QBE Renters Insurance Review: Pros & Cons, Pricing, and Features

Studenomics Score: 2 Out of 5 Stars

Advertiser Disclosure: Our content is free because we are supported by advertisers. If you click on links in this post, we may earn a commission.

I believe that you’ll agree with us that you want a renters insurance policy that gives you the protection for your personal belongings and liability that you want to feel comfortable.

QBE Renters Insurance claims to offer a full range of personal liability and personal property coverage to meet your needs as a renter.

We know what it's like to look renters insurance coverage that matches your lifestyle and budget when you try to find a renters insurance quote to protect yourself.

This is why we’re going to review QBE Renters Insurance...

Highlights:

Overview:

QBE is an Australian company with over 11,000 employees in 27 countries. They specialize in commercial and property insurance.

Known for:

- Established company with strong financial standing.

- You have to work with a local agent for coverage.

- Not available to all renters. Your landlord must work with QBE.

Financial Rating:

QBE is rated A for financial strength by A.M. Best

Who is QBE Renters Insurance?

Before we look at the renter’s insurance policies and what the company has to offer, let’s take a look at QBE Insurance to see what we could find out about the company.

According to the official website:

“One of the largest carriers worldwide, QBE is a 130-year-old, $14 billion integrated specialist insurer operating in every key insurance market.”

QBE is an Australian-based company with over 11,000 employees worldwide. The company provides insurance services mainly in Australia, Europe, North America, and the Asia Pacific region.

Let’s take a look at at the renters insurance that QBE offers.

QBE CONTACT INFO

Website: www.qbena.com

Phone: 800.362.5448

Address: Wall Street Plaza

88 Pine Street

New York, NY 10005

How Does QBE Renters Insurance Work?

As you look through renter's insurance policies, you're going to want to find a policy that matches your budget and level of protection that you're looking for.

How does QBE Renters Insurance Work?

QBE offers the FlexHome Renters Insurance program through local agents. You're going to want to contact your landlord or an independent agent to see if you qualify.

According to the official QBE Renters Insurance website:

"QBE provides the power of a global organization with a strong local presence. Our branch offices deliver the individual attention and superior services you deserve."

The good news is that you can work with a local agent to address your unique needs. The bad news is that you can't obtain a quote online. More on this later in this QBE Renters Insurance review...

Bundle and Save Up to 50%

Save up to $850/year by bundling renters with car insurance. Quick Online Quotes. Compare & Save 50% on: Auto, Motorcycle, Home, Condo, & Renter.

It's free to apply!

Is QBE Renters Insurance Good?

We know that you want a decent renter's insurance policy so that you have enough coverage to protect everything that you worked so hard for. This is why we take these renters insurance reviews seriously.

Is QBE Renters Insurance good?

We're going to do a full breakdown just to see what kind of protection you get. We were impressed with the global presence of QBE, but we're fairly disappointed with the lack of transparency on the website about the renter's insurance coverage options and pricing.

Is QBE Renters Insurance legit?

We went over the pricing, customer service, policy options, and the financial strength of QBE to provide you with a fair look of QBE Renters Insurance.

We're going to look at the renters insurance coverage, the prices, what regular customers have to say, and other details to help you make an informed decision about renter's insurance.

Our editor's scores for QBE Renters Insurance for pricing, customer service, policy options, and financial stability:

Studenomics Score: 2 Out of 5 Stars

PRICING SCORE: 1 Out of 5

How Much Does QBE Renters Insurance Cost?

It’s impossible to look at a renter’s insurance policy without taking a look at the price so that you know the value of a renter's insurance policy. The issue here is that you can't obtain a renter's insurance quote online.

To enrol in a QBE Renters Insurance policy, you have to see if your landlord qualifies.

The good news is that QBE Renters Insurance offers multiple discounts, such as:

- Bundling your insurance.

- Going claims-free.

- Having continuous coverage on your personal property.

As always, we urge you to obtain a renter's insurance quote to see what the pricing is like. Unfortunately, we had to score QBE Renters Insurance a 1 for pricing due to a lack of transparency and how difficult it is to get a quote.

Renters Insurance Starting at $5/month

No brokers, no paperwork, get a policy in seconds. Zero Hassle, zero paperwork, zero worry. Join now! Starting at $5/month.

It's free to apply!

QBE Renters Insurance Quotes.

This is the section where we would include various renters insurance quotes from around the country. However, you can't obtain a QBE Renters Insurance quote online.

According to a brochure from the official website, here's how you can get a quote for QBE Renters Insurance:

"For more information on the FlexHome Renters insurance program or a free, no obligation quote, call your local independent QBE insurance agent."

As you can see, that's extremely vague.

How do you obtain a QBE renter’s insurance quote?

- Ask your landlord if you qualify for QBE Renters Insurance and if you could apply through the online portal.

- Call QBE at 866-318-2016.

- Find a local QBE Renters Insurance agent to ask about a quote.

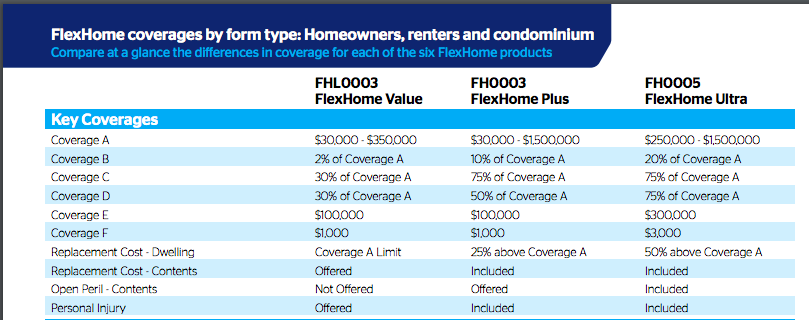

The image below is an example of the pamphlet that's available to agents.

Pro Renters Insurance Tip

Renters insurance doesn't just cover the replacement of your belongings, but also protects you if someone gets hurt on your property. Limits usually start at $100,000.

Is QBE Renters Insurance Worth The Cost?

It's impossible to determine if one could say that QBE Renters Insurance is worth the cost if you can't easily obtain a renter's insurance quote.

You're going to want to apply for a QBE Renters Insurance quote and to see what discounts you qualify for.

Can I Bundle My QBE Renters Insurance With My Auto Insurance?

The good news is QBE allows you to bundle your renters insurance with your auto insurance so that you can save money on insurance.

As always, we suggest that you always shop around and consider bundling your insurance to find the best possible package for your budget.

Studenomics Pricing Score: 1 out of 5

Bundle and Save Up to 50%

Save up to $850/year by bundling renters with car insurance. Quick Online Quotes. Compare & Save 50% on: Auto, Motorcycle, Home, Condo, & Renter.

It's free to apply!

CUSTOMER SERVICE SCORE: 1 Out of 5

How is QBE's Reputation for Service?

We looked through Glassdoor, BBB, and Reddit to see what real customers had to say about their experiences with QBE Renters Insurance.

We scored a 1 here because there were too many negative reviews on forums and on the BBB website. Wake take customer complaints very seriously because we know how stressful it can be to look for a renter's insurance policy.

BBB Rating: B

Number of Ratings: 26

Glassdoor Rating: 64% would recommend

Number of Ratings: 951

Reddit Sentiment: Negative

Number of Comments: We found negative discussions about QBE.

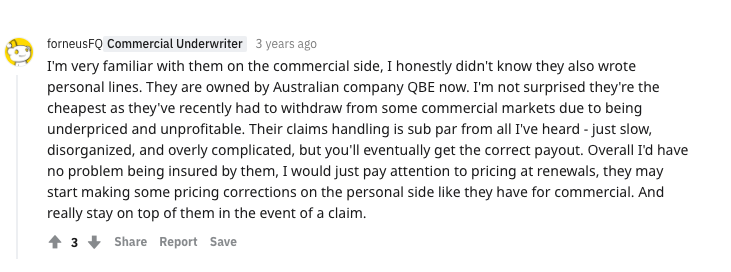

QBE Insurance Reddit Feedback

We looked up QBE Renters Insurance Reddit to see what regular customers had to say about the company to provide an accurate picture.

Here's one example of QBE Renters Insurance Reddit discussion...

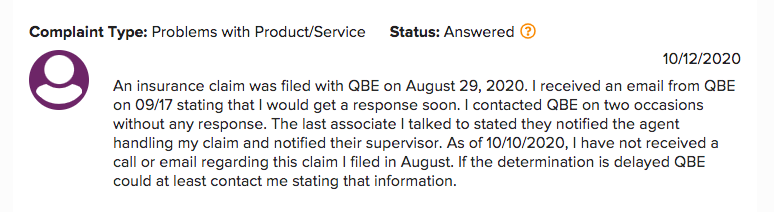

Then there are issues with QBE on the official BBB website. We looked through some of the complaints about QBE Renters Insurance and here was one that stuck out.

QBE scored a B with BBB, but they had a 1/5 for customer services with 59 complaints. Here's an example of a recent complaint about QBE Renters Insurance.

Notable Quote From Finder Against QBE Renters Insurance:

"A QBE renters policy might be a good option if your landlord has a deal in place and you can buy it through them, or if you already have your auto insurance with QBE. Otherwise, it might be difficult to find a local agent and you can’t apply online."

Renters Insurance Starting at $5/month

No brokers, no paperwork, get a policy in seconds. Zero Hassle, zero paperwork, zero worry. Join now! Starting at $5/month.

It's free to apply!

How Do You File a QBE Renters Insurance Claim?

How do you file a renter’s insurance claim with QBE?

We looked through the official website to find out details. Here’s a portion of what the company had to say:

“Every customer is unique and every claim is different. We work closely with our customers to quickly and efficiently deliver the best outcome their coverage provides, every time.”

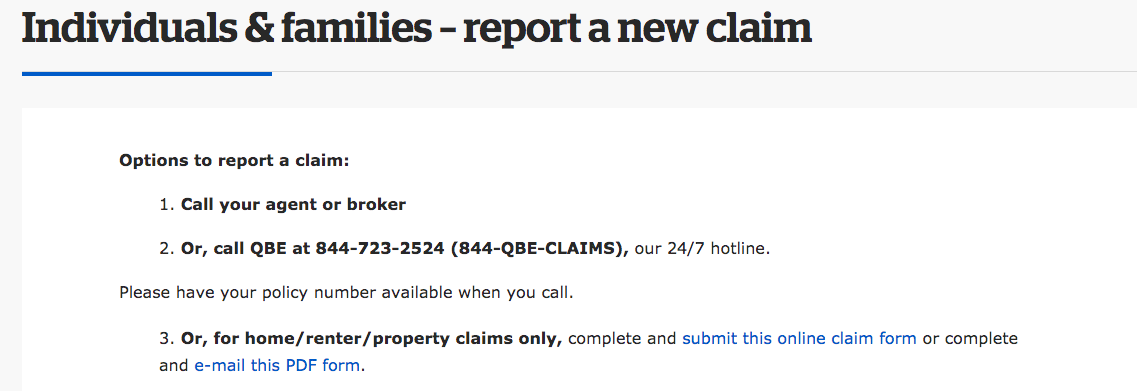

QBE has an entire page dedicated to the renter’s insurance claims process here:

Here’s how you can file a renter’s insurance claim with QBE:

- Contact your local agent or fill out a form with all of the details about the damages/theft.

- Wait for a QBE professional to contact you within one business day.

- Discuss your policy and the coverage that you have with QBE.

What should you do before you file a renter's insurance claim with QBE Renters Insurance?

- Document the damages or theft with photos and by finding receipts for items.

- Contact your landlord.

- Contact the authorities to file a police report.

- Look over your policy to see what's covered and what's not covered.

That's how you can file a claim with QBE Renters Insurance. The image below is what the claims page looks like on the official QBE Renters Insurance website.

Studenomics Customer Service Score: 1 out of 5

POLICY OPTIONS SCORE: 2 Out of 5

What Does QBE Renters Insurance Cover?

We looked through the official website to find any information that we could discover on QBE Renters Insurance and what a policy would cover.

Here's what's covered with a QBE Renters Insurance policy:

Personal property coverage.

This coverage applies to any of your personal property that gets damaged or stolen due to a covered loss.

According to the official website:

"Renters insurance will cover a stolen laptop whether it’s stolen from your home or outside your home, such as your local café if you have selected the additional option for portable contents on your policy."

Liability coverage.

This will protect you in the event of any legal issues stemming from a covered loss or damage.

Loss of use coverage.

This would include the hotel costs when you can't live in your unit due to a covered loss or damage.

The QBE Renters Insurance website mentions this:

"If your home is damaged after an insured incident, such as flooding after a storm or after a kitchen fire and it’s unsafe or uninhabitable, renters insurance can cover the cost of temporary accommodation up to a maximum of 12 months from the time of damage."

The official QBE Renters Insurance actually has a detailed article on the topic here.

Here are additions that you can make to your QBE Renters Insurance policy:

- Assisted living care.

- Student away at college coverage.

- Personal security.

- Personal injury.

- Replacement cost for your contents.

- High-value items.

These additional levels of coverage are worth looking into depending on your situation. For example, you want to protect your kid at school or pay for personal injury in case you get sued for slander.

That's what's covered with your QBE Renters Insurance policy.

Bundle and Save Up to 50%

Save up to $850/year by bundling renters with car insurance. Quick Online Quotes. Compare & Save 50% on: Auto, Motorcycle, Home, Condo, & Renter.

It's free to apply!

What Isn’t Covered By My QBE Renters Insurance Policy?

What isn't covered by your QBE Renters Insurance policy is important to note because you want to know what to expect in the event of an emergency.

Here are a few things to consider about what's typically not covered with a renter's insurance policy:

- Your expensive items. Do you have jewelry or high-ticket items that need additional coverage?

- Running a business. Are you thinking about running a business from home?

- Coverage limits. There will be personal property coverage limits as always.

As always, it's important to look over a renter's insurance policy when you get the quote.

Can I Add My Roommate?

Are you looking to add your roommate to your QBE Renters Insurance policy? You're going to have to contact your local agent to see what the coverage options are.

You typically have to pay extra to add a roommate to your renter's insurance policy. You're often better off asking your roommate to obtain a separate policy for that added protection.

Studenomics Policy Options Score: 2 out of 5

FINANCIAL STRENGTH SCORE: 4 Out of 5

What is QBE's Financial Rating?

We aim to analyze the financial strength of an insurance company because we want you to know that you can trust this company in the event of the worst-case-scenario.

QBE has an A rating with A.M. Best and the company is publicly traded on the Australian stock exchange.

A.M. Best is the world's oldest credit rating agency so we take the ratings that they offer seriously when we look over an insurance company. An A rating indicates that the company will pay claims and be around for a long time.

Studenomics Financial Strength Score: 4 out of 5

Pros and Cons of QBE Renters Insurance?

We all know that the perfect insurance company doesn't exist nor will you ever find a renter's insurance policy that comes with no flaws. This is why we try to take a balanced approach with our reviews.

What are the pros and cons of QBE Renters Insurance?

Pros:

Cons:

Does QBE Offer Insurance In My State?

QBE offers insurance products across many countries and you're going to have to find a local agent to see if they service your region for your insurance needs.

The reason that you want to find a local agent is because you're going to want to find out if you can get an insurance bundle. QBE insures automobiles, homes, and boats.

You can also check the best renters insurance rates by state using the map below.

How can you cancel your QBE Renters Insurance?

What if you have to cancel your QBE Renters Insurance policy? What happens?

- You have to call QBE Renters Insurance at 866-318-2016. Monday- Friday 8am-8pm CST.

- You can contact your local agent to discuss options.

As always, please ensure that you have a plan for your property insurance.

Final thoughts on QBE Renters Insurance.

That’s our fair and detailed review of QBE Renters Insurance.

We were disappointed to find out that we couldn't obtain a renter's insurance quote online so most companies offer you a quote in minutes these days.

On the flip side, it's important to remember that companies that specialize in commercial insurance don't tend to put an emphasis on renter's insurance.

As always, we urge you to shop around so that you obtain a few renter's insurance quotes before you sign up for a policy.

Renters Insurance Starting at $5/month

No brokers, no paperwork, get a policy in seconds. Zero Hassle, zero paperwork, zero worry. Join now! Starting at $5/month.

It's free to apply!