Lemonade Renters Insurance Review: Pros & Cons, Pricing, and Features

Studenomics Score: 4.75 Out of 5 Stars

Advertiser Disclosure: Our content is free because we are supported by advertisers. If you click on links in this post, we may earn a commission.

If you've heard about Lemonade Renters Insurance, you've probably found it hard to find an unbiased review you can trust or to get a ballpark quote on pricing.

Don't worry... You're in the perfect place!

Lemonade Renters Insurance Review

We have reviewed just about every renters insurance company and our only wish is to bring you an honest Lemonade Renters Insurance Review. We'll tell you the pros and cons of using Lemonade and provide you with sample quotes, no personal info required!

Highlights:

Overview:

Strong company founded in 2015 with solid pricing. Easy to apply online. Very low rates.

Known for:

- Easy-to-use mobile app where everything's handled instantly.

- Simple claims process with minimal hassle.

- Leftover money is donated to charity.

Financial Rating:

Not yet rated for financial strength by A.M. Best, but rated A-exceptional by Demotech.

Who is Lemonade Insurance?

Lemonade Insurance came on the scene in 2015 and changed the renters insurance world by simplifying the entire process.

You can obtain a Lemonade Renters Insurance quote in seconds, file a claim instantly, and manage your policy from your phone.

Lemonade is the most unique insurance company because they offer low rates, have transparent policies, and make filing a claim painless.

Keep on reading to find out more Lemonade.

What's new Lemonade Insurance?

We had to update this article on 5/10/2021 to tell you about what's new with Lemonade Insurance.

Lemonade is now getting into the auto insurance space and expanding its offering of insurance products.

According to this article on Lemonade Insurance, here's what you can expect:

"The new line is Lemonade’s third expansion into a major new insurance category in less than a year. The company started with homeowners products, added pet insurance in the second half of 2020 and term life insurance in the first half of 2021.

Lemonade said both existing and new customers can bundle their home, pet and life policies with their car insurance."

This is good news for those looking to bundle their insurance policies. You can now purchase multiple insurance policies from Lemonade to help you save money and simplify your financial situation.

LEMONADE CONTACT INFO

Website: www.lemonade.com

Phone: (844) 733-8666

Address: 5 Crosby St. 3rd floor, New York, NY 10013

How Does Lemonade Renters Insurance Work?

Lemonade Renters Insurance isn’t your typical renters insurance company. This is a unique tech-based renters insurance without any agents.

According to the official website, here's how Lemonade Renters Insurance works:

“Lemonade reverses the traditional insurance model. We treat the premiums you pay as if it's your money, not ours. With Lemonade, everything becomes simple and transparent. We take a flat fee, pay claims super fast, and give back what’s left to causes you care about.”

Lemonade takes a flat rate from your premium to cover operating costs (salaries, replacing technology, and overall operations) and the rest of the money goes towards paying claims. If there’s any money left at the end of the year, they donate it to charities that customers care about.

Lemonade also doesn’t see any extra money if there aren’t many claims in a period. This means that they won’t hassle you about every claim since they don’t profit from denying claims like other renters insurance companies do.

Renters Insurance Starting at $5/month

No brokers, no paperwork, get a policy in seconds. Zero Hassle, zero paperwork, zero worry. Join now! Starting at $5/month.

It's free to apply!

Is Lemonade Renters Insurance Legit?

You may be wondering about the credibility of a renters insurance company that can offer such low rates and handle everything within seconds.

We can understand those concerns and why one would be skeptical when an insurance policy seems too-good-to-be-true.

Lemonade renters insurance appears to be as legitimate as it comes.

The CEO and Co-Founder of Lemonade, Daniel Schreiber, made some interesting comments in a Forbes article that really showed what this insurance company is about:“It’s precisely that outsider, tech-focused perspective that we brought to the insurance industry. Lemonade set out to make insurance loveable, but also to transform it from a necessary evil into a social good. We built an unconflicted business model powered by AI and behavioral economics, and invented the Lemonade Giveback, where leftover premiums are donated to charities our customers choose.”

This tells you everything that you need to know if you were wondering about how Lemonade renters insurance works.

Is Lemonade Good Renters Insurance?

At Studenomics, we don't arbitrarily say whether a company is "good" or "bad" because that's not generally how renters insurance works.

We use a rating system where we analyze four components of the company's offerings and then give an average grade or score. Here is the breakdown for Lemonade Renters Insurance.

Our editor's scores for Lemonade for pricing, customer service, policy options, and financial stability:

Studenomics Score: 4.75 Out of 5 Stars

PRICING SCORE: 5 Out of 5

How Much Does Lemonade Renters Insurance Cost?

How much does Lemonade renters insurance cost?

After browsing around, it appears that Lemonade has the best rates out there. It’s difficult to give a one-size-fits-all answer here because your renters insurance premiums will depend on where you live, your history, what kind of coverage you’re looking for, and your claims history.

Rates start as low as $5/month for the most basic package and go up depending on where you live and how much coverage you need.

Renters Insurance Starting at $5/month

No brokers, no paperwork, get a policy in seconds. Zero Hassle, zero paperwork, zero worry. Join now! Starting at $5/month.

It's free to apply!

How Much Is Lemonade Renters Insurance?

The price will vary depending on where you live. Lemonade prides itself on offering low rates so that you don’t break the bank with renters insurance.

Lemonade Renters Insurance Quotes

The best part of Lemonade is that you can find renters insurance quotes easily. You simply type in your address along with other information about your living situation and they’ll find you a quote based on your situation.

Here are two quick examples of renters insurance Lemonade quotes:

- $12.50 in NYC.

- $25.92 in Dallas, Texas.

You can play around with the coverage amounts and deductible to see how the price fluctuates. Your premium will change depending on how much coverage you need.

Pro Renters Insurance Tip

Renters insurance doesn't just cover the replacement of your belongings, but also protects you if someone gets hurt on your property. Personal liability coverage usually start at $100,000.

Is Lemonade Worth The Cost?

Yes, Lemonade renters insurance is worth the cost. You get plenty of coverage and you don’t have to worry about breaking the bank with this insurance policy. You can sign up within minutes, file a claim easily, and rest knowing that you’re protected by your renters insurance policy.

Studenomics Pricing Score: 5 out of 5

CUSTOMER SERVICE SCORE: 5 Out of 5

How is Lemonade's Reputation for Service?

We looked through Reddit and many trusted websites to see what regular people were saying about Lemonade Renters Insurance to see what kind of reputation the company had.

BBB Rating: B+

Number of Ratings: 216

Glassdoor Rating: 94% would recommend to a friend

Number of Ratings: 90

Reddit Sentiment: Good/Bad/Neutral

Number of Comments: Approx. 50+ from 6 threads

Overview of the general sentiment, positive or negative. What are most people talking about.

Notable Quote Favoring Lemonade:

“I pay $6 a month for Lemonade. About a week after getting the policy, I was mugged outside of my office and my phone was stolen. Once I sent Lemonade a copy of the police report they reimbursed me. Even though they said my rates might go up they never did. I had a great experience and still use them.”

One Reddit user was surprised by their claim being auto-flagged:

"OHIO- A few days ago, my purse and its contents were stolen at a restaurant. The purse was expensive, so I filed a renter's insurance claim with Lemonade and it was auto flagged to the Special Investigations Unit. I provided a police report and the receipts of everything I claimed, but it was auto flagged by their AI system.

I've been with them for about a year and I've never filed a claim before. My credit is good. The only reason I can think of is that I recently changed my policy to add my boyfriend. Can anyone tell me what I can expect and what I should prepare?"

The general sentiment is that Lemonade Renters Insurance does an exceptional job of handling insurance claims.

There are some folks who are skeptical of how the company can continue with its simple claims process.

How Do You File a Lemonade Renters Insurance Claim?

Here's the big question. How do you file a claim? Do they make it nearly impossible? Here's where Lemonade shines...The process is very simple.

Here’s how you can file a claim on your policy from your phone:

- Click on the “claim” button.

- Explain what happened.

- AI goes over your claim. You may be asked a few questions. For example, if your phone was stolen you’ll be asked for the police report.

- If your claim is instantly approved, their AI will wire you money in seconds. If further review is needed, then a human on the team will follow up ASAP for more info.

That’s really all that you have to do to file a claim on your Lemonade policy. 52% of claims come from vandalism or theft. 30% of claims are handled instantly. Lemonade also touts a 3 second world record claim handling.

Why’s filing a claim so simply with Lemonade? According to the official website:

“Unlike any other insurance company, we take a flat fee from your premium, use the rest to pay claims, and give back what’s left to causes you care about. We gain nothing by delaying or denying claims, so we handle them quickly and fairly.”Studenomics Customer Service Score: 5 out of 5

POLICY OPTIONS SCORE: 5 Out of 5

What Does Lemonade Renters Insurance Cover?

What does Lemonade renters insurance cover?

Personal property coverage.

Lemonade will cover your personal items in the event that any theft or damage occurs. Your personal property will also be covered outside of your home. If your cell phone gets stolen at the coffee shop, you could have it replaced.

Loss of use coverage.

If water damage from a burst pipe or fire damage from a cooking fire (to name a few simple scenarios) were to make your place unlivable, your stay in a hotel along with the related expenses would be covered.

Personal liability coverage.

This may be the most important form of protection. Lemonade renters insurance will cover you for any medical or legal bills to you or a guest at your place.

If you’re still not sure about what Lemonade covers with its renters insurance policy, you can use the easy tool to customize your policy.

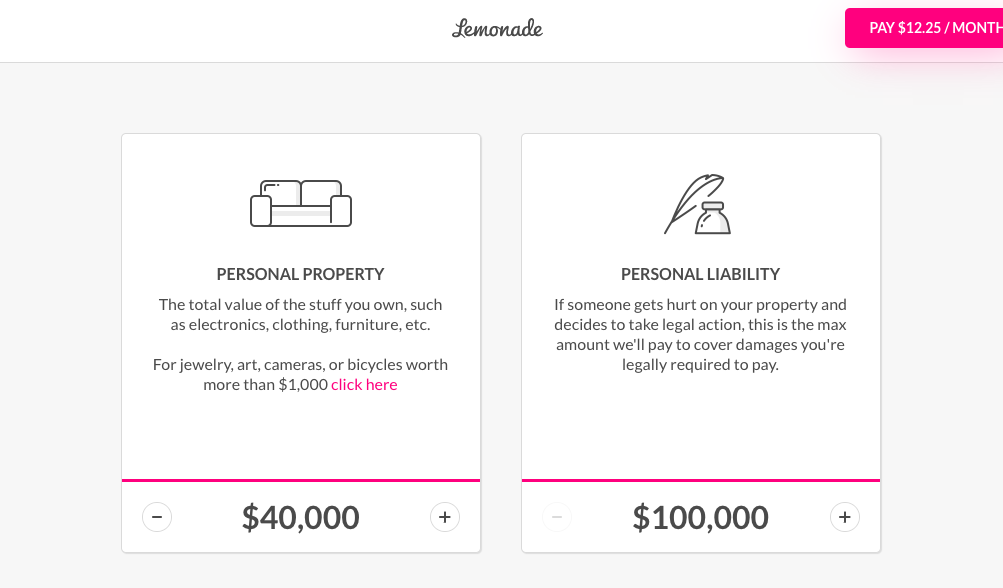

The form on the Lemonade website also makes it easy to see what’s covered. This image below is an example of how clearly Lemonade explains their coverages.

You’ll also see in the image below that you can easily change your coverage amounts. If you feel that you need additional coverage for your personal property, you can easily do so.

The good news is that as your situation changes, you can change your policy. According to the Lemonade website:

“However, Lemonade’s Live Policy allows customers to update their own coverage, whenever and wherever, on the Lemonade app. You can update your policy to reflect your needs in seconds, with no brokers or paperwork involved.”

What isn't covered by Lemonade Renters Insurance?

What isn’t covered by your policy with Lemonade?

We looked through the renters insurance policy to see what would be covered and what wouldn’t be covered. Here’s what may not be covered at all or may cost you extra:

- A place to stay if you have issues with bed bugs.

- Natural disasters (earthquakes and floods) aren’t covered. You may need additional coverage or a seperate policy altogether.

- Expensive items. You will need extra coverage for your fine art, jewelry, and items that are over the limit, which can be added on through Lemonade.

- Any issues with your power, water, or heating that don’t stem from a covered peril..

- High risk dog attacks.

These sound like extreme scenarios, but it’s good to know what kind of protection you have and don’t have with your renters insurance policy.

The screenshot from the Lemonade renters insurance policy sign up page below shows you how simply it is to add extra coverage.

We always suggest that you take a few minutes to double check your policy to ensure that everything you need in a renters insurance policy is included before you enroll.

Can I add a roommate?

If you have a roommate, Lemonade recommends that they sign up for their own policy, to ensure everyone living on the property is properly covered.

Your spouse is included for free. If you’re living with a partner or significant other, you can add them an extra cost.

Highlights | Lemonade |  State Farm |  Progressive |

|---|---|---|---|

Cost | Starting at $5/mth | Starting at $10/mth | Starting at $13/mth |

Personal Property Coverage (Starts At:) | $10,000 | $20,000 | $20,000 |

A.M. Best Rating (Financial Strength) | N/A | A+ | A+ |

BBB Rating | B+ | A | A |

Claims Process | Excellent | Excellent | xyz |

Best for: | Quick Online Purchasing | Customer Service | Lowest Cost |

Studenomics Rating | 4.6 Stars | 4.6 Stars Read Full Review | 4.6 Stars Read Full Review |

Lemonade has some of the lowest rates in the industry. It's an affordable option for renter's insurance and you can sign up for a policy in minutes. You also won't have to stress about filing a claim since it can be done over the mobile app in a few minutes.

Studenomics Policy Options Score: 5 out of 5

Renters Insurance Starting at $5/month

No brokers, no paperwork, get a policy in seconds. Zero Hassle, zero paperwork, zero worry. Join now! Starting at $5/month.

It's free to apply!

FINANCIAL STRENGTH SCORE: 4 Out of 5

What is Lemonade's Financial Rating?

When it comes time to make a claim, here's where you need your insurance company to step up.

They need to have the money to pay out a claim. The best way to determine if a company is financially stable and able to meet its ongoing claims obligations is by checking their financial rating and comparing it to other insurance companies.

The only setback with Lemonade is that it's a newer company that hasn't been rated by A.M Best yet.

Studenomics Financial Strength Score: 4 out of 5

"The process was very smooth and they deposited the money in my account in less than 3 days."

Ayman A. - BBB Review

Pros and Cons of Lemonade Renters Insurance?

As with any renters insurance policy there are going to be pros and cons since no renters insurance policy is perfect. Here's the quick list of the pros and cons of Lemonade Renters Insurance.

Pros:

Cons:

In this section, we'll have room to describe the pros in a bit more detail.

What are the pros of Lemonade renter’s insurance?

- You can customize your renters insurance policy for your unique situation.

- You can enroll for renters insurance within minutes. You don’t have to spend days of your life on the phone trying to wait to get a hold of an agent.

- Everything is easy to use. You can even file a claim in seconds without getting stuck on the phone for hours.

What are the cons of renters insurance Lemonade?

- You can’t get an insurance bundle since Lemonade doesn’t offer auto insurance (update: they now do offer more insurance products). However, you can actually bundle a renters or homeowners insurance policy with a pet insurance policy for a lower rate

- Lemonade isn’t available yet in every state so you may not be eligible for Lemonade renters insurance.

The simplest definition that I could find when it comes to what exactly is renters insurance was located on Investopedia:

“Renters insurance is property insurance that provides coverage for a policyholder's belongings, liabilities and possibly living expenses in case of a loss event. Renter's insurance is available to persons renting or subletting a single family home, apartment, duplex, condo, studio, loft or townhome. The policy protects against losses to the tenant's personal property within the rented property. In addition, a renter's insurance policy protects against losses resulting from liability claims, such as injuries occurring on the premises that are not due to a structural problem with the property (in this case, the owner's – not renter's – policy would apply).”

Does Lemonade Offer Insurance In My State?

Does Lemonade offer insurance in my state? As of 03/11/2021, here are the states where Lemonade insurance is offered:

Arizona, Arkansas, California, Colorado, Connecticut, District Of Columbia, Georgia, Illinois, Indiana, Iowa, Maryland, Massachusetts, Michigan, Missouri, Nevada, New Jersey, New Mexico, New York, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, Tennessee, Texas, Virginia, Washington, Wisconsin

Lemonade insurance is coming to the following states soon:

Alabama, Alaska, Delaware, Florida, Hawaii, Idaho, Kansas, Kentucky, Louisiana, Maine, Minnesota, Montana, Nebraska, New Hampshire, North Carolina, North Dakota, South Carolina, South Dakota, Utah, Vermont, West Virginia.

You can also check the best renters insurance rates by state using the map below.

How can you cancel your Lemonade Renters Insurance policy?

Do you want to cancel your Lemonade renters insurance for some reason? All you have to do is cancel on the Lemonade app or website and you’ll be reimbursed for the remaining coverage that you don’t use.

You’re not held to some long-term contract that you can’t get out of. We realize how important this is because you may have to cancel your renters insurance for a variety of reasons (financial, moving out of state, or other personal reasons).

The final word on Lemonade Renters Insurance...

Lemonade is a fairly new option when it comes to renters insurance but many readers are raving about them due to how easy it is to sign up and manage your policy.

We know that you have enough to worry about. If you want to save money and time, click here to get an insurance quote from Lemonade in minutes.

Renters Insurance Starting at $5/month

No brokers, no paperwork, get a policy in seconds. Zero Hassle, zero paperwork, zero worry. Join now! Starting at $5/month.

It's free to apply!