Homesite Renters Insurance Review: Pros & Cons, Pricing, and Features

Studenomics Score: 4 Out of 5 Stars

Advertiser Disclosure: Our content is free because we are supported by advertisers. If you click on links in this post, we may earn a commission.

I think you’ll agree that you want a renters insurance policy that you can trust. You also don’t want to search around forever to find a quote for a renter’s insurance policy since you have limited time.

Homesite Renters Insurance claims to be one of the first renters insurance providers to share quotes online so that you easily find a renters insurance quote without all of the hassle of waiting on the phone to hand out your personal information.

Homesite also promises that you can customize your policy so that you have the coverage you want without paying for the extras that you don't really need.

We’re going to look at Homesite Renters Insurance to see if this is the ideal renters insurance policy for you.

Highlights:

Overview:

Homesite has been offering a variety of insurance products since 1997.

Known for:

- Homesite was purchased by American Family Insurance.

- You can obtain a quote online in minutes.

- You get mold protection with your renter's insurance policy.

Financial Rating:

Homesite is rated A for financial strength by A.M Best.

Who is Homesite Renters Insurance?

Before we dig any further, let’s take a look at this company so that you know a little more about them before making your decision on renters insurance coverage.

Homesite Group Incorporated has been offering insurance products (home, renters, condo, small business, auto, and term life) since 1997.

The company was acquired by American Family Insurance in late-2013 and the deal was made official in this press release in 2014. The press release noted that:

"Adding Homesite to the American Family group of companies also spreads American Family's homeowners insurance catastrophe risk beyond its primary Midwest concentration, an important element of preserving financial strength. Homesite serves customers in 46 states and the District of Columbia."

HOMESITE CONTACT INFO

Website: www.homesite.com

Phone: 1-800-466-3748

Address: One Federal Street

Boston, MA 02110

How Does Homesite Renters Insurance Work?

As you look through renter's insurance policies, you're going to discover that every company has its own procedures in place for obtaining a quote and purchasing renters insurance.

The good news here is that the process of obtaining a renter's insurance quote and protecting yourself is rather simple.

You can fill out a few forms in minutes to obtain a renter's insurance quote based on your unique situation. From there, you can decide if you want to shop around some more.

Bundle and Save Up to 50%

Save up to $850/year by bundling renters with car insurance. Quick Online Quotes. Compare & Save 50% on: Auto, Motorcycle, Home, Condo, & Renter.

It's free to apply!

Is Homesite Renters Insurance Good?

We know that you want a decent renter's insurance policy so that you get your money's worth and can sleep at night knowing that you're covered.

As we looked at Homesite Renters Insurance, we were impressed with how easy it was to obtain a renter's insurance quote and how detailed the website was.

We were a bit disappointed with the customer service reviews.

Keep on reading for a full breakdown of Homesite Renters Insurance.

Is Homesite Renters Insurance legit?

We took the time to go over the pricing, customer service, policy options, and the financial strength of the company.

In our experience, these factors will reveal everything that you could want to know about a renter’s insurance company.

We're going to look at the renters insurance coverage, the price, and a few other factors.

Our editor's scores for Homesite Renters Insurance for pricing, customer service, policy options, and financial stability:

Studenomics Score: 4 Out of 5 Stars

PRICING SCORE: 4 Out of 5

How Much Does Homesite Renters Insurance Cost?

We wanted to look at the actual cost of Homesite Renters Insurance so that you know what to expect.

According to the official website:

“So while $187 a year provides a ballpark figure, a renters insurance policy could cost you more or less. Either way, you may be surprised to learn that it doesn’t cost as much as you think.”

We dug around to find some actual renters insurance quotes to give you an accurate picture of what you should expect to spend.

Renters Insurance Starting at $5/month

No brokers, no paperwork, get a policy in seconds. Zero Hassle, zero paperwork, zero worry. Join now! Starting at $5/month.

It's free to apply!

How Much Is Homesite Renters Insurance?

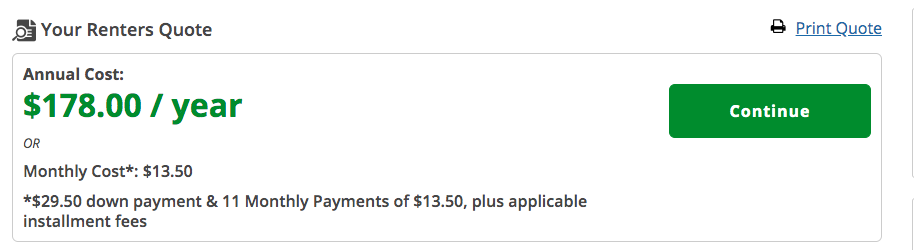

We found two quotes ranging from $13.50/month to $25.40/month.

The section below will break down the location of the units and what you get with your renter's insurance policy in every case.

Homesite Renters Insurance Quotes.

What are you asked for when applying for a Homesite renters insurance quote?

- Your basic personal information.

- If you live with anyone else.

- If you have any dogs.

- The amount of separate units in the building.

- If anyone works from home full-time.

It should be noted that you'll be asked about the security features of your building and the amount of units. This will help determine how safe your building is.

We went through this process and obtained Homesite Renters Insurance quotes for San Francisco and New York City.

Here’s what you get in San Francisco for Homesite Renters Insurance.

Renters Insurance Cost | $13.50/month or $178/year |

Personal property coverage | $15,000 |

Personal liability | $100,000 |

Medical liability | $1,000 |

Deductible | $500 |

Here's what you with Homesite Renters Insurance quote in New York City. As you'll see, the rates are much higher as the price of your policy will depend on where you live and what kind of unit you live in.

Renters Insurance Cost | $25.40/month or $335/year |

Personal property coverage | $15,000 |

Personal liability | $100,000 |

Medical liability | $1,000 |

Deductible | $1,000 |

Pro Renters Insurance Tip

Renters insurance doesn't just cover the replacement of your belongings, but also protects you if someone gets hurt on your property. Limits usually start at $100,000.

Is Homesite Renters Insurance Worth The Cost?

When we look at a renter's insurance policy, we look at the price compared to what you get for coverage.

We found that you could customize your renter's insurance policy and find low rates depending on your state.

We like that you have many payment options. You can pay monthly quarterly or anyway you would like to so that it's convenient for you.

We believe that Homesite Renters Insurance is worth the cost if you find a decent policy for your situation.

Can I Bundle My Homesite Renters Insurance With My Auto Insurance?

The good news is that Homesite encourages insurance bundling so you could insurance your car, property, and small business under one policy.

Studenomics Pricing Score: 4 out of 5

Bundle and Save Up to 50%

Save up to $850/year by bundling renters with car insurance. Quick Online Quotes. Compare & Save 50% on: Auto, Motorcycle, Home, Condo, & Renter.

It's free to apply!

CUSTOMER SERVICE SCORE: 3 Out of 5

How is Homesite's Reputation for Service?

We looked through Glassdoor, BBB, and Reddit to see what real customers and people had to say about Homesite Renters Insurance.

We have discovered that these are the best ways to get a feel for a company without actually becoming a customer.

We found that Homesite had a BBB rating of A+ but they had 105 complaints in the last 3 years and there was a fairly negative sentiment about the customer service.

We found many negative discussions about Homesite on Reddit and other forums regarding the customer service.

This is why we scored Homesite a 3 for customer service.

BBB Rating: A+

Number of Ratings: 67

Glassdoor Rating: 43% would recommend

Number of Ratings: 266

Reddit Sentiment: Negative

Number of Comments: There were many negative discussions about Homesite.

Homesite Renters Insurance Reddit Feedback

In our research, we've discovered that the best feedback is available by searching Homesite Renters Insurance Reddit to see what regular folks are saying.

One Reddit user (Jaggar345) responded to a Homesite Renters Insurance Reddit thread about Homesite with:

"I haven’t really heard too many good things about homesite in terms of claim service. My company would definitely put you in a hotel."

Then when we searched up Homesite Insurance Reddit to see what folks had to say about the general insurance, we found some more bad news.

Notable Quote From Value Penguin Against Homesite Renters Insurance:

“While Homesite's low rates can help you save on insurance, you might run into poor customer service if you ever need to file a claim."

Renters Insurance Starting at $5/month

No brokers, no paperwork, get a policy in seconds. Zero Hassle, zero paperwork, zero worry. Join now! Starting at $5/month.

It's free to apply!

How Do You File a Homesite Renters Insurance Claim?

This is where your renter’s insurance policy decision comes into play. Let’s say that something happens and you have to file a claim.

Will it be simple? Will it be a stressful process to file a renter's insurance claim? We always look at these questions.

How do you file a claim with Homesite Renters Insurance?

- Call 1-866-621-4823.

- Online -- https://www.homesite.com/OnlineServicing/Welcome.aspx?#Login

As always, please remember to take the proper precautions before filing your claim by following these steps:

- Contact the police to file a report if anything was stolen or damaged.

- Contact your landlord to notify them.

- Find your receipts for the stolen items.

- Keep any property relevant to the loss or damages.

Studenomics Customer Service Score: 3 out of 5

POLICY OPTIONS SCORE: 4 Out of 5

What Does Homesite Renters Insurance Cover?

What does Homesite Renters Insurance cover exactly?

The website goes into great detail of what’s covered and what’s not covered with your renter’s insurance policy.

Let’s look at what your Homesite Renters Insurance policy will cover…

Personal property.

This covers theft, destruction, and damage that occurs to your personal property up until your personal property coverage limit (usually starting at $15,000).

Personality liability.

What does this mean? The official Homesite Renters Insurance website has the best definition of this coverage:

“Pays for loss settlement and legal fees in the event that an insured party causes bodily injury and/or property damage to others.”

Mold protection.

This is unique coverage. The graphic below should explain this better.

Medical payment to others.

Regardless of fault, this will cover the medical bills up until a limit of anyone who gets injured on your property.

Loss of use coverage.

If your place gets damaged to the point that you can't live there, your Homesite Renters Insurance will cover your lodging expenses as you stay in a hotel.

That’s what’s covered with a standard Homesite Renters Insurance policy.

Bundle and Save Up to 50%

Save up to $850/year by bundling renters with car insurance. Quick Online Quotes. Compare & Save 50% on: Auto, Motorcycle, Home, Condo, & Renter.

It's free to apply!

What Isn’t Covered By My Homesite Renters Insurance Policy?

Now that you know what’s covered with your renters insurance policy, it’s important to note what isn’t covered so that you know what the full situation is.

What’s not with a standard Homesite Renters Insurance?

- Replacement cost coverage for personal property.

- Earthquakes.

- Jewelry and high-end items over a certain limit.

- Identity theft protection.

The good news is that just because something isn’t covered with a standard renters insurance policy, it doesn’t mean that you’re stuck. You can spend some extra money to upgrade your renter’s insurance policy so that you feel more comfortable.

As always, we urge you to go through your renter's insurance policy to see what coverage you need for your situation.

Can I Add My Roommate?

Are you looking to add a roommate to your Homesite Renters Insurance policy? When you go to obtain a quote, you’ll be asked about how many people are residing in the unit. This is your opportunity to include your roommate under your renter’s insurance policy.

Highlights | Lemonade | State Farm |   Progressive |

|---|---|---|---|

Cost | Starting at $13.50/mth | Starting at $5/mth | Starting at $13/mth |

Personal Property Coverage (Starts At:) | $15,000 | $10,000 | $20,000 |

A.M. Best Rating (Financial Strength) | A | N/A | A+ |

BBB Rating | A+ | B+ | A |

Claims Process | Simple | Excellent | Good |

Best for: | Quick quotes | Quick online purchasing | Lowest Cost |

Studenomics Rating | 4 Stars | 4.75 Stars Read Full Review | 4.6 Stars Read Full Review |

Studenomics Policy Options Score: 4 out of 5

Renters Insurance Starting at $5/month

No brokers, no paperwork, get a policy in seconds. Zero Hassle, zero paperwork, zero worry. Join now! Starting at $5/month.

It's free to apply!

FINANCIAL STRENGTH SCORE: 5 Out of 5

What is Homesite's Financial Rating?

We always look over the financial strength of an insurance company because we want you to protected in the worst case scenario (which is why most of us get insurance in the first place).

Homesite scored an A rating (excellent) with A.M. Best and the company is owned by American Family.

A.M. Best is the world's oldest credit rating agency and we look at the ratings to see where a company stands.

Studenomics Financial Strength Score: 5 out of 5

Pros and Cons of Homesite Renters Insurance?

Every renter’s insurance company has its own strengths and weaknesses. This is why it's important to weight both sides out to see if it's worth trusting the company with your money.

What are the pros and cons of Homesite Renters Insurance?

Pros:

Cons:

Does Homesite Offer Insurance In My State?

Homesite Renters Insurance is in a unique situation where the company is owned by American Family and they also underwrite policies for Progressive Renters Insurance.

So this means that you can obtain Homesite Renters Insurance in every state.

You can also check the best renters insurance rates by state using the map below.

How can you cancel your Homesite Renters Insurance?

What if life gets in the way or your situation changes and you have to cancel your Homesite Renters Insurance policy?

Here’s how you can cancel according to the official website:

"You may cancel your policy at any time by writing to your company and indicating the date the cancellation is to take effect."

You can also call in to speak with an agent. You don't have to feel like you're stuck.

Final thoughts on Homesite Renters Insurance.

That’s our review of Homesite Renters Insurance. As always, there are many pros and cons to think about.

We were pleasantly surprised with how easy it was to obtain a renters insurance quote and how detailed the website was.

We do wish the prices were a little lower though and that the customer service reviews were better.

Good luck with your hunt for the ideal renter's insurance policy for your situation.

Renters Insurance Starting at $5/month

No brokers, no paperwork, get a policy in seconds. Zero Hassle, zero paperwork, zero worry. Join now! Starting at $5/month.

It's free to apply!