Travelers Renters Insurance Review: Pros & Cons, Pricing, and Features

Studenomics Score: 4.5 Out of 5 Stars

Advertiser Disclosure: Our content is free because we are supported by advertisers. If you click on links in this post, we may earn a commission.

We know that you want protection for yourself and all of your stuff as a renter.

Travelers Renters Insurance promises that you’re going to find a renters insurance policy at a low price and that you won’t have to stress about making a claim.

Travelers Renters Insurance wants you to know that they care and that they work to protect you and your belongings.

According to the official website:

“We have been around for more than 165 years and have earned a reputation as one of the best property casualty insurers in the industry because we take care of our customers.”

We’re going to review Travelers Renters Insurance to see if the claims are true and if this is a solid renters insurance policy for you to invest into as you look for the ideal renters insurance policy for your needs.

Highlights:

Overview:

Travelers has been offering a variety of insurance products for over 165 years. Travelers is in amazing financial standing.

Known for:

- Providing a variety of insurance products for over a century.

- Many discount opportunities.

- Being an established insurance provider that's trusted by most people.

Financial Rating:

Travelers is rated A++ for financial strength by A.M Best.

Who is Travelers Insurance?

The Travelers Companies, Inc. (known as Travelers) has been around offering a variety of insurance products (home, auto, renters, boat, travel, wedding, business, and so on) since 1853.

The company has over 30,000 employees and 13,500 indendepent brokers in the United States, Canada, United Kingdom, and Ireland.

Travelers was ranked number 106 in the 2018 Fortune 500 list for the largest U.S corporations with a total revenue of $28.9B.

Today we're going to look at the renters insurance coverage that Travelers offers.

TRAVELERS CONTACT INFO

Website: www.travelers.com

Phone: 1-800-252-4633

Address: One Tower Square

Hartford, CT 06183

How Does Travelers Renters Insurance Work?

Travelers Renters Insurance provides you with protection for your personal belongings and your personal liability.

The good news is that Travelers Renters Insurance does an excellent job of explaining how to get renters insurance along with what kind of coverage you need for your unique situation.

Here's what's covered with your renters insurance policy so that you don't have to stress (more on exact coverage later in this review)...

Bundle and Save Up to 50%

Save up to $850/year by bundling renters with car insurance. Quick Online Quotes. Compare & Save 50% on: Auto, Motorcycle, Home, Condo, & Renter.

It's free to apply!

Is Travelers Renters Insurance Good?

We want to ensure that you sign up for a decent renter's insurance policy so that you pay a fair rate and then don't get hassled when it's time to file a claim.

The one thing that really impressed us is how detailed the information is about renters insurance on the official website.

“For example, if you are found legally responsible for accidental fire damage to the building where you live, liability coverage in a renters insurance policy may provide financial protection. This liability protection may also extend to any vacation property that you rent.”They also go into detail on what renter's insurance covers and what kind of protection you (as show in the graphic below).

Is Travelers Renters Insurance legit?

When we review a renters insurance company, we do our best to take a full look at what’s happening with the company.

We’re going to look at the pricing, the customer service, policy options, and the financial strength of Travelers Renters Insurance.

Our editor's scores for Travelers Renters Insurance for pricing, customer service, policy options, and financial stability:

Studenomics Score: 4.5 Out of 5 Stars

PRICING SCORE: 4 Out of 5

How Much Does Travelers Renters Insurance Cost?

How much is Travelers Renters Insurance?

We looked over the prices by obtaining quotes of our own across the nation just to see what the prices are like.

We have charts and screenshots below of how much Travelers Renters Insurance costs...

Renters Insurance Starting at $5/month

No brokers, no paperwork, get a policy in seconds. Zero Hassle, zero paperwork, zero worry. Join now! Starting at $5/month.

It's free to apply!

How Much Is Travelers Renters Insurance?

We can't ignore the costs of an actual renters insurance policy. This is why we were impressed with how easy it was to obtain a renter's insurance quote.

Before we look at Travelers Renters Insurance quotes, here's what you need to know about the process of obtaining a quote.

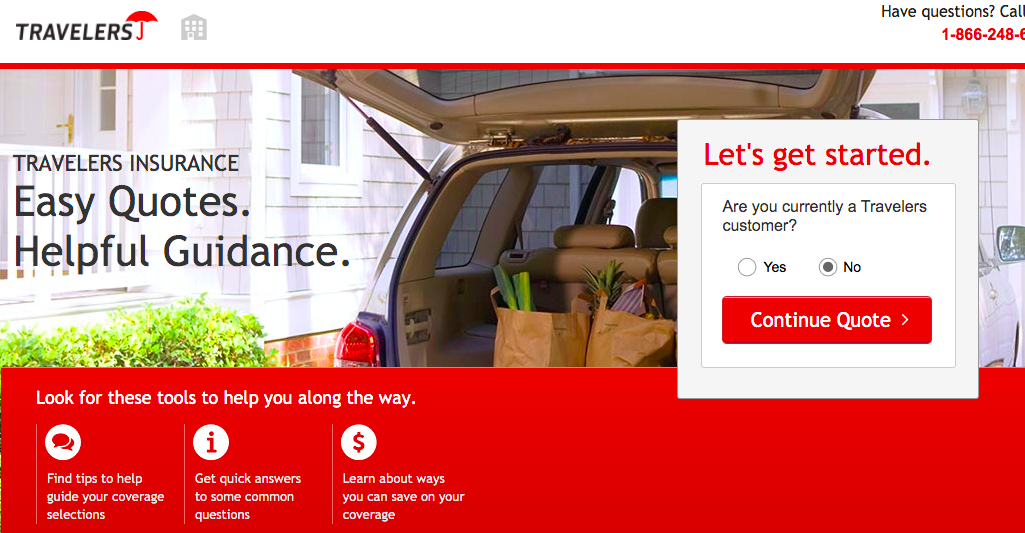

How do you obtain a Travelers Renters Insurance quote?

- You go to the official website and type in your zip code.

- They ask if you’re already a Travelers customer.

- Have you moved in the last 6 months?

- Your basic personal information.

- The type of property.

- Is this your primary residence.

- Do you have any pets?

- Your claims history.

- The source of heat.

- The security measures that are in place (fire alarm, sprinkler system, smoke detectors, deadbolt, and so on).

- Distance to the fire hall/fire hydrant.

- Building security.

- You then get your quote within a few minutes.

Travelers Renters Insurance Quotes.

We obtained a few Travelers Renters Insurance quotes from across the nation to give you an accurate picture of what the rates are like.

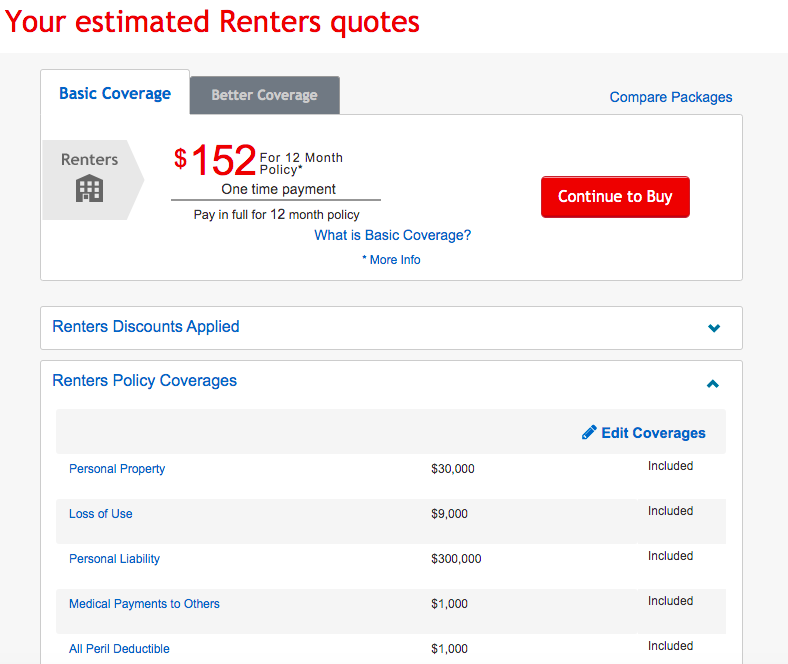

The image below captures a basic renter's insurance policy in NYC.

Type of coverage | Coverage amount |

|---|---|

Personal property coverage | $30,000 |

Loss of use coverage | $9,000 |

Personal liability coverage | $300,000 |

Medical to others | $1,000 |

Deductible | $1,000 |

Here's your renter's insurance coverage amounts with Travelers Renters Insurance in San Francisco...

Type of coverage | Coverage amount |

|---|---|

Personal property coverage | $30,000 |

Loss of use coverage | $9,000 |

Personal liability coverage | $100,000 |

Medical to others | $1,000 |

Deductible | $500 |

You can pay upfront for $242 for the year for Travelers Renters Insurance in San Francisco.

Pro Renters Insurance Tip

Renters insurance doesn't just cover the replacement of your belongings, but also protects you if someone gets hurt on your property. Limits usually start at $100,000.

Is Travelers Renters Insurance Worth The Cost?

We always try to look at the cost and value of a renter's insurance policy.

What impressed us about the Travelers Renters Insurance quotes was the high levels of coverage for personal property and loss of us coverage. You typically don't get this high of a limit.

We also appreciated how Travelers emailed us with a renter's insurance quote and a follow up on how to save money.

Can I Bundle My Travelers Renters Insurance With My Auto Insurance?

The good news is that Travelers encourages insurance bundling for you to save money.

You could bundle your life, boat, auto, and renters insurance all together under one umbrella.

Studenomics Pricing Score: 4 out of 5

Bundle and Save Up to 50%

Save up to $850/year by bundling renters with car insurance. Quick Online Quotes. Compare & Save 50% on: Auto, Motorcycle, Home, Condo, & Renter.

It's free to apply!

CUSTOMER SERVICE SCORE: 4 Out of 5

How is Travelers' Reputation for Service?

We looked through Glassdoor, BBB, and Reddit to see what real customers had to say about Geico Renters Insurance.

We always do this in our reviews because we want to present the full picture of what's happening.

BBB Rating: A+

Number of Ratings: 96

Glassdoor Rating: 64% would recommend

Number of Ratings: 2,900

Reddit Sentiment: Neutral

Number of Comments: We couldn't find many discussions about Travelers Renters Insurance since the company is known for offering auto insurance.

Travelers Renters Insurance Reddit Feedback

In our research, we've discovered that the best feedback is available by searching up Travelers Renters Insurance Reddit to see what regular people in forums and discussions are saying about the company.

Notable Quote From Reviews.com Against Travelers Renters Insurance:

“The only area where Travelers doesn’t excel is in the area of customer service, and even there, the results were mixed. It’s likely that you won’t have to deal with this unless you make a claim, and in that case, the odds are in your favor that it will be a positive interaction."

Renters Insurance Starting at $5/month

No brokers, no paperwork, get a policy in seconds. Zero Hassle, zero paperwork, zero worry. Join now! Starting at $5/month.

It's free to apply!

How Do You File a Travelers Renters Insurance Claim?

Let’s say that something were to happen and you have to file a claim, how do you go about this.

How do you file a renter's insurance claim with Travelers Renters Insurance?

- Log in to your account at https://www.travelers.com/claims/report-claim/individual

- Call 1-800-252-4633.

You can file a claim 24/7 with Travelers Renters Insurance.

Please don't forget to follow the typical steps when it comes to filing any claim:

- Notify your landlord and the police regarding any theft or damages.

- Document the damages.

- Go over your policy to ensure that you're covered.

We like that there are many options for filing a claim and tracking your claim once it has been filed.

Studenomics Customer Service Score: 4 out of 5

POLICY OPTIONS SCORE: 5 Out of 5

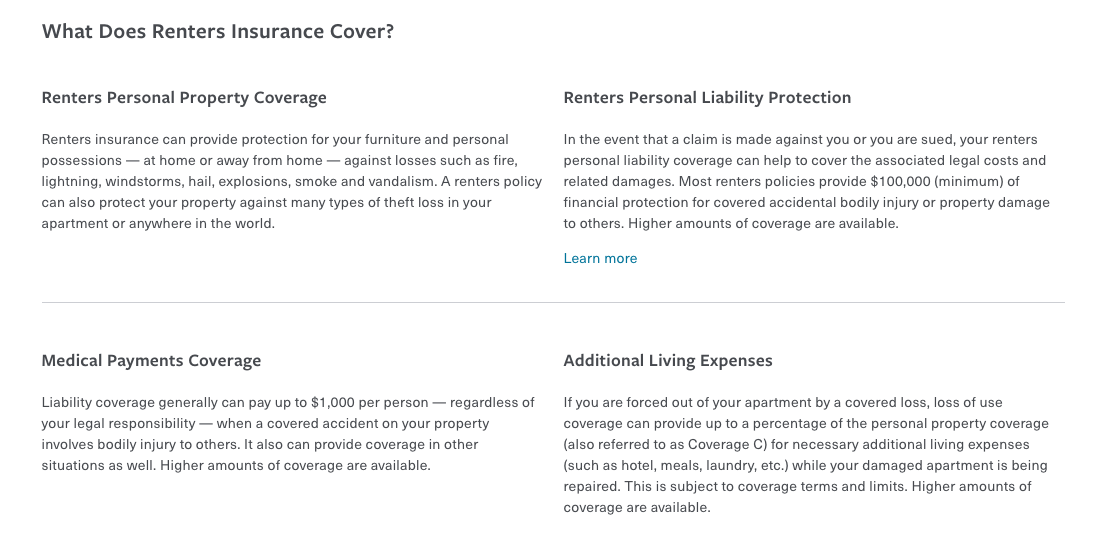

What Does Travelers Renters Insurance Cover?

What does your Travelers Renters Insurance policy cover?

When you sign up for a renter’s insurance policy, you want to know exactly what kind of coverage and protection you have. This is why we dug into the Travelers’ Renters Insurance policy.

What’s covered with Travelers Renters Insurance?

Renters Personal Property coverage.

This is protection for your personal belongings at home (and away from) against losses ranging from fire, smoke, vandalism, and theft to name a few.

You renter’s insurance policy can protect your property from theft at home or even when you’re traveling

Renters Personal Liability Protection.

You’re going to be protected in the event that a claim is made against you or you happen to be sued. The renters insurance policy will cover your legal costs and related damages to the incident.

Medical Payments coverage.

This coverage pays for the medical bills of others (based on your policy limits) when a covered accident occurs on your property.

Additional Living Expenses.

If you can’t live in your unit due to a covered loss, the loss of use coverage will pay for necessary additional living expenses (hotels, meals, laundry, and so on).

As always, it's important to go over your renter's insurance policy to ensure that you're satisfied with the coverage limits.

Bundle and Save Up to 50%

Save up to $850/year by bundling renters with car insurance. Quick Online Quotes. Compare & Save 50% on: Auto, Motorcycle, Home, Condo, & Renter.

It's free to apply!

What Isn’t Covered By My Travelers Renters Insurance Policy?

What isn’t covered by your renters insurance policy is almost as important as what’s covered. This is why we want to look at what your basic Travelers Renters Insurance policy won’t be covering.

What’s not covered with a Travelers Renters Insurance policy?

- You’re going to want to check your limits. You may have to spend some extra money for added protection with the Valuable items Plus option.

- Natural disasters. You’re going to want to look into flooding and Earthquakes if you live in an area prone to these. Never automatically assume that you’re covered with your renters insurance policy.

What should you look into with your insurance coverage?

Identity fraud protection.

This is an added protection in case your identity were to be compromised and you had to spend money on the entire process.

Equipment breakdown.

What’s this about? According to the official website:

“Provides for the replacement of appliances and mechanical equipment in your home in the event of an unexpected mechanical or electrical breakdown.”We also suggest that you go over your renters insurance policy to see what kind of coverage you have because you don't want to be stuck scrambling when it's time to file a claim.

Can I Add My Roommate?

Can you add your roommate to your Travelers Renters Insurance?

According to the official website:

“Travelers recommends that each occupant obtains his/her own policy to cover their individual stuff.

Some insurers allow roommates to be insured under a single policy.2 In these instances, roommates must agree to the level of coverage, based on the combined value of their stuff. If one roommate moves away, the remaining renter typically will need to obtain a new policy.”

Highlights | Lemonade | State Farm |   Progressive |

|---|---|---|---|

Cost | Starting at $12/mth | Starting at $5/mth | Starting at $13/mth |

Personal Property Coverage (Starts At:) | $30,000 | $10,000 | $20,000 |

A.M. Best Rating (Financial Strength) | A++ | N/A | A+ |

BBB Rating | A+ | B+ | A |

Claims Process | Excellent | Excellent | Good |

Best for: | Many discounts | Quick online purchasing | Lowest Cost |

Studenomics Rating | 4.5 Stars | 4.75 Stars Read Full Review | 4.6 Stars Read Full Review |

Studenomics Policy Options Score: 5 out of 5

Renters Insurance Starting at $5/month

No brokers, no paperwork, get a policy in seconds. Zero Hassle, zero paperwork, zero worry. Join now! Starting at $5/month.

It's free to apply!

FINANCIAL STRENGTH SCORE: 5 Out of 5

What is Travelers' Financial Rating?

Travelers scored an A++ rating from A.M Best which is very rare for an insurance company.

Why does this matter? It means that Travelers has the financial resources to cover a bunch of claims if a disaster were to occur.

We scored a 5 here because a company couldn't get a higher rating.

Studenomics Financial Strength Score: 5 out of 5

Pros and Cons of Travelers Renters Insurance?

Every renter’s insurance policy comes with positives and negatives. This is why we wanted to include this section so that you can think about both sides here.

What are the pros and cons of Travelers Renters Insurance?

Pros:

Cons:

Does Travelers Offer Insurance In My State?

Travelers currently offers insurance in all 50 states so you're in luck if you move across the nation.

You can also check the best renters insurance rates by state using the map below.

How can you cancel?

Let's say that something happens and you want to cancel your Travelers Renters Insurance.

How do you cancel your Travelers Renters Insurance policy?

You have to call 1.866.308.7203 to get on the phone with an agent to cancel your renter's insurance policy.

Final thoughts on Travelers Renters Insurance.

That's our review of Travelers Renters Insurance. We were impressed with the multiple discount opportunities and how easy the website was to navigate.

Our main suggestion as with any renter's insurance review is to go over your renter's insurance coverage to ensure that you're fully protected.

Renters Insurance Starting at $5/month

No brokers, no paperwork, get a policy in seconds. Zero Hassle, zero paperwork, zero worry. Join now! Starting at $5/month.

It's free to apply!