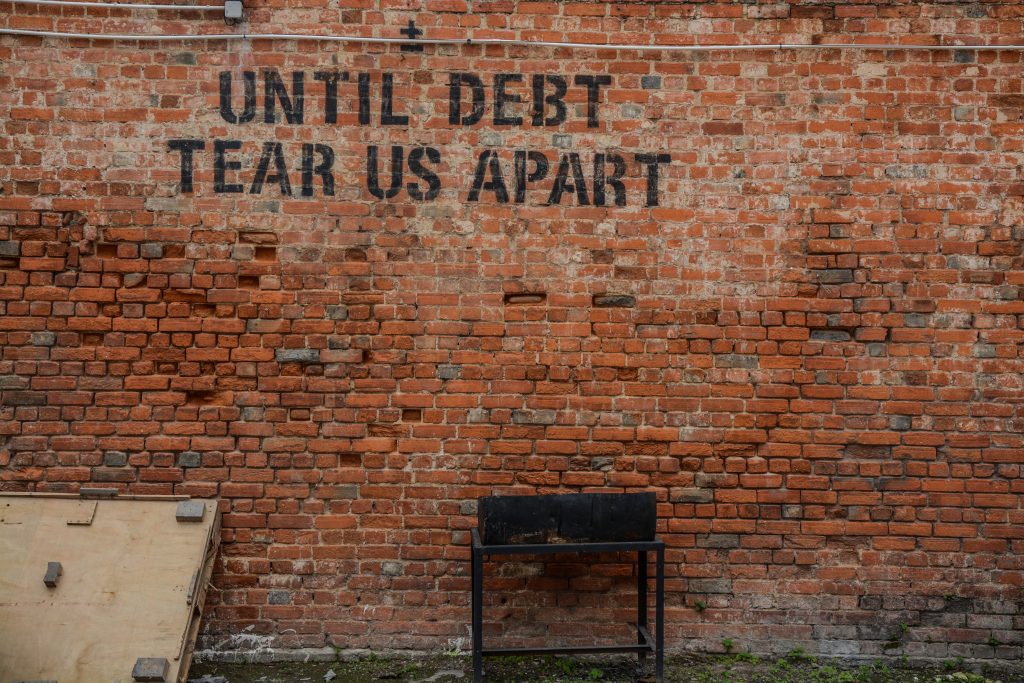

There has to be more to life than just paying debt, right? There has to be more to this world then just living in, right? Yes. Chances are that you’re fed up with being in debt. You want to pay off debt quickly so that you can move on with your life.

You’re now at the point financially where you understand your debt, you have found a debt elimination plan the works for you, and you’re on track to paying off your debt. What if you want to speed this process up? What if you want to pay off your debt faster?

Let’s look at how to pay off debt quickly to move on with life…

Are you ready to get hardcore about paying off your debt? At some point in your journey, you’re going to decide that it’s time to put the focus on paying off debt. That’s what this article is for. This guide is for everyone who’s ready to speed up the process to pay off debt faster than ever.

How do you pay off debt quickly?

These are some aggressive tips that you can use to pay off that debt quickly so that you can move on with your life. Only continue if you’re ready to get hardcore about your debt.

First you need to cut out all of the junk.

If you want to go all out with killing your debt then all unnecessary luxuries need to be cut for the time being. Well aren’t all luxuries unnecessary? Not really. I won’t tell you to cut your gym membership or cell phone plan (more on this later).

Your goal is to kill your debt so that you can enjoy life once you’re debt free.

Suck it up and stop drinking Grey Goose or White Crawls. Life won’t be so bad just because you go back to the basics for a short little while. You’re going to be focused on paying off your debt.

Then you need to find an extra $20+ to put towards your debt.

I said $20 but that is by no means a final number. You should strive to find at least an extra $20 a week to put towards your debt.

Here’s the million dollar question: where will this extra money come from?

That’s your job as you go through this article. You’ll need to search deep for that extra money to put towards your debt. You’ll have to do stuff that you think is lame. You’ll have to keep track of all of your spending (hey, I didn’t say this would be fun). You’ll need to meticulously look through your finances to find a hole where you can pull out the money.

If you absolutely can’t find an extra $20 and think that frugality tips are completely lame, then let me help you with some hardcore tips (don’t worry you can still drink your coffee in the morning).

Here are some tips for when you want to get hardcore about paying off your debt:

- Reduce your subscription features. I currently pay a little extra for my gym membership because I have access to the Mixed Martial Arts classes. I pay a little extra each month for my iPhone because I have unlimited internet access to keep my sane in my spare time. However, if you want to pay off your debt hardcore style you’ll need to reduce certain features.

- Delay services. Instead of getting your haircut weekly, revert to the ways of a child and get your hair cut less frequently. Hair is not the only example, but it’s a common expense for most of us. If you already save money on hair cuts then find another way that you can delay a service to save some cash (less personal training lessons, less days at the spa, etc.). Delaying your treats won’t be fun but you’re speeding up your freedom from debt.

- Work on making more money. We cover this next.

How do you make more money to pay off debt quickly?

Now you must try to earn more money.

For me this is the fun part, for others it’s the really challenging part. I don’t mind putting in the hours in if I know the money will be used to reach a goal. Other people have extremely busy lives as it is and really don’t have any additional time to direct towards working more. Unfortunately, the busy folks are going to hate this part. Below are a few of my suggestions to earn more money to put towards your debt repayment.

1. Find a part time job. If you want to pay off debt aggressively you’ll have to put the time in. You can always find a job in retail or in the service industry. You can deliver food or find an online freelancing gig to speed up the process.

2. Start a blog. The money sucks but if you write about a topic that excites you, the few dollars you make will make it all seem worth it. There are many online jobs for college students if you’re ready to work. You can always grow this blog as a hobby when you’re trying to pay off your debt.

3. Find work around campus. This is the ideal option for college students that are looking to cut down on debt prior to graduation. I’ve written about this plenty of times so I will just quickly throw out some of the options for work around campus: teaching assistant, department help, custodian, bus driver, computer programming, customer service, etc.

Long story short: you have to find a way to make some more money. When you make more money, you’re going to put this money towards your debt. This will help you speed up the process since you’re fed up with being in debt.

This article isn’t for everyone. Some people value and cherish the time that they spend with those close to them. As a result they’re not willing to spend the little free time they have on working and are willing to pay off their debt a little slower. That is perfectly acceptable. If you want to get hardcore about paying off your debt then this article is for you. I wish you all the best and I hope that you guys can share your debt reduction stories with us.

What’s the final word on paying off debt faster?

You already know what to do. It’s time to do it. You have to find a few extra bucks to put towards your debt. You have to get aggressive about the process.

- The bad news is that you won’t have much fun for the next few months.

- The good news is that you’re going to become debt-free much faster and you can move on with your life.

Let us know if you plan on paying off debt quicker or if you’re willing to wait…

“Debt is like any other trap, easy enough to get into, but hard enough to get out of.” — Henry Wheeler Shaw