If my readers don’t succeed, I’m a failure. Studenomics is all about you guys and helping you reach financial freedom.

Today we’re all going back to school. We’re going to help a reader figure out her finances, get out of debt, and live a better life where money isn’t an issue.

Welcome Jacquelyn, a young lady looking to slap her debt around and live a better life.

Before anything else is said, I need to thank Jacquelyn for having the guts to do this. She’s fully transparent about her finances. So please go easy on her. She didn’t have to do this, but she’s serious about improving her situation.

What’s Jacquelyn’s current situation?

First, let’s look at her debt/banking setup.

Credit Union of Denver:

Savings: 584.09

Checking: 764.72

Credit Union of Denver Credit Card:

$1,250.43 @ 9.4%

Credit Limit = $2,000.00

Discover:

$771.21 @ 3.99% until 12/2014

Credit Limit = $1000.00

Capital One:

$4,637.25 @ 20.99%

Credit Limit = $7,500.00

Zales:

$2,000.00 have until 12/9/14 to pay off interest-free.

MyFedLoan:

$23,132 @ 6.55% (Direct Debit)

AESuccess:

$4,157 @ 6.55% (Direct Debit)

Fox Valley CU:

Savings: $37.03

Retirement:

$404.69 = Vested Balance

What are the fixed expenses like?

- Rent is $572.50 currently with utilities averaging from $90-100/month. All amounts are debited from my account and roommate pays back in cash.

- Loans debit $360.05 every month.

- My phone bill is $70/month on average.

- Renter’s insurance is $20.17 monthly.

- My Tollway Transponder is about $50/month.

- Spotify is $9.99/month.

- LA Tan is $2.99/month since I have it frozen (haven’t used it in years).

- Automobile Gas ranges from $200-300/month.

What are the problem areas for Jacquelyn?

I asked to see what the major issues were. According to her, the problems are:

- The amounts I pay for my credit cards are not consistent and are what I’m trying to fix.

- Will be moving so that’s where my money will be directed.

- Right now, I am trying to figure out a cheaper way to work because it takes a tank and a half every week with this new job since it’s so far from me.

- My starter went out in Canada which is why my Capital One balance went up significantly because I was a bit strapped.

- I try to be more aware but I catch myself with the mindset of “oh it’s just $10”. Recently spent $60 on a date night.

- We have started cooking in more, instead of going out to eat, that saves lots of money, but I get bored in my apartment.

- Need a structured system for paying off debt.

What other financials should you know?

I got a new job as a Manager in Chicago making $55,000.00 annually. I make an extra $8,000 with this new job.

I’ll be looking into getting a job at the airport once we have moved to make extra cash and save on flights to see family.

We will be moving in together the end of August. Partner has been helping making some payments on the Capitol One credit card. I’ve asked her to help me with the Discover to get that one down to $0 then chipping away at Capitol One. She’s on board.

###

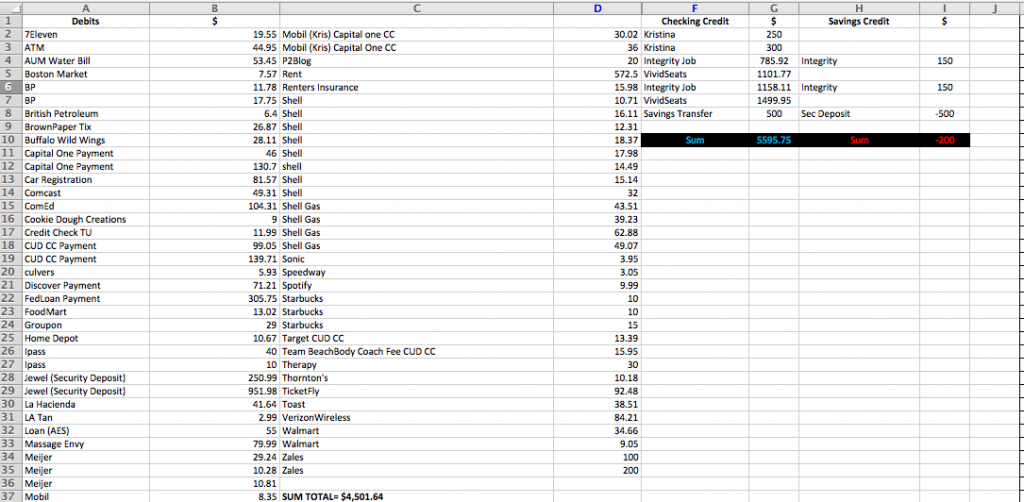

Let’s look at Jacquelyn’s spending in August!

Huge props to Jacquelyn for doing this. I’m so proud of her for sticking through the whole month and not giving up.

August results:

- Money spent: $4501.6

- Income: $5,595.75

(I messed up the chart a bit because I suck at editing. The information is all there though. Click on it for a full view.)

How can Jacquelyn improve her financial situation and destroy the debt?

I can’t really sugarcoat it. There’s good news and bad news. The good news is that Jacquelyn can easily get out of debt and reach financial freedom. The bad news is that it won’t be easy, it’s going to take a long time, and she’s going to have to sacrifice. She makes more money than people that have killed more debt. She’s young and ambitious.

I always tell my friends that you can’t get mad about the results you didn’t get with the work you didn’t do.

My tips are simple and are designed to provide structure:

Focus on debt 100%!

First, find a debt strategy that works for you.

You can either attack the lowest debt first or the one with the highest interest rate. You can also consider consolidating your debts.

Then, you focus on this debt 100%. Your goal should be to pay off your debt. This should be all that you think about 24/7. This is your project for the next little while. You need to kill the debt so that you can enjoy life.

You should put every extra dollar towards the debt.

I would even go as far as to suggest selling some stuff. Host a yard sale, put some stuff up on Kijiji, and get rid of it for money.

Cut back expenses.

There are two ways to cut back on expenses:

- The major/fixed purchases. I would suggest cutting back the cell phone plan, finding a way to carpool to work/take the bus, and even consider selling the car.

- Everyday life. It’s cool to go for coffee. I’m the biggest caffeine addict. The thing is, there’s no reason to be spending $10 or $15 on one Starbucks trip.

Work more.

You can’t avoid this one. You have to work more. You already know this though. You may have to find a part-time job on the weekends to help out with payments. Since your partner is on board, maybe you can try finding work together on the weekends.

Have fun on the cheap.

The trick to staying sane is to get wild without going broke. I still want you to have fun. Just try to do it on the cheap. Drink at home, host house parties, stay local, and try take advantage of free events in your community.

What are some must read articles?

It’s time to go back to school if you’re not 100% on top of your finances. Actually, this is the opposite of school. Lame personal finance advice comes to Studenomics to die.

I didn’t want to repeat myself so I’m sharing the must read articles for Jacquelyn and all readers in a similar situation.

How-to drink without going broke — This is key. I can’t tell anyone not to party. I would be the world’s biggest hypocrite. I can only suggest ways to save money on this expense and to not let it consume your life.

Start an online business in 6 easy steps — You can start your own online business and make money in the future (it won’t be easy). This is a fun hobby that could POSSIBLY lead to money down the road.

How you can save $25k by 25 — Proven tactics that have worked for me. No excuses! The title says it all and it applies to every age.

The ultimate guide to crushing your debt — Over 2,000 words on destroying your debt. The best possible guide on the whole damn web. You’ll find a strategy that works for you in here.

Add play to your life and never feel miserable again — A quick guide to helping you feel good. Being in debt can really bring you down. You need to do everything possible to stay positive.

That’s enough for now, I don’t want you to experience information overload.

This is just the beginning of the journey for Jacquelyn. I’ve helped many readers reach their financial goals. This is the first time that I’m actually doing it in such a public forum.

It’s time for you guys to help out. What advice do you have to share? What has worked for you?

My new favorite quote “you can’t get mad about the results you didn’t get with the work you didn’t do.”

I would also agree to focus on debt first. You can accomplish so much more when you focus. I personally like the “start from the lowest amount first.” I feel so much better when I have one less bill to pay and then it gets me pumped up to pay off the next balance.

You can do it Jaquelyn! It make take a little while but in a year from now you’ll be so glad that you stuck to it.

It’s never easy seeing your situation blown up onto the Web. For me, Martin knows this, the best accountability can be that I no longer have a way to escape or hide it.

I am going to set up a formal deadline for my goals, instead of always talking about it. That’s how I got here.

I will be tracking my spending every month as it was a shock to my system…I mean my spending was outrageous.

I will add the Starbucks transactions are for reloads…to get several coffees 😉

However, I have a Keurig and FREE coffee at work.

I want to be out of debt ASAP. I will be securing a part-time job as soon as possible while continuing to reach out for freelancing gigs.

If ANYONE has additional tips or tools for time management…I am all eyes, need to learn some new ways because mine simply haven’t been effective for me.

Am I reading it right that she is moving to Chicago? If so, here are my suggestions from a fellow Chicagoan on money saving tips:

1. Rent on the cheap. Do not pick a pricey, but trendy location like Wrigleyville or Lincoln Park. Instead look for value homes west of the city that are near CTA buses or trains. Rogers Park, Edgewater, and neighborhoods on the north-west side are much, much cheaper.

2. Sell the car. If you’re living and working in Chicago (or the near suburbs), you won’t need one. Instead, invest in a zip car rental which could save you hundreds of dollars a month on gas, insurance, repairs, etc. A monthly CTA pass costs about $120 for all access. Use and abuse it.

3. Shop at Aldi instead of Jewel, Meyer, Whole Foods, etc. Try to live centrally to a grocery store so you can walk instead of drive.

4. Volunteer! I totally understand the getting bored in your apartment deal. That is why I volunteer almost daily so that I can get out of the house and speak with others. Also, look into free activities downtown like Millennium Park’s Saturday workouts or cultural center offerings. GoldStar also usually offers comp tickets to events that may interest you.

Best of luck, Jaquelyn!

Thanks Alexa! I need to pay down my Zales balance by 12/9, which is now at $1700, otherwise I acquire about $3000 in interest to have to pay.

Thanks Michelle!

This information about my situation is slightly outdated. We got a location in Bucktown, but for good reason. I am 2 miles from work an easy bike or public trans trip for me. We are going to sell one of the cars. I technically can’t sell mine because well…it’s not mine.

Aldi is one of the best kept secrets…but sometimes the food is awful.

Thanks! I will check out GoldStar…that sounds interesting to me. I am hoping that having a part-time weekend gig will bust me out of the apartment a lot too!

Tracking your spending is a great first step. That’s what started a huge financial turnaround for me — and ended with my husband and I paying off our house. So definitely keep that up.

Do you have things you can sell to build up an emergency fund? That would also help you prep for the move, so bonus 🙂 When you have an emergency fund (and later, a car repair fund) it helps you stay out of debt/avoid going deeper into it.

A few more questions:

December is coming up really quickly. What happens if you don’t have the $2000 Zales amount paid off by then?

What are the minimum payments on all of your debts? I was going to plug it into my debt snowball app for you to see when you could be debt free but it’s hard to tell from the spreadsheet what those are.

Why do you want to be out of debt? Having a REALLY solid, burning reason will help you to make that happen. Getting out of debt is about changing the way you think about it, and then acting on those changes.

Way to go attacking your debt! Life will look rosier with every payment. Sending you the best of luck!

Hi Jacquelyn!

At first glance, it’s pretty much a financial emergency that you’re paying 20.99% interest on your Capital One credit card, so the two steps I would take before you does anything else would be to sign up for income-based repayment for your student loans and look for a 0%, no-fee balance transfer for your higher rate credit cards. IBR would likely allow you to send less to the lower-interest student loans STRICTLY for the purpose of sending the difference to that 20.99% interest credit card instead. The BT would likely require you signing up for a new credit card — also not ideal — but would mean you’re not losing so much of your payments to interest.

Moreover, what happens to her Zales loan if you don’t pay it off by December? What happens to your Discover rate if you doesn’t pay it off the balance by December? These too could fall into that emergency range once the low, teaser rates expire.

There are plenty of other details to fill in when it comes to retirement, insurance, and so forth, but these two steps are where I’d start.

And that’s just the numbers side of things! There’s even more to talk about when it comes to lifestyle changes.

Good luck!

@Jackie,

I am currently moved in. The big issue was the security deposit and rent payment around the same time. It totaled out at $2400…that sucked. However, I had some friends help move so I didn’t’ have to really spend any money on moving…I even got PTO for the day I took off for it!

I am trying to figure out ways or things I could get rid of to build up my emergency fund…I definitely don’t have one. With my girlfriend’s untimely work situation, it put us in a serious bind (me in particular since I will be shelving most of the housing finances until she can get a better position).

The idea is to not have to worry about car repair funds because I won’t be using it…I hope. Most we will use it for is to visit her family in the suburbs.

Honestly, I have no choice I will make the Zales payment and complete it. Right now, I haven’t been able to give as much to it because I was 1. lazy 2. moving and 3. thinking I was in a better financial position.

Minimum payments required:

CUD: $27-30

Zales: $25

Capital One: $125

Discover: $30

AESuccess: 55

FedLoan: 305.75

In all honesty, I am trying to figure out my burning reason. Frankly, I am tired of feeling so shitty all the time about my finances and it putting so much stress on my relationships, both friends and my gf.

the biggest issue is I have a lot of resentment built up against my girlfriend regarding finances because it has always been a big stress in our relationship.

Using the resentment to move forward, not backward would be helpful all around….I know it, it’s just not an easy thing for me to let go.

@Mario,

Is there a card you would recommend I transfer to from where I am at? I have shopped the market a little bit, but it’s a large balance to transfer and I can’t get the guarantee that my amount will be transferred over to close that capital one cc.

I did just speak with them about lowering the interest rate yesterday, given my consistent payment history. If they don’t do it, I will likely threaten to leave. I was upset with myself about that because I apparently missed the finer print that states there was no promotional interest rate on the Capital One CC…which is why I signed up…and also explains the credit limit they were allowing for me.

If I don’t get Zales paid off, which I will, I don’t have a choice, I would incur about $3000 in interest fees.

Discover will be assisted with the help of my girlfriend and we have put a stop to using the credit cards completely.

The interest rate for Discover jumps up to the same rate as Capital One in December. My ideal situation with that card is to drive that to $0 and then use it like Martin suggests which is make the payment in full every month.

Dreams!

First congrats on coming to terms with your financial situation. Many people have a hard time looking the facts and it’s the first step in making a positive change. It’s going to be a difficult journey but one that can be done.

Make sure you are contributing to your new company’s 401K up to the max they match. Focus on debt repayment and any additional income, overtime or side hustle to paying down the debt.

I would consider a peer-to-peer lender (Prosper or Lending Club) to help you consolidate all those unsecured credit card debt into one loan. The rates I’ve seen has been drastically lower than the credit card APRs. Some of the people I’ve worked with have been able to get approved up to $30k to get all the credit card under one payment and paid off in 3 years. One recently paid off his $15k in 2 years making additional payments.

If you can find additional ways to supplement your income and use all proceeds to pay off debt. I have a list of 37 things you can do.

Hating your financial situation is as good a reason as any for making a change. If it were me I would use that as an “I never want to be here again” type vow, and also spend time daily imagining what it would be like to not owe any money to anyone anywhere.

I plugged in your debts, their minimum payments, and current interest rates into the app. I put them in this order: Zales, Discover, Capital One, CUD, AE Success, MyFedLoan. Can you come up with an additional $640 per month on top of your minimum payments to send to debt? (By selling stuff, spending less, earning more, etc.) If you can do that AND you use the debt snowball method with the debts put in that order, you can be completely debt free in 2 years 9 months. You’ll also have the Zales and Discover cards wiped out in 4 payments, and everything but AE Success and MyFedLoan gone in less than a year.

Getting Zales paid off before the deadline would be priority #1 if it were me. Paid off for real that is, not transferred somewhere else.

Jason,

I am curious to know more about the peer-to-peer lending you talk about. That is the first time I have heard of that so I am not entirely familiar with how I would go about that.

Jackie,

Are were you saying knock out Zales first, then Discover and so on? Or was there a specific way you had payments laid out.

Is this debt app you have available to be used by your readers? I use the REady For Zero app currently, I love it, I just need to lay out my exact payments better.

STRUCTURE. that’s what I need 🙂

Brief Update:

@Michelle : Ventra 30 day pass purchased for $100, able to use subway and buses with this pass. I checked out GoldStar and will hopefully see some good things come from that. I am also looking at other volunteer opportunities to invest my time but also network for my blog and business.

@Jackie and @Jason : Jackie I am working on trying to add more income to my budget based solely for debt repayment. Jason’s 37 different ways have seen a small ROI but will likely grow to more as I get more accustomed : CrowdSource and GigWalker

Also, Kristina and I have decided to join debts, which will add another $8200 to our overall total but will be easier to make sure we are on the same page, honest, accountable and working toward the same goals.

I got my Capital One interest rate down to 16.9% for the next 7 months, which I hope to be making a dent on in the next 3 months after Discover and Zales are taken care of.

Small victories!