, can't remember.

If you think you can get a better deal elsewhere, you should try your luck elsewhere. I've done so in the past for certain things, my dad's been a member for years and he's done so as well. It's really hard to compare USAA to their competitors because they aren't particularly interested in competing with the market. They'll be in the ballpark when they can, but in my experience they're rarely the cheapest.

Except for customer service. They win at customer service.”

Notable Quote From The Simple Dollar About USAA:

“Because it understands the mobile lives of active-duty military, USAA ensures that all your personal belongings will be covered, no matter where they are located. In addition to the excellent coverages, USAA ranked five out of five in overall satisfaction, policy offerings, price, billing process and policy information and interaction in J.D. Power’s 2019 Renters Insurance Study.”

As you can see, USAA Insurance is trusted and used by many around the nation so you don’t have to worry about that.

Renters Insurance Starting at $5/month

No brokers, no paperwork, get a policy in seconds. Zero Hassle, zero paperwork, zero worry. Join now! Starting at $5/month.

It's free to apply!

How Do You File a USAA Renters Insurance Claim?

How can you file a claim with USAA Renters Insurance?

One of the most stressful aspects of renter’s insurance is one thing that we all hope to avoid. Nobody wants to file a claim. However, our belongings could be damaged or something else could occur where we have to file a claim.

The good news is that the process is simple with USAA Renters Insurance.You can also file a claim 24/7.

Here’s how you can file a claim with USAA:

Use the online portal 24/7 to file your insurance claim.

Your claim will depend on a few factors:

The amount of damage.

The availability of contractors.

Your availability.

Every claim is unique. We shared a review here from a Reddit user who had their keyboard claim settled in minutes. The money showed up in their bank account. Personal property coverage is much different than liability and property damage.

You can initiate your claim on your mobile app so that you don’t have to worry about being on the phone for hours.

Studenomics Customer Service Score: 5 out of 5

POLICY OPTIONS SCORE: 5 Out of 5

What Does USAA Renters Insurance Cover?

You’re likely wondering about the coverage with USAA Renters Insurance. We were pleasantly surprised by how much coverage is included with a basic policy.

Personal property coverage.

Most renters’ insurance plans will cover your personal property.

However, USAA goes into detail as to what they cover on the official website.

Here’s what’s covered:

Here's a list of the losses that are covered by USAA Renters Insurance:

One thing that stuck out to us was the replacement coverage. According to the official USAA website:

“We offer replacement cost coverage. That means rather than depreciating an old TV to almost nothing, your policy would compensate you enough to buy a new one if it was stolen or damaged.”

This alone will save you a lot of money and headaches in the future since most insurance company don’t provide you with replacement cost coverage (it’s extra).

Liability coverage.

This will cover bodily harm and property damages that you’re legally liable for.

Liability propertection will also cover your defense and settlements up until the limit of your coverage.

Additional living expenses.

This will cover the expenses incurred when your home becomes uninhabitable due to a covered loss. USAA will try to match your hotel and additional expenses to match your normal lifestyle.

Bundle and Save Up to 50%

Save up to $850/year by bundling renters with car insurance. Quick Online Quotes. Compare & Save 50% on: Auto, Motorcycle, Home, Condo, & Renter.

It's free to apply!

What Isn’t Covered By My USAA Renter's Insurance Policy?

What’s not covered by your USAA Renters Insurance Policy?

This is where we typically write about how flood and Earthquake coverage is extra, but that isn’t the case with USAA Renters INsurance. You’re covered in those unique scenarios.

“Renters insurance does not cover breakage, marring, scratching or damage caused by temperature change caused during your move or while storing your belongings.”

It’s also important to remember that business and commercial activities on your property are not covered with a basic plan.

Can I Add My Roommate?

Are you looking to add a roommate to your insurance policy?

Your USAA Renters Insurance policy automatically extends to all family members living with you. Unfortunately, you can’t add a roommate since the policy is exclusive. You can call 800-531-USAA for any questions that you may have on the topic.Highlights | Lemonade | State Farm |   Progressive |

|---|---|---|---|

Cost | Starting at $12/mth | Starting at $5/mth | Starting at $13/mth |

Personal Property Coverage (Starts At:) | $25,000 | $10,000 | $20,000 |

A.M. Best Rating (Financial Strength) | A++ | N/A | A+ |

BBB Rating | B+ | B+ | A |

Claims Process | Excellent | Excellent | Good |

Best for: | Comprehensive coverage | Quick online purchasing | Lowest Cost |

Studenomics Rating | 4.75 Stars | 4.75 Stars Read Full Review | 4.6 Stars Read Full Review |

Studenomics Policy Options Score: 5 out of 5

Renters Insurance Starting at $5/month

No brokers, no paperwork, get a policy in seconds. Zero Hassle, zero paperwork, zero worry. Join now! Starting at $5/month.

It's free to apply!

FINANCIAL STRENGTH SCORE: 5 Out of 5

What is USAA's Financial Rating?

USAA Insurance scored very well when it came to financial strength. The company has an A.M Best score of A++ which is superior and the highest score that a company could have.

They’re also a publicly-traded company so the finances are transparent and you can easily see how the company is performing if you're curious about that.

You don’t have to worry about any payout issues with USAA Renters Insurance.

Studenomics Financial Strength Score: 5 out of 5

Pros and Cons of USAA Renters Insurance?

Every renter’s insurance policy comes with its strengths and weaknesses. In the interest of a transparent review, we want to share the pros and cons of USAA Renters Insurance.

What are the pros and cons of USAA Renters Insurance?

Pros:

Cons:

Those are the pros and cons that we want you to think about when it comes to USAA Renters Insurance.

Does USAA Offer Insurance In My State?

USAA currently offers insurance in all 50 states.

You can also check the best renters insurance rates by state using the map below.

How to Cancel?

You can cancel your USAA Renters Insurance policy at any time. Just call 800-531-USAA.

Take Action

That’s our fair review of USAA Renters Insurance. If you’re eligible, then we would highly recommend considering using USAA due to the extensive coverage and pricing.

You don’t have to stress about filing a claim either as the process is simple. You have more coverage than you would typically find.

Renters Insurance Starting at $5/month

No brokers, no paperwork, get a policy in seconds. Zero Hassle, zero paperwork, zero worry. Join now! Starting at $5/month.

It's free to apply!

I love USAA! I’ve been a member for 20 years. I should definitely write about USAA renters insurance, homeowners insurance, and auto insurance as well.

Thanks Martin!

Sam

20 years? Sounds like they’re worth the money!