Metlife Renters Insurance Review: Pros & Cons, Pricing, and Features

Studenomics Score: 2.5 Out of 5 Stars

Advertiser Disclosure: Our content is free because we are supported by advertisers. If you click on links in this post, we may earn a commission.

I think you’ll agree that you want a renters insurance policy that's customized to your unique situation because there's no such thing as an identical household.

You want renter's insurance coverage that makes sense for you.

MetLife Renters Insurance claims to offer customizable renters insurance coverage when you try to find a renters insurance quote. This means that you should be able to find the perfect renter's insurance plan for your situation.

We’re going to look at MetLife Renters Insurance to see if it's worth trusting them with your insurance needs...

Highlights:

Overview:

MetLife has been offering a variety of insurance products since 1868 and had a revenue of $67.941 billion in 2018.

Known for:

- You can file a claim 24/7.

- Some customer service issues (more on this in here).

- Identity protection services are included with every policy.

Financial Rating:

MetLife is rated A+ for financial strength by A.M Best.

Who is MetLife Renters Insurance?

Before we get into actual review of MetLife Renters Insurance, it's about to look at the history of the company to see if they can be reliable for your renters insurance coverage.

Metropolitan Life Insurance Company is a publicly-traded insurance provider in the financial services sector. The company offers insurance, annuities, and employe benefit programs in over 60 countries with 90 million customers worldwide.

According to the official website of Metlife Renters Insurance:

"MetLife operates under the 'Three Lines of Defense' model, which designates business and functional owners as the first and primary line of defense in identifying, measuring, monitoring, managing, and reporting risks. Global Risk Management, which includes Corporate Ethics and Compliance, along with IT Risk and Security form the second line of defense and provide effective review, challenge, and advice to business and functional owners. Internal Audit serves as the third line of defense, providing independent assurance and testing over the risk and control environment."

MetLife isn't really known for its renters insurance coverage. We were surprised that they even offered it.

METLIFE CONTACT INFO

Website: www.metlife.com

Phone: 855-266-6881

Address: 200 Park Avenue, New York, NY 10166

How Does MetLife Renters Insurance Work?

As you look through renter's insurance policies, you're going to see that every insurance company as its own standard operating procedures.

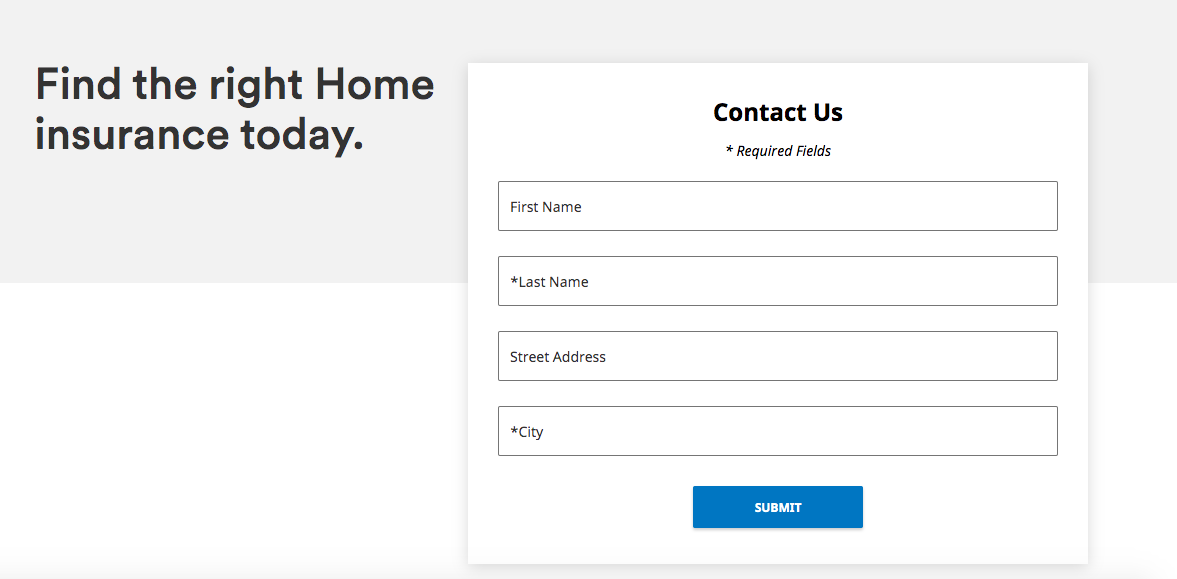

MetLife Renters Insurance is a bit different than other policies. The frustrating aspect with this company is that you can't obtain a renter's insurance quote online. You have to either call in or submit a form to have an agent contact you.

In a world where you can obtain a renter's insurance quote in minutes online, this is obviously very frustrating and annoying.

Keep on reading to find out more about MetLife Renters Insurance...

Bundle and Save Up to 50%

Save up to $850/year by bundling renters with car insurance. Quick Online Quotes. Compare & Save 50% on: Auto, Motorcycle, Home, Condo, & Renter.

It's free to apply!

Is MetLife Renters Insurance Good?

We know that you want a decent renter's insurance policy so that you don't have to stress about having enough coverage for your budget.

As we looked through the little information that's available on MetLife Renters Insurance, we weren't impressed with the policies and the options that you get.

For example, a standard MetLife Renters Insurance policy doesn't come with loss of use coverage. This means that you would be stuck paying out of pocket if you had to stay somewhere else while your unit was damaged.

Is MetLife Renters Insurance legit?

We took the time to go over the pricing, customer service, policy options, and the financial solvency of the company to see if MetLife Renters Insurance is legit.

We're going to look at the renters insurance coverage, the pricing, the customer service, and a few other factors to provide you with an accurate picture of MetLife Renters Insurance.

Our editor's scores for Metlife Renters Insurance for pricing, customer service, policy options, and financial stability:

Studenomics Score: 2.5 Out of 5 Stars

PRICING SCORE: 1 Out of 5

How Much Does MetLife Renters Insurance Cost?

We wanted to look at the actual cost of MetLife Renters Insurance so that we could tell you about the exact pricing structure as we like to do with our reviews. When we checked out the official website, we discovered that quotes weren't available online.

Renters Insurance Starting at $5/month

No brokers, no paperwork, get a policy in seconds. Zero Hassle, zero paperwork, zero worry. Join now! Starting at $5/month.

It's free to apply!

MetLife Renters Insurance Quotes.

This is the section where we would normally share MetLife Renters Insurance quotes. Unfortunately, the company doesn't offer quotes online so we can't share with you what the quotes are.

How do you obtain a renter’s insurance quote?

You have to contact Metlife to obtain your customized quote. Here's the official link: https://www.metlife.com/insurance/home-insurance/#contactus

Pro Renters Insurance Tip

Renters insurance doesn't just cover the replacement of your belongings, but also protects you if someone gets hurt on your property. Limits usually start at $100,000.

Is MetLife Renters Insurance Worth The Cost?

When we look at a renter's insurance policy, we look at the price compared to what you get for coverage. Since we don't know the cost, we can't tell you if it's worth the cost.

Considering every other renters insurance company offers a free estimate online in minutes, it was disappointed to see that MetLife Renters Insurance doesn't have this same option.

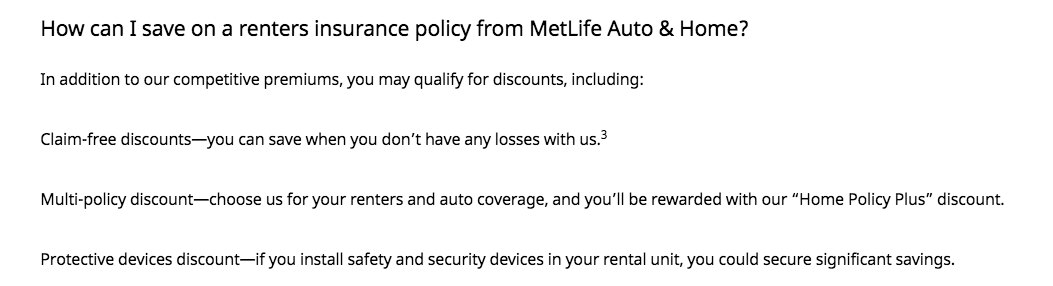

This is why we scored a 1 here for MetLife Renters Insurance. The one bit of good news on that quotes front is that it looks like there are discounts available to help you save money as we indicated with the image below.

Can I Bundle My Metlife Renters Insurance With My Auto Insurance?

The good news is that MetLife offers a variety of insurance products so you could have all of your insurance under one umbrella.

Studenomics Pricing Score: 1 out of 5

Bundle and Save Up to 50%

Save up to $850/year by bundling renters with car insurance. Quick Online Quotes. Compare & Save 50% on: Auto, Motorcycle, Home, Condo, & Renter.

It's free to apply!

CUSTOMER SERVICE SCORE: 2 Out of 5

How is MetLife's Reputation for Service?

We checked out Glassdoor, BBB, and Reddit to see what real customers had to say about MetLife Renters Insurance. We want to see how people feel about the policies, the customer service, and the overall satisfaction with a company.

BBB Rating: A-

Number of Ratings: 95

Glassdoor Rating: 75% would recommend

Number of Ratings: 4,200

Reddit Sentiment: Negative

Number of Comments: We found a shocking amount of negative comments about Metlife Insurance.

MetLife Renters Insurance Reddit Feedback

We typed in Renters Insurance MetLife Reddit to see what regular folks were saying about their experiences:

User @billygreen23 in this Reddit Metlife Insurance discussion:

“We currently have MetLife and just purchased a new car. With the new car our rate will be $1321 every 6 months. I thought I'd get some quotes from other places and Progressive came back with $467. I called MetLife to see if they could come down on my rate but they said they didn't compete with other insurers and that they try to provide a better service than most.

Am I missing something? Why should I be paying $900 more for MetLife? What are people opinions about Progressive? Thanks!”

Then there was this discussion on Reddit about MetLife Renters Insurance...

We found a few other negative discussions when searching for "MetLife Renters Insurance Reddit" that we couldn't even share because of the cursing.

The BBB website has 665 complaints. The gripes range from filing a claim to dealing with the customer service.

Notable Quote From The Simple Dollar Against Metlfie Renters Insurance:

“One of the biggest downsides of buying renters insurance from MetLife is that they don’t offer free estimates online. You can fill out a form and ask to be contacted by an agent, but you can’t find out approximately how much you would pay for renters insurance coverage without speaking to a person.”

Renters Insurance Starting at $5/month

No brokers, no paperwork, get a policy in seconds. Zero Hassle, zero paperwork, zero worry. Join now! Starting at $5/month.

It's free to apply!

How Do You File a MetLife Renters Insurance Claim?

Let’s say that something happens and you have to file a renter’s insurance claim with MetLife Renters Insurance.

How do you do this? How do you file a MetLife Renters Insurance claim?

You can call 24/7 to 1-800-854-6011.

Please remember the following steps for when you have to file a renter’s insurance claim:

- Contact the authorities to file a police report if any damages or theft occurred.

- Contact your landlord.

- Take pictures of any damages.

- Look for receipts of damaged/stolen items just to have the rough value.

Studenomics Customer Service Score: 2 out of 5

POLICY OPTIONS SCORE: 2 Out of 5

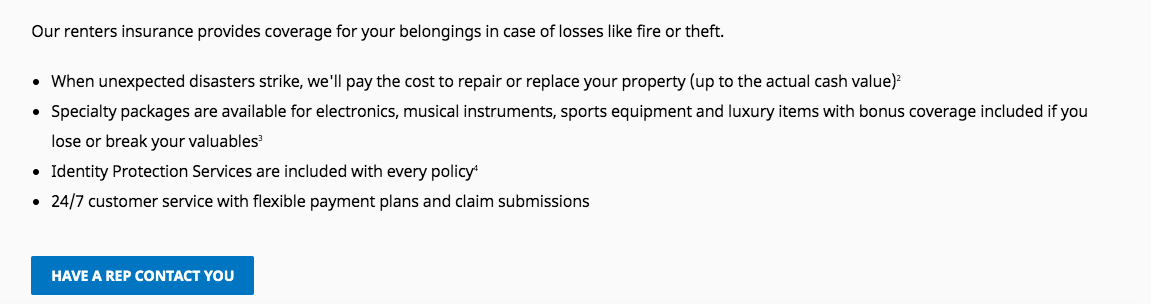

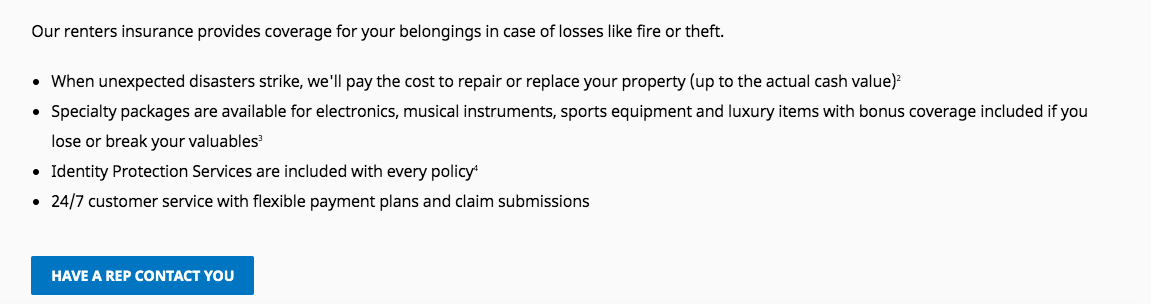

What Does MetLife Renters Insurance Cover?

We looked through the official website to see what MetLife Renters Insurance covers so that you know the level of protection that you’re getting.

Here’s what’s covered with a basic MetLife Renters Insurance policy…

Personal property coverage.

This covers your personal belongings worldwide from any theft or damages or that may occur.

The official website mentions the following:

“Replacement cost coverage, which will cover you if something happens and you need to repair or replace your property. Our policies don’t deduct for depreciation (up to your coverage amount).”

Personal liability protection.

You have up to $100,000 in protection here if anyone were to get hurt on your property and if you had to deal with any legal issues regarding a covered loss.

To find out what else is covered with MetLifeRenters Insurance, you’re going to have to contact them directly for more information. It looks like a standard MetLife Renters Insurance policy comes with identity protection services which is rare.

The graphic below is a screenshot from the official website where they roughly mention the coverage that you get with a MetLife Renters Insurance policy. You can have a rep contact you directly for more information.

Bundle and Save Up to 50%

Save up to $850/year by bundling renters with car insurance. Quick Online Quotes. Compare & Save 50% on: Auto, Motorcycle, Home, Condo, & Renter.

It's free to apply!

What Isn’t Covered By My MetLife Renters Insurance Policy?

Since you know what kind of coverage you’re roughly going to have with MetLife Renters Insurance, it’s time to look at what’s not covered with a standard policy.

Since we don’t know what’s exactly covered, it’s difficult to tell what isn’t covered. We always urge you to go over your renter's insurance policy to see what kind of coverage you have.

Here’s a rough idea from the official MetLife Renters Insurance website:

“In some states, we also offer four specialty coverage packages, which can be added to your basic renters policy. These packages cover electronics, musical instruments, recreational/sports equipment, and luxury items. It features broader, all-risk coverage, which means everything is protected regardless of where or how they were lost or damaged. We will repair or replace them without deduction for depreciation."It also looks like loss of use coverage isn't included with MetLife Renters Insurance. This means that you would be on the hook for the cost of living expenses and all associated costs if you couldn't live in your unit even due to a covered loss.

Can I Add My Roommate?

Are you looking to add a roommate to your MetLife Renters Insurance policy?

Since you can't obtain a MetLife Renters Insurance quote online, it's difficult to figure out if a roommate would be charged extra.

Studenomics Policy Options Score: 2 out of 5

Renters Insurance Starting at $5/month

No brokers, no paperwork, get a policy in seconds. Zero Hassle, zero paperwork, zero worry. Join now! Starting at $5/month.

It's free to apply!

FINANCIAL STRENGTH SCORE: 5 Out of 5

What is Metlife's Financial Rating?

We try to analyze the financial strength of an insurance company because we want you to be protected in the worst case scenario and to be with a company that can be trusted financially.

Metlife, Inc. has an A.M. Best rating of A+ and the company is publicly traded on the NYSE. The company doesn't appear to be at any risks financially in the near future.

A.M. Best is the world's oldest credit rating agency and how they rank a company is critical to our reviews.

Studenomics Financial Strength Score: 5 out of 5

Pros and Cons of MetLife Renters Insurance?

Let's be realistic about renters insurance: there's no such thing as the perfect company. There will be many advantages and disadvantages.

What are the pros and cons of MetLife Renters Insurance?

Pros:

Cons:

Does Metlife Offer Insurance In My State?

Metlife, Inc. offers insurance products and financial services across the entire luck. You can move anywhere in the country and have your insurance policy transferred with you.

This is why many folks prefer to go with these larger companies. You want coverage anywhere and everywhere.

You can also check the best renters insurance rates by state using the map below.

How can you cancel your MetLife Renters Insurance?

What if you have to cancel your MetLife Renters Insurance policy?

From what we could gather, it looks like you can't cancel MetLife Renters Insurance online. You have to call in to speak with your representative to discuss your options.

Cancel MetLife Renters Insurance by phone by calling 1-800-422-4272.

Final thoughts on MetLife Renters Insurance.

That’s our review of MetLife Renters Insurance. There are many negatives and positives to think about as you look for renter's insurance.

It's unfortunate that you can't find a renter's insurance quote online as this seems to be very common these days.

If you have the time and are looking for an insurance bundle, it may be worth your effort to leave your contact information for a quote to see what MetLife Renters Insurance has to offer.

Good luck with your search for a renter's insurance policy that matches your budget and expectations.

Renters Insurance Starting at $5/month

No brokers, no paperwork, get a policy in seconds. Zero Hassle, zero paperwork, zero worry. Join now! Starting at $5/month.

It's free to apply!