Nationwide Renters Insurance Review: Pros & Cons, Pricing, and Features

Studenomics Score: 4 Out of 5 Stars

Advertiser Disclosure: Our content is free because we are supported by advertisers. If you click on links in this post, we may earn a commission.

We all want to protect our valuable possessions when renting without spending a fortune on a renter's insurance policy.

We all know what it’s like to try to find the ideal renter’s insurance policy so that you can pay a fair rate and not have to worry about filing a claim.

This is why we decided to review Nationwide Renters Insurance.

Nationwide Renters Insurance is known for the slogan ,“Nationwide is on your side.”

Check out this Nationwide Renters Insurance review to see if it’s worth trusting your money with this company for your renters insurance.

Highlights:

Overview:

Nationwide has been offering a variety of insurance products and financial services across the country since 1925.

Known for:

- Providing a variety of insurance products for over 90 years.

- Having local agents available near you.

- Being an established insurance provider.

Financial Rating:

Nationwide is rated A+ for financial strength by A.M Best.

Who is Nationwide Renters Insurance?

Who is Nationwide Mutual Insurance Company? This company has been offering a variety of insurance products (home, life, boat, renters, and so on) and financial services (investing and retirement planning) since 1925.

The company has grown over the last 90-something years from a small auto insurer that was owned by policyholders to a large insurance company with over 30,000 employees across the nation.

The company touts the following in its branding:

“We work hard to help you protect what matters today and to prepare you for what comes tomorrow.”

We’re going to look at Nationwide Renters Insurance to see if this company is legit and if it’s worth trusting your money with them as you look to protect your assets as a renter.

NATIONWIDE CONTACT INFO

Website: www.nationwide.com

Phone: 1-877-669-6877

Address: 1 Nationwide PlZ

Columbus, OH 43215-2226

How Does Nationwide Renters Insurance Work?

As you look through renter's insurance policies, we know that you're going to have many questions.

You may be nervous about the idea of renters insurance and you’re wondering about how Nationwide Renters Insurance works.

The process is fairly simple. You go to the official website to apply for a quote. When you’re on the website, you can learn more about renters insurance as they do an exceptional job of explaining everything to you so that you know what renters insurance covers.

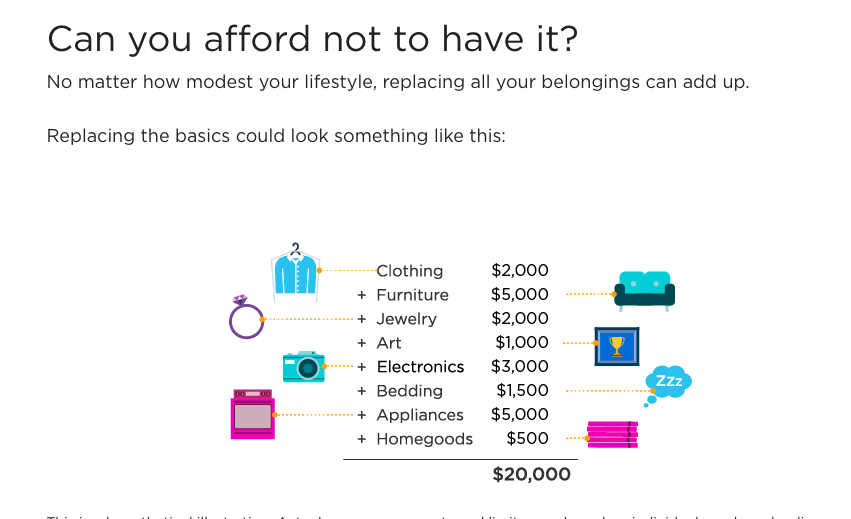

The graphic below shows you why you need personal property coverage since your belongings may be worth more than you think.

Bundle and Save Up to 50%

Save up to $850/year by bundling renters with car insurance. Quick Online Quotes. Compare & Save 50% on: Auto, Motorcycle, Home, Condo, & Renter.

It's free to apply!

Is Nationwide Renters Insurance Good?

We want to ensure that you sign up for a decent renter's insurance policy so that you're comfortable with your coverage and costs.

Is Nationwide Renters Insurance good?

The one thing that we can confirm is that the website helps you understand everything about renters insurance.

For example, Nationwide shares why you need renters insurance:

- Protect your property.

- Protect yourself and others.

- Ensure you have somewhere to live.

Those are three very important reasons for why you need renter’s insurance. We’re glad that Nationwide took the time to explain this.

Nationwide has also been offering insurance products for over 90 years so you know that the company isn't going to disappear anytime soon.

Keep on reading for more about the customer service and policy options with Nationwide.

Is Nationwide Renters Insurance legit?

Is Nationwide Renters Insurance legit? To give you an adequate answer, we took the time to go over the pricing, customer service, policy options, and the financial strength of the company.

In our experience, these factors will reveal everything that you could want to know about a renter’s insurance company.

Our editor's scores for Nationwide Renters Insurance for pricing, customer service, policy options, and financial stability:

Studenomics Score: 4 Out of 5 Stars

PRICING SCORE: 3 Out of 5

How Much Does Nationwide Renters Insurance Cost?

How much is Nationwide Renters Insurance?

If you’re looking for the price of Nationwide Renter’s Insurance, you can easily obtain a quote.

You have three options for obtaining a Nationwide Renters Insurance quote:

- Online through the website (nationwide.com).

- Calling in at 1-877-669-6877.

- Finding an agent near you.

You can choose whichever method you’re most comfortable with. Then it’s time to obtain a renter’s insurance quote to compare the rates of different renter's insurance companies out there.

Renters Insurance Starting at $5/month

No brokers, no paperwork, get a policy in seconds. Zero Hassle, zero paperwork, zero worry. Join now! Starting at $5/month.

It's free to apply!

How Much Is Nationwide Renters Insurance?

We can't ignore the costs of an actual renters insurance policy because we know that you want that perfect balance of coverage and cost.

It’s time to look at Nationwide Renters Insurance quotes.

What does Nationwide ask you for when you obtain a renter’s insurance quote?

- Your address.

- Your basic personal information.

- The amount of units in the building.

- The protective devices in the building.

- Who lives with you.

Nationwide Renters Insurance Quotes.

We obtained a few Nationwide Renters Insurance quotes from across the nation to give you an accurate picture of what the rates are like.

For the sake of research, we obtained two Nationwide Renters Insurance quotes from New York City and San Francisco.

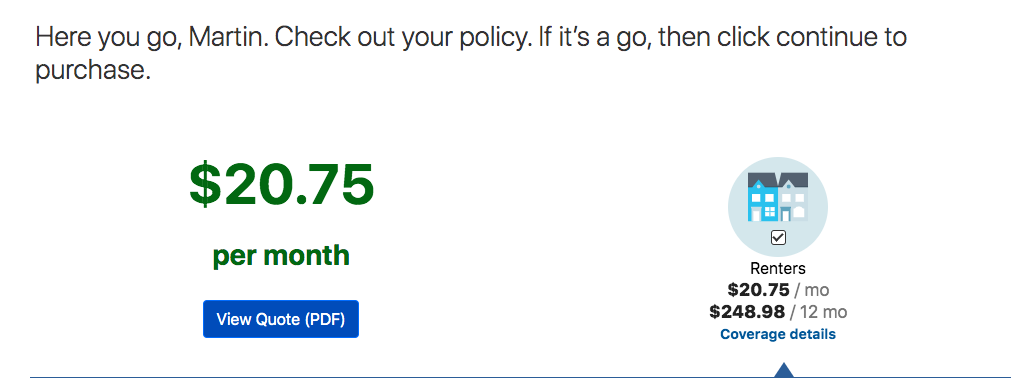

The image below captures a basic renter's insurance policy in NYC where you're going to pay $20.75/month or $248.98 upfront.

Type of coverage | Coverage amount |

|---|---|

Personal property coverage | $15,000 |

Loss of use coverage | Actual loss sustained |

Personal liability coverage | $100,000 |

Medical to others | $1,000 |

Deductible | $500 |

Here's your renter's insurance coverage amounts with Nationwide Renters Insurance in San Francisco. The renter's insurance quote is $32.68/month and $392.15 upfront for the year.

Type of coverage | Coverage amount |

|---|---|

Personal property coverage | $15,000 |

Loss of use coverage | Actual loss sustained |

Personal liability coverage | $100,000 |

Medical to others | $1,000 |

Deductible | $500 |

Pro Renters Insurance Tip

Renters insurance doesn't just cover the replacement of your belongings, but also protects you if someone gets hurt on your property. Limits usually start at $100,000.

Is Nationwide Renters Insurance Worth The Cost?

We always try to look at the cost and value of a renter's insurance policy. With that being said, let's address the question.

Is Nationwide Renters Insurance worth the cost?

Yes. While the rates are higher than most, we do feel that you could have the adequate coverage that you need if you can afford the higher rates.

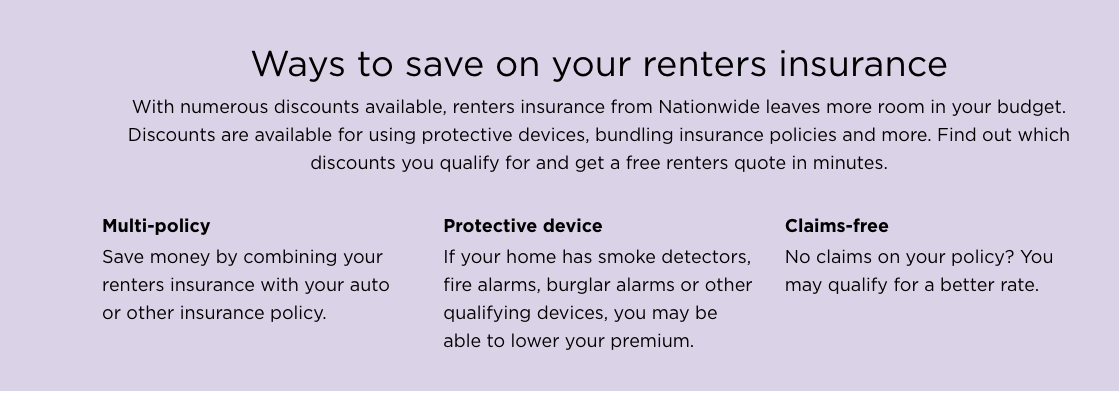

The good news is that you have many options for saving money on your renter's insurance policy (check the graphic below).

Can I Bundle My Nationwide Renters Insurance With My Auto Insurance?

The good news is Nationwide wants you to bundle every insurance policy that you require under one umbrella.

You could bundle your life, boat, auto, and renters insurance all together under one umbrella.

Studenomics Pricing Score: 3 out of 5

Bundle and Save Up to 50%

Save up to $850/year by bundling renters with car insurance. Quick Online Quotes. Compare & Save 50% on: Auto, Motorcycle, Home, Condo, & Renter.

It's free to apply!

CUSTOMER SERVICE SCORE: 4 Out of 5

How is Nationwide's Reputation for Service?

We looked through Glassdoor, BBB, and Reddit to see what real customers had to say about Nationwide Renters Insurance.

We always do this in our reviews because we want to present the full picture of what's happening. We look at what actual customers and even employees are saying.

BBB Rating: A+

Number of Ratings: 96

Glassdoor Rating: 49% would recommend

Number of Ratings: 3,300

Reddit Sentiment: Neutral

Number of Comments: We couldn't find many discussions about the renters insurance aspect.

Nationwide Renters Insurance Reddit Feedback

In our research, we've discovered that the best feedback is available by searching Nationwide Renters Insurance Reddit to see what regular people in forums about the insurance coverage.

This one Reddit user below shared how Nationwide was the cheapest quote that the found a few years back.

As you can see, renters insurance quotes will often depend on your situation and where you live.

As we looked through the results of "Reddit Nationwide Renters Insurance" we found this comment from a user.

Notable Quote From Finder.com Against Nationwide Renters Insurance:

“On the flipside, the company doesn’t have the highest customer satisfaction ratings compared to other renters insurers. Although its local agents add a personal touch, online companies can offset that benefit with lower rates. If Nationwide’s benefits don’t line up with your priorities, consider other renters insurance providers."

Renters Insurance Starting at $5/month

No brokers, no paperwork, get a policy in seconds. Zero Hassle, zero paperwork, zero worry. Join now! Starting at $5/month.

It's free to apply!

How Do You File a Nationwide Renters Insurance Claim?

Let’s say that something were to happen and you have to file a claim, how do you go about this.

How do you file a renter's insurance claim with Nationwide Renters Insurance?

- Log in to your account to do it online 24/7.

- Contact your local agent to begin your renter's insurance claim.

- Call Nationwide Claims at 1-800-421-3535.

Please don't forget to follow the typical steps when it comes to filing any renter's insurance claim:

- Notify your landlord and the police regarding what happened.

- Document the damages to your personal property.

- Go over your policy to ensure that you're covered (you may have to pay extra for expensive items).

We like that there are many options for filing a claim and tracking your claim once it has been filed.

Studenomics Customer Service Score: 4 out of 5

POLICY OPTIONS SCORE: 4 Out of 5

What Does Nationwide Renters Insurance Cover?

What does your Nationwide Renters Insurance policy cover?

When you enrol with a renters insurance company, you want to know that you have enough protection for your current lifestyle. This is why we obtained Nationwide Renters Insurance quotes and looked through what the polices cover.

What’s covered with Nationwide Renters Insurance?

Contents coverage.

This will cover your items that are damaged or stolen due to a covered loss with your renter's insurance policy.

Loss of use.

This coverage will cover the expenses that come with being forced to move out of your unit due to a covered loss (hotel fees and so on).

Personal liability.

This will protect you from an legal expenses in the event that you were to get sued.

Medical payment to others.

This coverage will cover the medical bills of anyone who gets injured on your property.

Building additions and alterations.

This coverage will protect any additions or alterations that you've made to the unit in the event of a covered damage.

Credit card coverage.

This unique protection will cover unauthorized transactions on your credit card.

That's what's covered with a Nationwide Renters Insurance policy.

Bundle and Save Up to 50%

Save up to $850/year by bundling renters with car insurance. Quick Online Quotes. Compare & Save 50% on: Auto, Motorcycle, Home, Condo, & Renter.

It's free to apply!

What Isn’t Covered By My Nationwide Renters Insurance Policy?

What’s not covered with your basic Nationwide Renters Insurance policy?

- Roommates. Every person living in the unit needs their own renter's insurance policy.

- Operating a business. You have to inform Nationwide if you run a business out of the unit.

- Water backup. This will protect you from sewage backup.

- Earthquake. Natural disasters are often not covered.

You can spend some extra money on coverage with Nationwide, such as:

Brand new belongings. For about $2 extra month, you can pay to have your belongings replaced at the current market price and not what they cost many years a go.

Identity theft. You’ll be reimbursed fo expenses related to identity theft.

That's what's not covered with Nationwide Renters Insurance.

Can I Add My Roommate?

Can you add your roommate to your Nationwide Insurance?

Yes, you can. When you request a Nationwide Renters Insurance quote, they ask you how many people live with you. That's where you have to notify them of any roommates.

Highlights | Lemonade | State Farm |   Progressive |

|---|---|---|---|

Cost | Starting at $20/mth | Starting at $5/mth | Starting at $13/mth |

Personal Property Coverage (Starts At:) | $15,000 | $10,000 | $20,000 |

A.M. Best Rating (Financial Strength) | A+ | N/A | A+ |

BBB Rating | A+ | B+ | A |

Claims Process | Solid | Excellent | Good |

Best for: | Many discounts | Quick online purchasing | Lowest Cost |

Studenomics Rating | 4 Stars | 4.75 Stars Read Full Review | 4.6 Stars Read Full Review |

Studenomics Policy Options Score: 4 out of 5

Renters Insurance Starting at $5/month

No brokers, no paperwork, get a policy in seconds. Zero Hassle, zero paperwork, zero worry. Join now! Starting at $5/month.

It's free to apply!

FINANCIAL STRENGTH SCORE: 5 Out of 5

What is Nationwide's Financial Rating?

We always look over the financial strength of an insurance company because we want you to know that you're going to be protected. When an insurance company is financially strong, they're likely to cover all claims.

Nationwide scored an A+ score with A.M Best, which means that they're a financially strong company.

Nationwide has also been offering all kinds of insurance products and financial services for decades so the company is in a strong financial position right now.

Studenomics Financial Strength Score: 5 out of 5

Pros and Cons of Nationwide Renters Insurance?

Every renter’s insurance policy comes with positives and negatives.

This is why we try to include this section so that you know what you're getting yourself into when you sign up for a renter's insurance policy.

What are the pros and cons of Nationwide Renters Insurance?

Pros:

Cons:

Does Nationwide Offer Insurance In My State?

Nationwide currently offers insurance in all 50 states as the name suggests so you don't have to worry about trying to find a policy if you move.

You can also check the best renters insurance rates by state using the map below.

How can you cancel?

How do you cancel your Nationwide Renters Insurance policy?

There are a few options here:

- Call 877-669-6877.

- Contact your local agent.

We must stress that you should look into renter's insurance so that you're covered and don't go any period of time with no coverage.

Final thoughts on Nationwide Renters Insurance.

That's our fair and honest Nationwide Renters Insurance Review. We looked at the pricing, policy options, customer service, and financial strength of the company.

While Nationwide is an established insurance provider, there are many cheaper alternatives out there if you're looking to save some money.

Renters Insurance Starting at $5/month

No brokers, no paperwork, get a policy in seconds. Zero Hassle, zero paperwork, zero worry. Join now! Starting at $5/month.

It's free to apply!