First American Renters Insurance Review: Pros & Cons, Pricing, and Features

Studenomics Score: 2 Out of 5 Stars

Advertiser Disclosure: Our content is free because we are supported by advertisers. If you click on links in this post, we may earn a commission.

I believe that you’ll agree that you want a renters insurance policy that values your business. You also want your personal items to be protected so that you don’t have to stress about replacing everything if an accident were to happen.

You also want a company that’s going to value you and provide you with the customer service that will make insurance simple.

First American Property & Casualty Group claims to value all customers with super customer service and fair pricing.

We also know what it's like to look for customizable renters insurance coverage when you try to find a renters insurance quote for your situation.

This is why we’re going to review First American Renters Insurance...

Highlights:

Overview:

First American Corporation has been offering insurance products and financial services since 1889. The company is traded on the NYSE with the symbol FAF.

Known for:

- You can file a claim 24/7 with your policy.

- Customer service issues (more on this in the review).

- Established company that has been around for over a century.

Financial Rating:

First American Financial is Rated A for financial strength by A.M. Best

Who is First American Renters Insurance?

Before we break down the renter’s insurance features, let’s take a look at First American Property & Casualty Group.

The company can trace its roots back to 1889. However, First American Property & Casualty Group began its operations in 1979. This section of the business handles a variety of insurance products (ranging from auto insurance to property insurance).

First American Corporation is publicly traded on the NYSE under the symbol of FAF. The company currently has 18,412 full-time employees and they operate mainly in the financial services sector.

Accordion to the First American Property & Casualty Group official website, the mission statement is:

“At First American, our mission and promise to you is to provide you with comprehensive insurance solutions that provide security, protection, peace of mind, and superior customer service at value pricing. We value you as customers, and it’s not only about protecting your greatest assets in life...It’s how you are treated.”

Keep on reading our review of First American Renters Insurance...

FIRST AMERICAN CONTACT INFO

Website: www.fapcig.com

Phone: 888-922-5343

Address: 1 First American Way

Santa Ana, CA 92707-5913

How Does First American Renters Insurance Work?

As you look through renter's insurance policies, you're going to want to find a policy that matches your budget and your lifestyle. It's our job to analyze renters insurance companies to see if they're worth your money and if the policies are decent.

First American offers renters insurance nationwide even though the company specializes in other financial services.

It looks like you can apply for a quote on the website, but unfortunately they only provide you with a list of local insurance offices based on your zip code. More on this in here...

Bundle and Save Up to 50%

Save up to $850/year by bundling renters with car insurance. Quick Online Quotes. Compare & Save 50% on: Auto, Motorcycle, Home, Condo, & Renter.

It's free to apply!

Is First American Renters Insurance Good?

We know that you want a decent renter's insurance policy so that you don't have to stress about having enough coverage for your budget.

Is First American Renters Insurance good?

It's difficult to give an accurate answer when there's limited information available online and you can't obtain a First American Renters Insurance quote online.

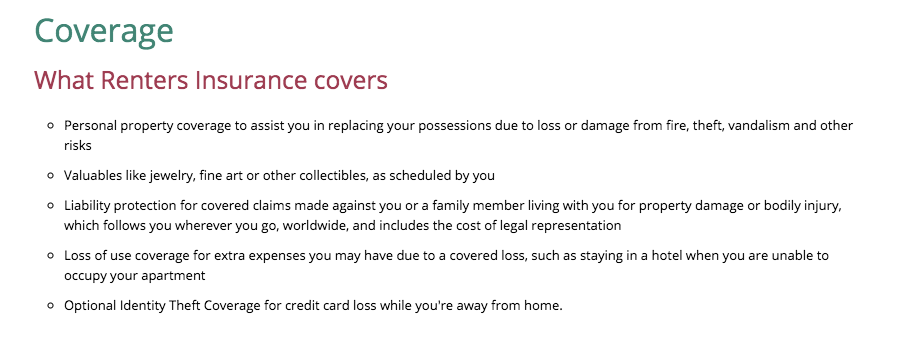

The following graphic is the only information that we could find on First American Renters Insurance.

Is First American Renters Insurance legit?

As always, we went over the pricing, customer service, policy options, and the financial solvency of the company to provide you with a fair look at First American Renters Insurance.

We're going to look at the renters insurance coverage, what it costs, what the customer service is like, and what regular people have to say about the company so that you have the information that you need to proceed.

Our editor's scores for First American Renters Insurance for pricing, customer service, policy options, and financial stability:

Studenomics Score: 2 Out of 5 Stars

PRICING SCORE: 1 Out of 5

How Much Does First American Renters Insurance Cost?

It’s impossible to look at a renter’s insurance policy without discussing the cost so that you know you’re getting your money’s worth.

According to the official First American Renters Insurance:

“First American Renters Insurance will cover you and your property in the event of a loss. For less than $1 a day, you can have peace of mind knowing that you are financially protected.”

Renters Insurance Starting at $5/month

No brokers, no paperwork, get a policy in seconds. Zero Hassle, zero paperwork, zero worry. Join now! Starting at $5/month.

It's free to apply!

We're going to take a deeper dive into First American Renters Insurance to see if they can back this claim.

First American Renters Insurance Quotes.

This is the section where we would normally share First American Renters Insurance quotes from two cities across the nation.

Unfortunately, the company doesn't offer quotes online so we can't share with you what the quotes are.

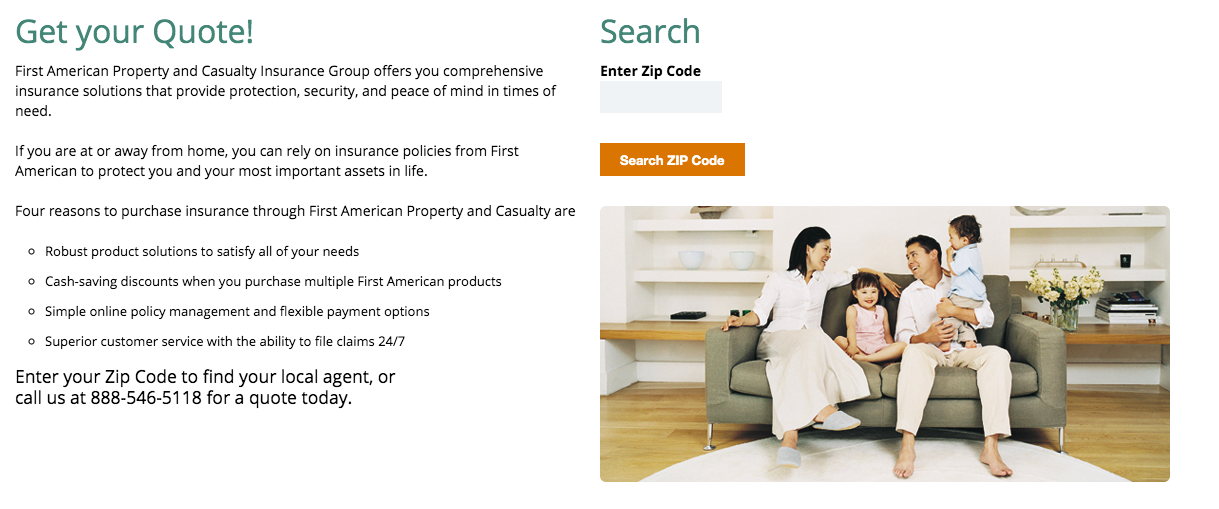

The website tool makes it seem like you're going to get a renter's insurance quote, but instead you just get a list of local agents to contact. This was a bit surprising since most people expect to get a quote online instead of being directed to a local agent to phone.

How do you obtain a First American renter’s insurance quote?

- You call 888-546-5118 to get a quote over the phone.

- You input your zip code into the tool to find a list of local agents to choose from.

The image below is what you see on the official First American Renters Insurance page where you go to get a quote...

Pro Renters Insurance Tip

Renters insurance doesn't just cover the replacement of your belongings, but also protects you if someone gets hurt on your property. Limits usually start at $100,000.

Is First American Renters Insurance Worth The Cost?

It's impossible to determine if First American Renters Insurance is worth the cost when you can't obtain a renter's insurance quote online. We couldn't obtain a quote.

It's disappointing these days when you can usually land a quote in minutes to not be able to even obtain a rough quote from First American.

The one bit of good news is that First American Renters Insurance offers many discounts for multiple policies, fire alarms/sprinklers, and loyalty to the company.

Can I Bundle My First American Renters Insurance With My Auto Insurance?

The good news is that First American offers a variety of insurance products so you can bundle your insurance under one umbrella.

As always, we urge you to shop around for the best possible quotes so that you get your money's worth for your insurance package.

Studenomics Pricing Score: 1 out of 5

Bundle and Save Up to 50%

Save up to $850/year by bundling renters with car insurance. Quick Online Quotes. Compare & Save 50% on: Auto, Motorcycle, Home, Condo, & Renter.

It's free to apply!

CUSTOMER SERVICE SCORE: 1 Out of 5

How is First American's Reputation for Service?

We looked through Glassdoor, BBB, and Reddit to see what real customers had to say about First American Renters Insurance.

We were almost shocked to see that the company had an F rating with BBB. This is the worst rating that we've ever seen for a renter's insurance company.

BBB Rating: F

Number of Ratings: 10

Glassdoor Rating: 69% would recommend

Number of Ratings: 1,200

Reddit Sentiment: Negative

Number of Comments: We found multiple negative threads about First American

First American Renters Insurance Reddit Feedback

We searched up First American Renters Insurance Reddit to see what regular folks were saying about their experiences with the company. We found multiple negative threads about First American Renters Insurance.

Here's one example...

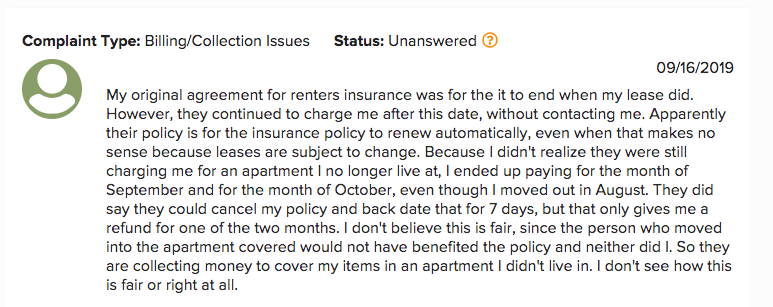

We couldn't ignore the negative comments about First American Renters Insurance on the official BBB website.

Here's one negative comment about First American Renters Insurance from June 2020 that hasn't been resolved yet.

"First American Property and Casualty insurance continues to charge me for renter’s insurance for an apartment I have not lived in in over two years. I have contacted them and told them that I no longer live there and no longer need their insurance service but they have continued to charge."

Here's another negative comment about First American Renters Insurance from the BBB website:

Notable Quote From Finder Against First American Renters Insurance:

"First American is a national company with a solid foundation and a long history. And while it offers a good set of insurance products, it may be hard to overlook the overwhelming customer complaints."

Renters Insurance Starting at $5/month

No brokers, no paperwork, get a policy in seconds. Zero Hassle, zero paperwork, zero worry. Join now! Starting at $5/month.

It's free to apply!

How Do You File a First American Renters Insurance Claim?

Let’s say that an emergency happens and you have to file a renter’s insurance claim with your First American Renters Insurance policy.

How do you file a First American Renters Insurance claim?

You fill out a form online located here: https://www.fapcig.com/claims/.

You're going to be asked for your name, policy number, email, phone number, loss type, date of loss, time of loss, and a description.

You can also contact your local agent to begin the First American Renters Insurance claim over the phone.

Please keep in mind the following steps for when you have to file a renter’s insurance claim in general:

- Take reasonable measures to control the situation.

- File a police report if any damages or theft occurred so that you have proper documentation.

- Contact your landlord and inform them of any damages.

- Take pictures of any damages or issues with the unit.

- Try to find your receipts for damaged or stolen items.

Studenomics Customer Service Score: 1 out of 5

POLICY OPTIONS SCORE: 2 Out of 5

What Does First American Renters Insurance Cover?

We looked through the official website and whatever information we could find to see what First American Renters Insurance covers.

Here’s what’s covered with a standard First American Renters Insurance policy…

Personal property coverage.

This coverage will replace your personal belongings that are either damaged or stolen due to a covered loss.

According to the official website:

"Personal property coverage to assist you in replacing your possessions due to loss or damage from fire, theft, vandalism and other risks."

It's important that you look into your coverage limits to see if your higher-end items are protected.

Personal liability coverage.

This will protect you in the event of any legal issues due to damages sustained on your property due to a covered loss. First American Renters Insurance will even pay for your legal representation.

Loss of use coverage.

This will cover you in the event that you can't live in your unit due to a covered damage. Your First American Renters Insurance policy will provide you with a hotel and cover other related expenses.

For more information about renters insurance coverage, you're going to have to contact a First American Renters Insurance local agent .

Bundle and Save Up to 50%

Save up to $850/year by bundling renters with car insurance. Quick Online Quotes. Compare & Save 50% on: Auto, Motorcycle, Home, Condo, & Renter.

It's free to apply!

What Isn’t Covered By My First American Renters Insurance Policy?

What isn't covered by your First American Renters Insurance policy is just as important as what's covered. We tried to look over the little information that's available online to see what kind of coverage you don't have with your renter's insurance policy.

There isn't much information available so we can only assume that you may need additional coverage if you have pets or plan on running a business out of your unit. You may want to call in to obtain a First American Renters Insurance quote to see what kind of coverage is available.Can I Add My Roommate?

Are you looking to add your roommate to your First American Renters Insurance policy? You're going to have to contact your local agent to see what they have to see.

We can't provide more information at this moment since it's difficult to find additional information on First American Renters Insurance coverage.

Studenomics Policy Options Score: 2 out of 5

Renters Insurance Starting at $5/month

No brokers, no paperwork, get a policy in seconds. Zero Hassle, zero paperwork, zero worry. Join now! Starting at $5/month.

It's free to apply!

FINANCIAL STRENGTH SCORE: 4 Out of 5

What is First American's Financial Rating?

We try to analyze the financial strength of an insurance company because we want you to be protected in the event of the worst possible case.

First American Financial Corporation has an A.M. Best rating of A and the company is publicly traded on the NYSE (FAF).

This indicates to us that the company is in strong financial standing and in no risks of going out of business anytime soon.

A.M. Best is the world's oldest credit rating agency so we go by the rankings that the have to offer to see where a company stands.

Studenomics Financial Strength Score: 4 out of 5

Pros and Cons of First American Renters Insurance?

What are the pros and cons of First American Renters Insurance?

Pros:

Cons:

Does First American Offer Insurance In My State?

First American Property & Casualty Group offers insurance products across the entire nation through local agents.

You have to either call or input your zip code online to find what kind of coverage is available near you.

The one benefit of working with a larger company is that you can find coverage nationwide through a local agent.

You can also check the best renters insurance rates by state using the map below.

How can you cancel your First American Renters Insurance?

What if you have to cancel your First American Renters Insurance policy if you wanted to?

We looked around and found the following about how to cancel your policy on the official website:

"You may cancel your policy at any time by calling us toll free at 866-654-9900 or by mailing a written request to cancel to the following address: First American P & C PO BOX 2009 Santa Ana, CA 92707-0009."

Final thoughts on First American Renters Insurance.

That’s our fair and honest review of First American Renters Insurance.

We were disappointed with the negative customer reviews that we found and we couldn't look past those.

We also wish that they had online quotes available.

If you do have the time, it's always worth trying to obtain a quote to see what the pricing and the coverage is like with First American Renters Insurance.

Good luck with your hunt for the ideal renter's insurance policy for your unique situation.

Renters Insurance Starting at $5/month

No brokers, no paperwork, get a policy in seconds. Zero Hassle, zero paperwork, zero worry. Join now! Starting at $5/month.

It's free to apply!

Anyone actually tried this? Seems expensive for what is covered

We would love to hear from the readers about First American Renters Insurance.