“I want to buy my own place. I don’t want to pay someone’s mortgage. I’m tired of renting/living at home.”

You want to invest in real estate and buy your first property. You’re just not sure how to start.

Many young people are confused about real estate. While it’s tempting to complain on social media about how rough our generation has it, I know that you’re better than that. You can choose to do something about it and actually figure out how to buy a place. This article will help you buy your first home (investment property or primary residence).

“It is a comfortable feeling to know that you stand on your own ground. Land is about the only thing that can’t fly away.” — Anthony Trollop

Here’s the exact process for buying your first home or rental property.

PART #1: Before you even think about buying a rental property/home.

When I wrote about building wealth, I mentioned how important rental properties can be in your portfolio as your build up your nest egg.

The greatest investment that I ever made was buying a rental property. The worst investment that some of my friends have made is buying a home. Real estate will be either your greatest investment or biggest mistake in your 20s. You’re either going to love or it be pissed off at the world because you’re flat broke and hate all of the home-related expenses.

How can a great investment for one be a horrible investment for someone else?

It all comes down to perspective and preparation.

Buying a rental home comes with the assumption that you plan on using this property as an investment. Buying a home as primary residence comes shouldn’t be seen as only an investment. This is your home. Don’t expect to get rich off your primary residence the day that you move in.

For the sake of this article, I’m assuming that you’ve decided to buy. I’m also going to assume that you’re not okay with living at home in your 30s.

What do you need to do before you can even think about buying real estate?

Step 1: Figure out how much money you need.

How much money do you need for this property?

I’m not talking about just your mortgage down-payment. That’s kind of the easy part. The difficult part is the other expenses that creep up.

I want you think about the hidden expenses:

- Closing costs.

- Lawyer fees (often figured into closing costs along with land transfer taxes).

- Repairs (could be a deal breaker).

- Mortgage insurance (if necessary).

- Maintenance fees.

- Property taxes

- Increased consumption (you know you have to throw parties now, right?).

You have to factor these expenses in with the down payment. Don’t just look at the 10% down (or whatever amount you choose to put down) because that’s going to leave you delusional about the process. Figure out how much money you really need.

For example, with my first rental property, I had to come up with 5% on signing and then 5% in six months, another 5% in a year, and the final 5% on closing. Each 5% was about $12k. I knew how much money I needed on the exact dates. What I didn’t know was how expensive the other fees would be.

If you plan on renting the place out, you have to factor everything into the monthly cost.

Step 2: Get a mortgage pre-approval/see what you can afford/ACTUALLY RUN THE NUMBERS YOU FOOL!

Have you been pre-approved for a mortgage yet?

I would suggest doing this first. Then you can see where you stand. You might be impressed with the pre-approval amount or it might make you cry. Either way, you can’t deny the numbers because they don’t lie.

What’s the point of a mortgage pre-approval?

According to BMO:

“Getting pre-approved lets you shop for a house confidently because you’ll know how much you can borrow. The amount you can borrow is based on how much you earn each month and how much debt you have.”

[Quick note: a pre-approval is not the full approval. You don’t need one 100% of the time. It’s just good to know where you stand as a first-timer. A pre-approval is really important in your 20s too. You may find out that you still have to keep on saving up.]

What do you need for this stage?

- Proof of income.

- A solid credit score.

- Employment history.

- Important documentation.

- Proof of assets.

Once again, you don’t need a mortgage pre-approval, but I would recommend going in for one as a first-timer just so you know how much you could afford for your first rental property. Another benefit of this process is that it’s going to force you to get your paperwork in order. You’re also going to receive a clear picture of your finances.

I should also note that when I bought my first property at pre-construction prices, a pre-approval was MANDATORY. So you might not have a choice here. You should also remember that you may be approved for the mortgage, but it doesn’t mean that you can afford it when it comes down to it.

From what I’ve been told job stability/income are really important. The bank won’t be excited to loan you money if you run a vegan yoga blog that generates zero revenue.

RUN THE NUMBERS!

- If you want to live here, then see what your monthly expenses will be.

- If you want to rent the place out, then see what you’re dealing with.

You can go to RateSupermarket to check out the numbers (possible interest rates and monthly mortgage payments).

For example:

If you know $400 is going to maintenance fees, property taxes are $3,000 for the year and the mortgage payment is $1,400, then how much profit is there per year? Calculate your ROI based off that. If you’re only making 1% of the total investment for the whole year, it’s a bad deal. You have to know what you’re getting yourself into. This isn’t a spontaneous Tinder date.

Next, you need to think about the money that you’re going to need to maintain your new lifestyle. If this home is a rental property then you have to run all of the numbers to see if you can even turn a profit. If you plan on living here, then you want to know that you can afford to pay your bills and still eat. I’m also going under the impression that you’re going to have a cell phone plan and Internet.

Step 3: Start saving up some more.

How much money do you saved up? Have you been saving up this whole time?

You generally want to have 20% of the purchase price saved up if you want to avoid paying for mortgage insurance.

The most boring part of personal finance is when you’re trying to save up that first little bit.

How much money do you have saved up right now? What’s your pre-approval amount?

There are no shortcuts here. You have to start saving. You can’t borrow money to borrow money to borrow money. You need some skin in the game. Read this article on making more money, then start a blog, then read about freelancing, try driving for Uber, and then stack up the money.

[Must read: Why you should save $10k in the next six months.]

Step 4: Work on your credit score.

How’s your credit? Have you been on top of your finances the past few years?

Your credit score will have a huge factor in you being accepted for that mortgage. Your credit score will also be a factor in your interest rate. This could be the difference of thousands of dollars of the course of the mortgage.

So what’s the deal with your credit?

A poor credit score will take money out of your pocket. Nobody will want to loan you money, unless they charge you a high interest rate because they won’t trust you with hundreds of thousands of dollars. You’re going to struggle to get a mortgage. Having a poor credit score sucks on all levels. You could be screwed out of buying your first rental property if your credit score sucks.

A poor credit score will take money out of your pocket. Nobody will want to loan you money, unless they charge you a high interest rate because they won’t trust you with hundreds of thousands of dollars. You’re going to struggle to get a mortgage. Having a poor credit score sucks on all levels. You could be screwed out of buying your first rental property if your credit score sucks.

A strong credit score is amazing. It will help you save money since you’ll get offered the lower interest rates when you apply for a home mortgage or any sort of loan.

For everything (and more) that you could possibly want to know about your credit, you need to grab a copy of Completely Conquer Credit, my premium guide which is now selling for FREE. I don’t want you to spend any more money. Build your credit so that you get approved for that mortgage.

What’s your credit score like?

It’s okay if you made some mistakes in your younger more foolish days. That’s life. It’s time to get your stuff back on track.

[You can use Credit Sesame to find your current credit score or you can figure this out if you go in for a pre-approval. It’s important that you know where you stand here.]

PART #2: What happens when you’re ready to buy a property?

Step 5: Start looking for the right place.

As you’re saving, you have time to browse for the place.

I browsed forever. Real estate consumed my life at one point in 2007. I spent a good six months checking out listings, walking into presentation offices, and dreaming about walls. All I thought about was real estate. It took me forever to make a decision, but I finally chose a pre-construction condo because I’m not very handy.

What’s the right place? This depends 100% on the type of investment you’re looking to make. I was a rookie with no standards so I wanted something that came with zero work.

What sort of place do you want for your first rental property? Home, condo, triplex, or something else?

If you plan on living here, ensure that you like the community because you’re going to be stuck for a while.

Step 6: Look into the property.

(I have the best seats for the air show.)

It’s time to look into the property and everything it has to offer.

What makes this specific property ideal for you? Why do you want this rental? Why do you want to live here?

I want you to think about the following if it’s a rental:

- Who would be your ideal tenant?

- How many rooms could you rent out?

- Is it ready to rent?

- Does any work have to be done?

You don’t want to be stuck with four walls and a mortgage because you rushed for some reason.

If you plan on living here, then the next step will be crucial for you.

Step 7: Research the community/market.

How’s the demand in this area? Does anyone want to even live there? What’s the community known for?

My current condo has a Facebook group. Members of the group always complain about the noise. Here’s the thing. We live on Queen West in one of the busiest areas of the city. There are night clubs all around us. Did they not research the community for more than 10 minutes?

I was lucky enough that my first condo was in Toronto, where it’s fairly easy to find tenants. I’ve heard from friends who bought places in small towns and are surprised that they can’t find a tenant for their 4-bed room home. Well, did you research the market? Was there any demand for a four bed room place?

You can’t hope for the best because hope isn’t a game plan.

How do you research the community/market?

The Globe and Mail said it best in this article:

“The key is to look for a community or region that shows clear signs of growth and economic sustainability. Avoid one-horse towns whose existence are tied to a single company, no matter how tempting the sale price.”

Investopedia posted about quality here:

“The quality of the neighborhood in which you buy will influence both the types of tenants you attract and how often you face vacancies. For example, if you buy in a neighborhood near a university, the chances are that your pool of potential tenants will be mainly made up of students and that you will face vacancies on a fairly regular basis (during summer, when students tend to return back home).”

Most of this will be common sense. Don’t move into a building without spending some in the area. The same logic applies to a community. Drive around and see what the vibe’s like. This is a place where you’re going to live for at least a few years.

PART #3: You have the property. Now what?

If you plan on living in this place, then it’s time to plan a move and to bribe your friends with beer to help you carry your stuff in. If you want to rent this place out, keep on reading…

(When I did the pre-inspection of my first property, I was totally confused.)

Step 8: Reverse engineer the process.

How did I research the market?

Pretend that you want to rent a place similar to yours.

You don’t want to find a place and then be stuck when you can’t find a tenant. I’ve never struggled to find a tenant because I always did the Kijiji Test.

What’s this?

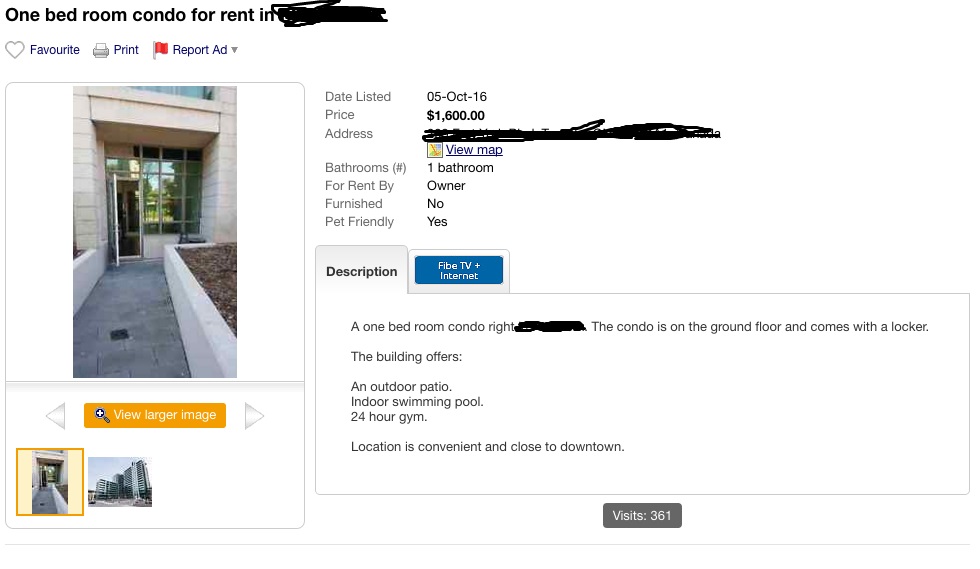

Go on Kijiji and check out the demand. Pretend that you want to rent a place in that area. Go for open houses. I used the Toronto real estate section of Kijiji. I checked condos for rent in my exact building. I then emailed the landlords.

When my condo was ready, I used similar ads and the EXACT same prices. I had 8 people show up for viewings on the first day of viewings. I screened and got to pick-and-choose potential tenants.

You can use Craigslist or any similar site. Look up real estate in the community of the rental. Look at the prices of rentals. Study this for a few weeks so you see how long ads stay up. Message the landlords to test them and to see the availability. This will give you a sign of how demand is in the market.

Look at the types of units that are available in the community.

What types of units are available for sale/rent? How are these units doing? How long have the ads been up for?

If someone with the exact same unit in the market is struggling to find a tenant, what makes you think that you’re going to be better off?

Check out the units in the area and then make your decision. You want to know exactly what you’re getting into since there’s so much money at stake here.

Step 9: Ensure you’re ready to be a landlord.

Are you ready to be a landlord? Will you outsource this process to a property management firm? Will you be okay with finding tenants, screening tenants, and dealing with tenants?

The aforementioned Globe article also mentions this:

“Many investors choose to save money by doing the management work themselves, but that comes with its own costs. Landlords should expect to put effort into finding good tenants, avoiding bad ones and fielding the overnight phone calls when something goes wrong.”

Can you handle being a landlord?

I want you to be the landlord for your first rental property. Don’t act like you’re too busy. Don’t outsource this process. You have to do this on your own the first time around. I’m going to show you how to find a tenant for your rental property.

Step 10: Look for tenants.

Now it’s time to get your hands dirty. I was fortunate enough to know that the demand in my building was there by doing the work BEFORE I bought my most recent rental. Then just to amuse myself, I put up the worst ad possible. I woke up to multiple emails and I had viewings planned before I even had the keys in my hands.

You may want to put up a better ad. I personally would just find similar units and try to copy what they’re doing. You’re also going to want some quality pictures. I didn’t have any decent pictures because I didn’t even have the keys to the unit yet.

You want to host an open house. The four times I’ve gone through this process I was usually lucky enough to have multiple tenants apply. I would then host an open house. I would tell everyone what time to come. I then had applicants view the place one at a time.

Imagine doing this at 23? They were probably wondering who this young punk was.

Step 11: Screen tenants.

(That's me loitering on my current balcony in the summer.)

You have to start screening your applicants.

What do you need to do?

Send them a typical application form if they’re interested. You just have to Google:

“[your city/province/state name rental application form]”

I’m the luckiest fool in the world. With my first rental, the tenant actually showed up with a filled out application form. I played it off cool as if I left my copies in the car.

Then you look into their information.

Find out where they work and how much they make. See what their credit is like. Make sure that they have enough money for two month’s worth of rent (first and last).

Go through the information diligently. Call their last landlord and the one before that. Ask for references from an employer.

Finally, you choose your tenant.

(A panoramic view from my balcony.)

What are you going to do? Do you have any questions on buying your first rental property?

I simplify every complex financial topic in my book, Next Round’s On Me. Real estate can help you get to the next level. I don’t want you to be confused about this process. Leave your questions in the comments section.

Your first home purchase is the most important decision of your 20s (next to settling down if you plan on doing that). Read this article over daily before you buy that place. I don’t want you to go broke while trying to enter the real estate market. If you can’t afford a home or feel that prices are too high, then keep on saving up and stay patient. You don’t have to do anything with your money that you don’t want to do.

Can you claim tax deductions on an investment property?

Yes. Please consult an accountant, but you can claim some of the expenses.

A good friend of mine was interested in learning more about buying real estate. It would help her a lot to know that having a good credit is important. This will make the buying process a lot simpler for the buyer.

Great credit is everything. It’s tough to get someone to loan you money without it.

You’ve got great tips for buying a real estate property. I like how you said that the first step is to figure out how much money we’re going to need in total. I hadn’t thought about lawyer fees or property taxes, so that’s great to keep in mind!

It’s amazing how many hidden expenses creep up on you when you buy a place.

My sister wants to have her own place and move in near her office. It was explained here that she should first figure out how much money should she need for the property that she wanted. Furthermore, it’s advisable to talk to real estate experts when planning to buy a property.