Liberty Mutual Renters Insurance Review: Pros & Cons, Pricing, and Features

Studenomics Score: 4.5 Out of 5 Stars

Advertiser Disclosure: Our content is free because we are supported by advertisers. If you click on links in this post, we may earn a commission.

We all know what it’s like to hunt for the perfect renter’s insurance policy. You want a policy that suits your your lifestyle and needs.

You also want to save money because you already have enough expenses with everything that's going on.

You want to pay a fair price for renter’s insurance without missing out on decent coverage.

This is why we’re going to review Liberty Mutual Renters Insurance today. The company is known for offering low rates and flexible renters' insurance policies so we wanted to see if the hype was worth it.

Keep on reading for our Liberty Mutual Renters Insurance review...

Highlights:

Overview:

Liberty Mutual has been offering insurance in the nation since 1912. They're a large corporation in strong financial standing.

Known for:

- Many discount options to help you save money.

- Flexible and affordable policies.

- Innovative and easy-to-use website.

Financial Rating:

Liberty Mutual is rated A for financial strength by A.M Best.

Who is Liberty Mutual Insurance?

Liberty Mutual Insurance has been around since 1912. They rank 75th on the Fortune 100 list of the largest corporations in America (based on 2018 revenue).

Liberty Mutual offers a variety of insurance products (home, life, auto, etc.) with 45,000 employees around the world. In 2019, they had a revenue of $43.228 billion.

We're going to be focusing on the renter's insurance offered by Liberty Mutual today...

LIBERTY MUTUAL CONTACT INFO

Website: www.libertymutual.com

Phone: 1-800-291-8711

Address: Liberty Mutual Group, Inc.

175 Berkeley Street

Boston, MA 02116

How Does Liberty Mutual Renters Insurance Work?

Liberty Mutual offers insurance just like most other companies in the field. You can sign up for a policy online in minutes and be instantly protected.

You go through the website to find a quote. They then ask you a series of questions to help figure out more about your situation.

They prompt with questions about your situation to help you land discounts. Then you get your Liberty Mutual Renters Insurance quote. From there, you can sign up and get started.

We're going to breakdown the renters insurance coverage, quotes, and everything else that you could possibly want to know about Liberty Mutual.

Bundle and Save Up to 50%

Save up to $850/year by bundling renters with car insurance. Quick Online Quotes. Compare & Save 50% on: Auto, Motorcycle, Home, Condo, & Renter.

It's free to apply!

Is Liberty Mutual Renters Insurance Good?

Is Liberty Mutual good Renters Insurance? We played around with the interface and looked through reviews to see what regular folks had to say about this company.

We were mostly impressed by the discounts and the detailed website.

The official website explains everything that you could want to know about renter's insurance and your policy. This level of transparency isn't always there with other insurance companies.

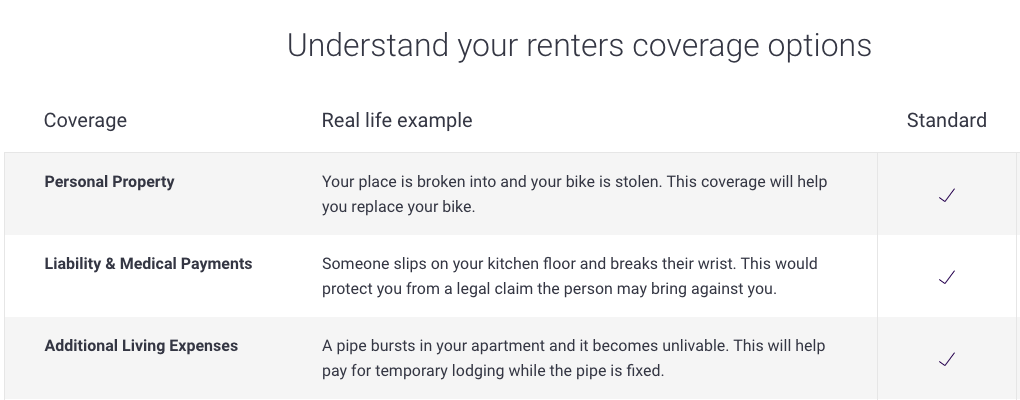

This graphic below explains your renters coverage options.

Is Liberty Mutual Renters Insurance legit?

We make it a priority to conduct a deep dive investigation on every renter’s insurance company that we review on Studenomics.

We’ve concluded that Liberty Mutual is legit insurance. From the discounts to the coverage, you can't go wrong.

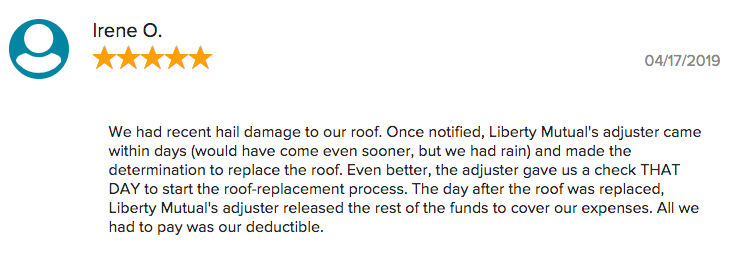

Here's one review from the BBB website that stuck out to us during our research.

Our editor's scores for Liberty Mutual Renters Insurance for pricing, customer service, policy options, and financial stability:

Studenomics Score: 4.5 Out of 5 Stars

PRICING SCORE: 5 Out of 5

How Much Does Liberty Mutual Renters Insurance Cost?

We always look at the cost of a renters insurance policy to ensure that you’re not overpaying since we realize how sensitive price can be these days with everything that’s going on in the world.

We looked through dozens of renters' insurance quotes so that you don't have to.

Renters Insurance Starting at $5/month

No brokers, no paperwork, get a policy in seconds. Zero Hassle, zero paperwork, zero worry. Join now! Starting at $5/month.

It's free to apply!

How Much Is Liberty Mutual Renters Insurance?

Liberty Mutual claims that they offer low insurance products. Our research has found that an average renter’s insurance policy will cost about $16/month.

So we looked through quotes.

One thing that we were pleasantly surprised by were the many opportunities to earn a discount.

Here are a few questions that you’ll be asked when you look for an online quote with Liberty Mutual:

- What type of building is the unit in?

- How many people live there?

- Is the unit in a secured/gated community?

- Are there any animals?

- How long have you lived there?

- Your insurance history.

Here’s how you can get a discount with Liberty Mutal Renters Insurance:

Claims-free.

Early shopper discount.

Multi-policy discount.

Preferred payment discount.

Online purchase discount.

We then played around with the quotes to see how the pricing changes.

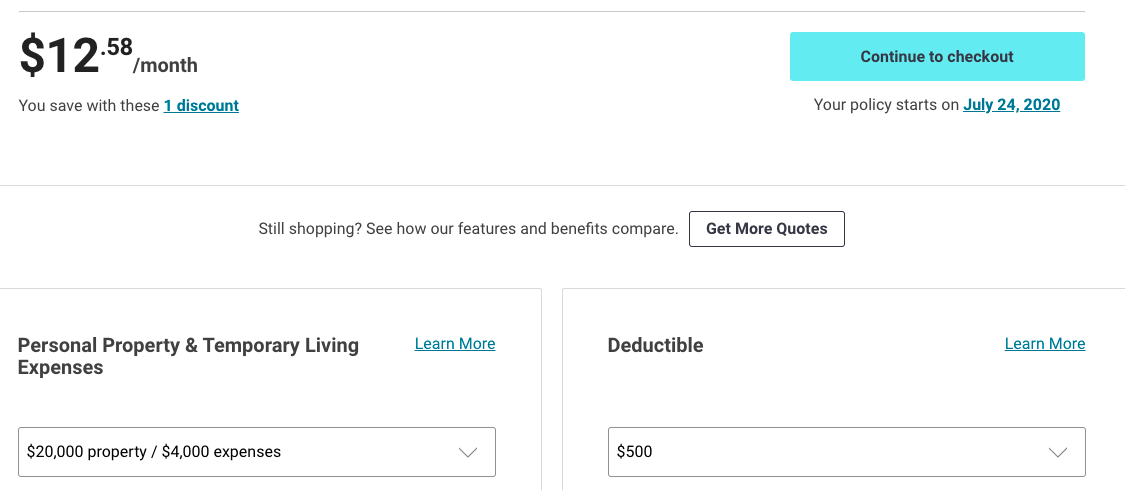

You can raise your deductible to $5,000 and your policy rate goes down in half.

Deductibles range from $100 to $5,000. The higher your deductible, the lower your monthly rate. On the flip side, a lower deductible

Liberty Mutual Renters Insurance Quotes.

We shopped around for quotes to determine exactly how much the policy would cost you.

San Francisco: with just one discount. $12.58/month gets you $20,000 in personal property coverage and $4,000 in temporary living expenses.

Keep in mind that we found that Liberty Mutual Renters Insurance quote with zero discounts. As mentioned above, there are many opprotunities to earn a discount to drive your price down.

Pro Renters Insurance Tip

Renters insurance doesn't just cover the replacement of your belongings, but also protects you if someone gets hurt on your property. Limits usually start at $100,000.

Is Liberty Mutual Worth The Cost?

You get your money's worth with Liberty Mutual because you can easily find a renter's insurance policy that fits your budget and your lifestyle.

You can customize your policy until you find one that you can afford. You can also attempt to apply for a variety of discounts.

You can always look for a cheaper alternative if you're willing to look around for quotes.

Can I Bundle My Liberty Mutual Renters Insurance With My Auto Insurance?

The good news is that Liberty Mutual encourages you to bundle your insurance packages. They want you to bundle so that you can save money.

Studenomics Pricing Score: 5 out of 5

Bundle and Save Up to 50%

Save up to $850/year by bundling renters with car insurance. Quick Online Quotes. Compare & Save 50% on: Auto, Motorcycle, Home, Condo, & Renter.

It's free to apply!

CUSTOMER SERVICE SCORE: 4 Out of 5

How is Liberty Mutual's Reputation for Service?

We looked through Glassdoor, BBB, and Reddit to see what regular people had to say about Liberty Mutual Insurance. In our experience, these are the best indicators of how a company actually operates.

BBB Rating: A+

Number of Ratings: 372

Glassdoor Rating: 58% would recommend

Number of Ratings: 5,000

Reddit Sentiment: Neutral

Number of Comments: We were able to find many conversations about Liberty Mutual insurance products.

Liberty Mutual Renters Insurance Reddit Feedback

We searched up the phrase Liberty Mutual Renters Insurance Reddit to see what regular folks were saying about this insurance company.

Here's what we were able to find.

Reddit User, "Maffs" was disappointed about the lack of flood coverage:

"I moved into an apartment in Louisville, KY and you are required to get renters insurance. After moving to Louisville, my apartment flooded four times. During this period, I purchased a renters policy from LM. I talked to several companies prior to making the purchase and ultimately chose LM because they covered flooding of this type.

I filed a claim after the apartment became unlivable and was denied coverage because they claim not to support flooding.

The moral of the story is if you have a specific situation you need coverage for, do not under any circumstances believe the sales person as they will lie to you in order to make a sale. More importantly avoid Liberty Mutual's rental insurance coverage."

Notable Quote From The Simple Dollar About Liberty Mutual Renters Insurance:

"While Liberty Mutual’s standard renters insurance policies offer basic coverages, the discount programs exceed most other insurance companies. If a standard policy doesn’t fit your needs, Liberty Mutual has a few options such as earthquake, jewelry and replacement cost coverages to provide more comprehensive protection."

Renters Insurance Starting at $5/month

No brokers, no paperwork, get a policy in seconds. Zero Hassle, zero paperwork, zero worry. Join now! Starting at $5/month.

It's free to apply!

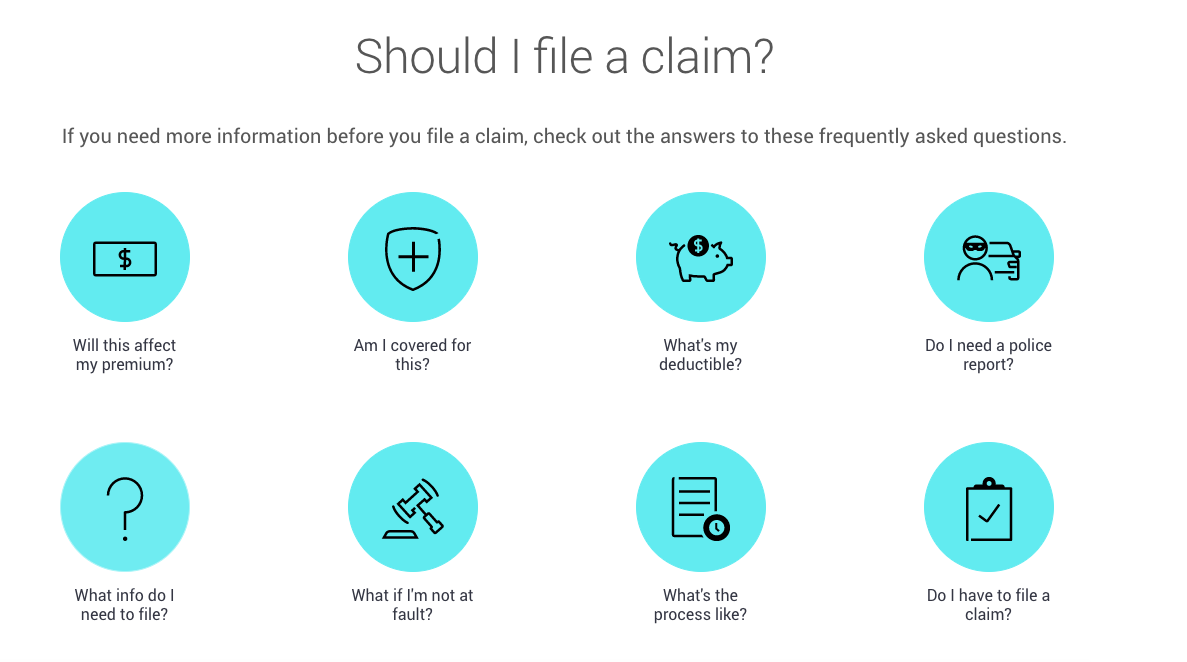

How Do You File a Liberty Mutual Renters Insurance Claim?

Let's say that something happens and you have to file a claim, how do yu go about this?

It turns out that Liberty Mutual has an online claims centre where you can digitally file claims 24/7. They claim that the entire process should take less than 10 minutes. You can also track your claim online to see what the status is.

What do you need to file an insurance claim?

- Username/password to login.

- The date of the incident.

- Genetal details of what happened.

Liberty Mutual Renters Insurance also goes above and beyond to explain the process of filing a claim. This graphic below illustrates what we mean.

Studenomics Customer Service Score: 4 out of 5

POLICY OPTIONS SCORE: 5 Out of 5

What Does Liberty Mutual Renters Insurance Cover?

What's the coverage like with Liberty Mutual Renters Insurance? The website does a detailed job of explaining exactly what's covered with your renter's insurance policy so that there shouldn't be any surprises.

Your belongings.

This will cover your personal belongings (furniture, clothing, electronics, and valuables up until a limit).

Your policy will also replace your jewlery if it's stolen or lost with no deductible or upfront apparaisal needed.

You also have to replacement cost for your belongings. You can pay extra for actual cash value.

Damages.

Damage/personal liability refers to injury or property damage to others and Earthquake damage.

The damages will cover legal bills if you get sued, medical bills of someone who gets injured on your property, and repairs for accidental damage caused to another property.

Expenses.

This essentially refers to a place for you to stay if you get displaced. This will cover any fees that are necessary to maintain your standard of living when you can't live in your unit.

Possible reasons for requiring this insurance coverage include:

- Fire.

- Tornado.

- Pain and suffering.

- Authorities asking you to leave due to weather conditions.

Bundle and Save Up to 50%

Save up to $850/year by bundling renters with car insurance. Quick Online Quotes. Compare & Save 50% on: Auto, Motorcycle, Home, Condo, & Renter.

It's free to apply!

What Isn’t Covered By My Liberty Mutual Renter's Insurance Policy?

What’s not covered by your Liberty Mutual Renters Insurance Policy?

Flood damage isn't covered so you want to double check if you need that.

As always, you should disclose if you plan on running a business out of your unit.

You should also look into your coverage limits and deductible to see where you stand.

Can I Add My Roommate?

Are you looking to add a roommate to your insurance policy?

Your Liberty Mutual Renters Insurance will autoamtically extend to any family members who live with you.

“If you live with someone, you can optionally add them to your policy. Spouses and family members who live with you are already covered.”

You may have to pay a fee to add a roomate. It's important that you provide all information when applying for a quote online.Highlights | Lemonade | State Farm |   Progressive |

|---|---|---|---|

Cost | Starting at $12/mth | Starting at $5/mth | Starting at $13/mth |

Personal Property Coverage (Starts At:) | $20,000 | $10,000 | $20,000 |

A.M. Best Rating (Financial Strength) | A | N/A | A+ |

BBB Rating | A+ | B+ | A |

Claims Process | Easy-to-use | Excellent | Good |

Best for: | Discounts | Quick online purchasing | Lowest Cost |

Studenomics Rating | 4.5 Stars | 4.75 Stars Read Full Review | 4.6 Stars Read Full Review |

Studenomics Policy Options Score: 5 out of 5

Renters Insurance Starting at $5/month

No brokers, no paperwork, get a policy in seconds. Zero Hassle, zero paperwork, zero worry. Join now! Starting at $5/month.

It's free to apply!

FINANCIAL STRENGTH SCORE: 4 Out of 5

What is Liberty Mutual's Financial Rating?

Liberty Mutual Insurance scored well when it came to financial strength. The company has an A.M Best score of A.

What this means is that they have the ability to meet their insurance obligations.

It's a large corporation that has been around for a long time so you don't have to worry about them going out of business.

Studenomics Financial Strength Score: 4 out of 5

Pros and Cons of Liberty Mutual Renters Insurance?

Every renter’s insurance policy comes with its own set of pros and cons.

In the interest of a transparent review, we want to look at the positives and the negatives of Liberty Mutual Renters Insurance:

What are the pros and cons of Liberty Mutual Renters Insurance?

Pros:

Cons:

Those are the pros and cons that we want you to think about before deciding to use Liberty Mutual Renters Insurance.

Does Liberty Mutual Offer Insurance In My State?

You're in luck because Liberty Mutual currently offers insurance in all 50 states.

You can also check the best renters insurance rates by state using the map below.

How can you cancel?

Let’s say life gets in the and you have to cancel your Liberty Mutual Renters Insurance, how would you do this?

You can call in at any time to 1-800-658-9857 to cancel your insurance policy.

Before you cancel, it’s important to understand why you’re canceling and what you plan on doing. Sometimes we think that we’re finding a better deal on renter’s insurance when in reality we’re going to be losing out on coverage.

Take Action

That’s our review of Liberty Mutual Renters Insurance. We were pleasantly impressed by the website and the plethora of opportunites for discounts to help you save some money.

Overall, you can find some decent coverage at fair rates here.

As always, we recommend that you obtain a few quotes before signing up for a renter’s insurance policy that matches your situation.

Renters Insurance Starting at $5/month

No brokers, no paperwork, get a policy in seconds. Zero Hassle, zero paperwork, zero worry. Join now! Starting at $5/month.

It's free to apply!