Toggle Renters Insurance Review: Pros & Cons, Pricing, and Features

Studenomics Score: 4 Out of 5 Stars

Advertiser Disclosure: Our content is free because we are supported by advertisers. If you click on links in this post, we may earn a commission.

I believe that you'll agree that you want a renter's insurance policy isn't stressful to purchase and comes with a fair price.

You also want to feel in control and like you understand your renter's insurance policy because insurance can be a confusing topic for most of us.

If you're trying to find a renter’s insurance policy that's affordable and fits your lifestyle, you may be interested in Toggle.

Toggle promises to make insurance make sense and that they're not like every other insurance company out there.

We know that it can be a struggle and you may even feel like giving up on renter's insurance coverage when you see some of the prices out there. This is why we believe that you're going to want to read this Toggle Renters Insurance Review.

Highlights:

Overview:

Toggle is a member of the Farmers Insurance family (which has over 90 years of experience). They have very unique plans that are highly customized.

Known for:

- Very low rates if you're looking for basic renters insurance.

- Easy to customize your policy until you find what a policy that works for you.

- You can obtain a quote in a few minutes with minimal personal information.

Financial Rating:

Farmers Insurance Group is rated A for financial strength by A.M Best.

Who is Toggle Renters Insurance?

Before we dig any further, let’s take a look at the actual company here so that you know what you're getting into with Toggle Renters Insurance.

Toggle is a member of the Farmers Insurance family. They provide three levels of renter's insurance subscriptions (more on this later).

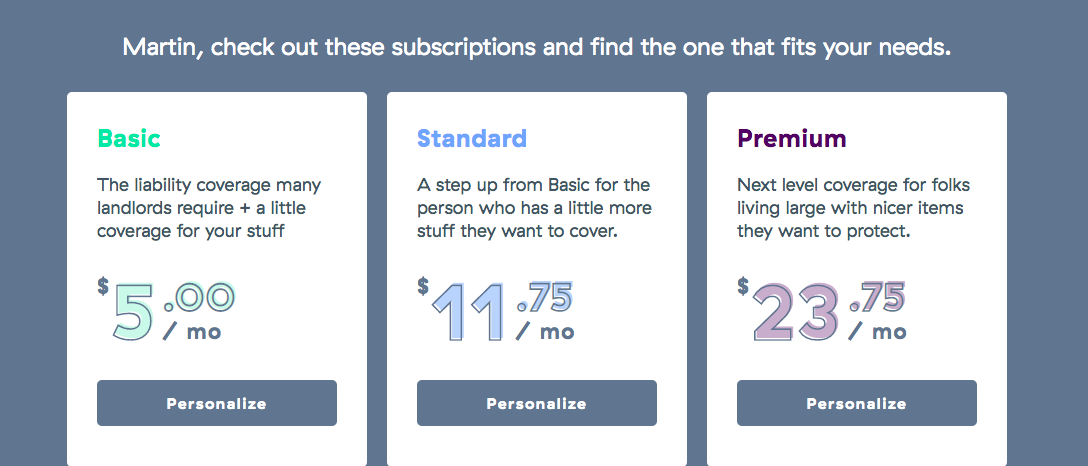

This image below best summarizes the uniqueness of a Toggle Renters Insurance policy. Toggle provides basic, standard, and premium packages when it comes to renters insurance.

Toggle Renters Insurance Review

TOGGLE CONTACT INFO

Website: www.gettoggle.com

Phone: Chat available on the website

Address: 6301 Owensmouth Ave,

Woodland Hills, CA 91367

How Does Toggle Renters Insurance Work?

As you look through renter's insurance policies, we know that you're going to want to know how the whole process works.

We found the experience with Toggle to be very unique. As the name suggests, you can toggle with every aspect of your renter's insurance policy.

You can go to the website and get a quote within two minutes with only very basic information. You then decide which subscription package you want to invest into. You're going to see exactly how much coverage you have.

Keep on reading to see more about the process of obtaining a Toggle Renters Insurance quote online...

Bundle and Save Up to 50%

Save up to $850/year by bundling renters with car insurance. Quick Online Quotes. Compare & Save 50% on: Auto, Motorcycle, Home, Condo, & Renter.

It's free to apply!

Is Toggle Renters Insurance Good?

We know that you want a decent renter's insurance policy so that you can sleep at night knowing that you're protected.

According to the official website:

"Toggle is more than the one-size-fits-all renter’s insurance of yesterday. It’s coverage that moves and grows with you, because you’re more than just another tenant on an apartment lease, and your needs vary from your [screaming at the TV all night] neighbor’s. Every policy includes basic coverage and we give you the opportunity to protect the important things that make you, you––like your collection of snow globes or your beloved Chihuahua, Charlie."

Toggle Renters Insurance goes on to say:

"We take insurance seriously, but we don't take ourselves too seriously. When we aren't figuring out smarter ways to insure renters like you, we like to do stuff like knit, practice mixed martial arts, fly fish, craft lattes, play video games and more."

It looks like Toggle Renters Insurance knows its audience. The graphic below summarizes the Toggle mission.

Is Toggle Renters Insurance legit?

Is Toggle Renters Insurance legit? We took the time to go over the pricing, customer service, policy options, and the financial strength of the company.

These key factors will reveal everything that you could want to know about a renter’s insurance company before you make your decision.

Our editor's scores for Toggle Renters Insurance for pricing, customer service, policy options, and financial stability:

Studenomics Score: 4 Out of 5 Stars

PRICING SCORE: 4 Out of 5

How Much Does Toggle Renters Insurance Cost?

How much is Toggle Renters Insurance?

We know that it's impossible to write a Toggle Renters Insurance without looking into the cost. We looked over a few quotes to see what the rates were like.

Toggle has a very unique pricing strategy. Keep on reading for actual examples of how much Toggle Renters Insurance costs.

Renters Insurance Starting at $5/month

No brokers, no paperwork, get a policy in seconds. Zero Hassle, zero paperwork, zero worry. Join now! Starting at $5/month.

It's free to apply!

How Much Is Toggle Renters Insurance?

We noticed that the prices fluctuate with Toggle Renters Insurance from $5 to $30 per month depending on what kind of coverage you're looking for.

We understand that renter's insurance can be hefty expense when you're already on a tight budget. This is why it's important to note that you can get a bare bones policy just for liability (when your landlord requires you to have renters insurance).

Toggle Renters Insurance Quotes.

When looking through a renters insurance company, we obtain a few quotes to see what the rates are like. We were pleasantly surprised with how easy it was to get a Toggle Renters Insurance quote.

Here are some of the questions that they’re going to ask to you for a renter’s insurance quote:

- Full name.

- Address.

- Birthday.

- Email.

That's all. They don't ask about your history or about the details of your unit. We couldn't believe how easy it was to obtain a Toggle Renters Insurance quote online.

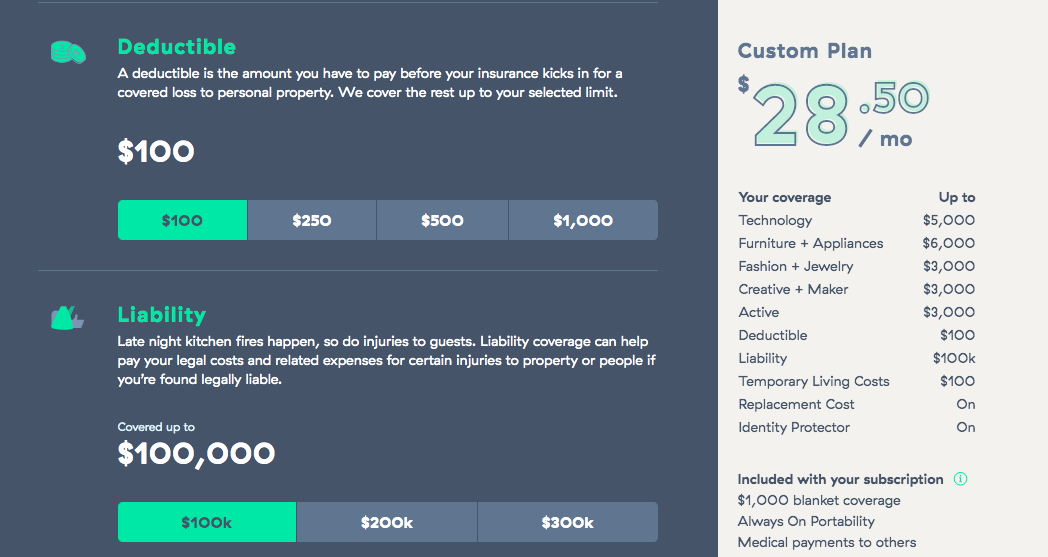

The graphic below summarizes the three subscription levels with Toggle Renters Insurance: Basic, standard, and premium.

Please keep in mind that this is a Toggle Renters Insurance quote for San Francisco (the company is not yet in New York).

The renters insurance rates range from $5 to $23.75 depending on what kind of coverage you're looking for.

From there on, you can customize every aspect of your Toggle Renters Insurance policy.

What the graphic above shows is that you customize every aspect of your quote from the amount of technology coverage to your furniture.

This should give you a range of what to expect when obtaining a Toggle Renters Insurance quote. You can get everything in a matter of minutes.

Pro Renters Insurance Tip

Renters insurance doesn't just cover the replacement of your belongings, but also protects you if someone gets hurt on your property. Limits usually start at $100,000.

Is Toggle Renters Insurance Worth The Cost?

If you live in a qualifying state and wanted a renters insurance policy that you can customize, then Toggle Renters Insurance is the right choice for you.

As you can see below, every single aspect of your renter's insurance policy can be adjusted to fit your lifestyle and your budget.

We just couldn't score them a 5 out of 5 because the low rates may be misleading since the basic plan doesn't have enough coverage. Toggle Renters Insurance also isn't available in every state yet.

Can I Bundle My Toggle Renters Insurance With My Auto Insurance?

Are you looking to bundle your renters insurance with auto insurance?

There's good news and bad news. The good news is that Toggle Renters Insurance is already cheap enough. The bad news is that Toggle only specializes on renters insurance.

Studenomics Pricing Score: 4 out of 5

Bundle and Save Up to 50%

Save up to $850/year by bundling renters with car insurance. Quick Online Quotes. Compare & Save 50% on: Auto, Motorcycle, Home, Condo, & Renter.

It's free to apply!

CUSTOMER SERVICE SCORE: 4 Out of 5

How is Toggle's Reputation for Service?

We looked through Glassdoor, BBB, and Reddit to see what real customers had to say about Nationwide Renters Insurance.

We have found in our research that this is the best way to get the full picture of what a renter's insurance company is like. You're not just paying for the insurance. You also want the peace that comes with it.

Since Toggle is a member of the Farmers Insurance family, we're going to look at how Farmers scores here.

BBB Rating: A+

Number of Ratings: 98

Glassdoor Rating: 54% would recommend

Number of Ratings: 3,400

Reddit Sentiment: Neutral

Number of Comments: There weren't many discussions about Toggle Renters Insurance

Toggle Renters Insurance Reddit Feedback

In our research, we've discovered that the best feedback is available by searching Toggle Renters Insurance Reddit to see what regular folks are saying in chat rooms without any filters.

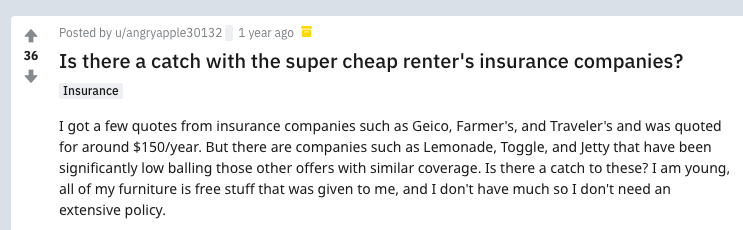

The graphic below shows one Toggle Renters Insurance Reddit conversation that stuck out to us.

The user was curious about the low prices associated with Toggle. As you can see, many people are skeptical with low rates because they're not used to seeing such low prices for renters insurance.

Notable Quote From Value Penguin Against Toggle Renters Insurance:

“As a standalone policy, Toggle doesn't offer adequate coverage for an affordable price. Compared to other cheap online renters insurance providers, such as Lemonade and Jetty, Toggle's protection doesn't measure up in either the amount of coverage it offers or its price."

Renters Insurance Starting at $5/month

No brokers, no paperwork, get a policy in seconds. Zero Hassle, zero paperwork, zero worry. Join now! Starting at $5/month.

It's free to apply!

How Do You File a Toggle Renters Insurance Claim?

Let’s say that something were to happen and you have to file a claim. How do you go about doing this?

The Toggle website goes into detail about claims.

If you’re insured with Toggle, log into your online account and go to the Claims page to submit a claims form for review.

Before you file a claim, it’s important to remember the basic rules to follow when it comes to filing a renters insurance claim:

- Note the damages that you feel you should report.

- Contact the police if needed.

- Contact your landlord.

- Look for receipts.

- File a renter's insurance claim with Toggle.

You may be asked to show receipts or a police report, so please try to track everything.

Studenomics Customer Service Score: 4 out of 5

POLICY OPTIONS SCORE: 4 Out of 5

What Does Toggle Renters Insurance Cover?

What does Toggle Renters Insurance cover?

It depends on which subscription you go with (basic, standard, or premium).

The basic plan has $100,000 in personal liability coverage with $1,000 as blanket coverage for everything else.

The standard and premium plans allow you to customize every single aspect of your renter's insurance coverage.

One thing that we must stress is that you can customize and adjust your renters insurance coverage as you wish.

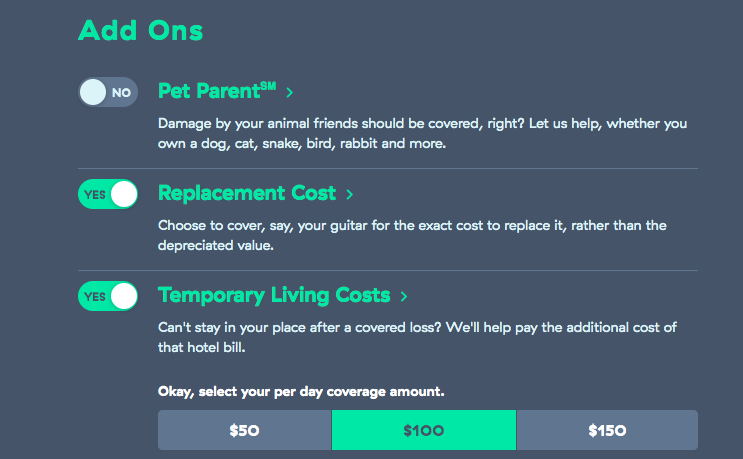

The image below shows what Toggle Renters Insurance can cover if you're willing to purchase add ons.

Here are a few examples of add ons with Toggle Renters Insurance:

- Pet Parent. This will take care of damages caused by your pet.

- Replacement cost. You will get the actual value of damaged or stolen items.

- Temporary living costs. This will take care of you when you can't live in your unit due to a covered loss. You can adjust your per day costs so that you can control what kind of hotel you stay in.

- And so on. You can customize every aspect of your coverage.

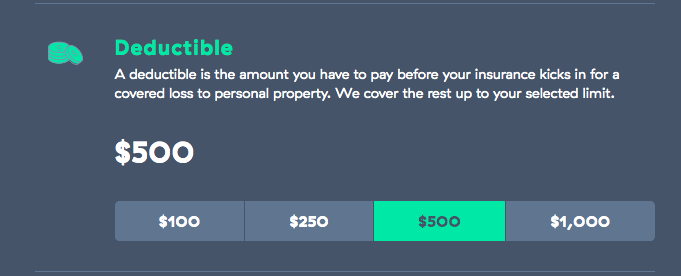

You can also customize your deductible and liability coverage with Toggle Renters Insurance.

It should be noted that your Toggle Renters Insurance rate will go up with a higher personal liability. You can also reduce your deductible to $100 (this will increase our monthly rate).

Please refer to the image below to see how detailed and customized your Toggle Renters Insurance quote can be. As you can see, you're in control of technology, furniture, and so on so that you can customize your policy based on your unique life.

Bundle and Save Up to 50%

Save up to $850/year by bundling renters with car insurance. Quick Online Quotes. Compare & Save 50% on: Auto, Motorcycle, Home, Condo, & Renter.

It's free to apply!

What Isn’t Covered By My Toggle Renters Insurance Policy?

What’s not covered with your basic Toggle Renters Insurance policy? It's important to look at what kind of coverage you're missing so that you know where you stand with your insurance.

The one setback of a highly customized insurance policy is that you have to add the features that you want. The positive of this is that you don't have any "wasted" coverage.

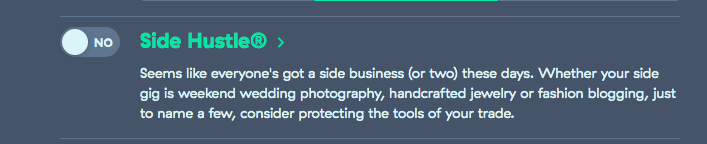

It's important that you look over your customized Toggle Renters Insurance policy to see what coverage is missing (roommates, flooding, and so on).

There are a few basic items that aren't covered by most renters' insurance policies:

- Running a business.

- Roommates.

- Flooding.

You can customize every single aspect of your Toggle Renters Insurance policy so you can add anything that you want.

This image below captures the detailed level of coverage that you can add with Toggle Renters Insurance. You can add the tools of your side hustle to your policy.

Can I Add My Roommate?

Can you add your roommate to your Toggle Renters Insurance?

Once again, it will depend on which level of subscription you sign up for. With the premium option, you can add your partner to the renters insurance policy.

Highlights | Lemonade | State Farm |   Progressive |

|---|---|---|---|

Cost | Starting at $5/mth | Starting at $5/mth | Starting at $13/mth |

Personal Property Coverage (Starts At:) | $1,000 | $10,000 | $20,000 |

A.M. Best Rating (Financial Strength) | A | N/A | A+ |

BBB Rating | A+ | B+ | A |

Claims Process | Solid | Excellent | Good |

Best for: | Basic plan on a budget | Quick online purchasing | Lowest Cost |

Studenomics Rating | 4 Stars | 4.75 Stars Read Full Review | 4.6 Stars Read Full Review |

Studenomics Policy Options Score: 4 out of 5

Renters Insurance Starting at $5/month

No brokers, no paperwork, get a policy in seconds. Zero Hassle, zero paperwork, zero worry. Join now! Starting at $5/month.

It's free to apply!

FINANCIAL STRENGTH SCORE: 4 Out of 5

What is Toggle's Financial Rating?

We always look over the financial strength of an insurance company because we want to know that this company would be able to cover your claim and every other claim if something were to happen.

Since Toggle is owned by Farmers Insurance, we gave them the same score. You can refer to our Farmers Renters Insurance Review for more information on the finances.

Studenomics Financial Strength Score: 4 out of 5

Pros and Cons of Toggle Renters Insurance?

Every renter’s insurance policy comes with its own set of pros and cons. There's no such thing as the perfect policy.

What are the pros and cons of Toggle Renters Insurance?

We were impressed with the basic introductory plans that Toggle Renters Insurance offers. It's important to keep in mind that the goal of the company is to provide cheap insurance. If you want additional coverage, you may want to look at the competitors.

The obvious setbacks with Toggle Renters Insurance are that some plans may be too basic and that the company isn't available in all states.

Pros:

Cons:

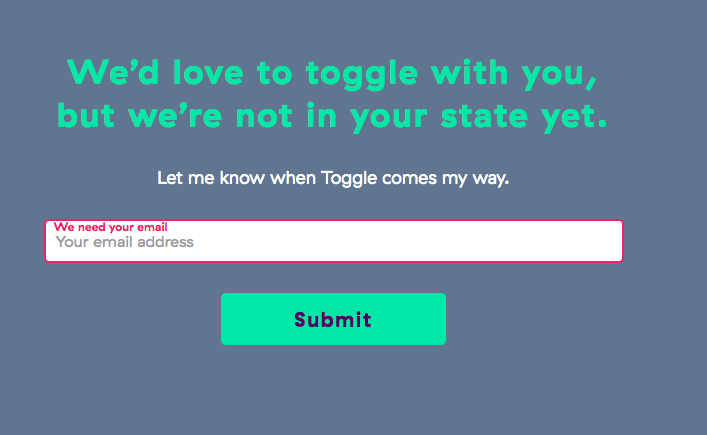

Does Toggle Offer Insurance In My State?

Unfortunately, Toggle Renters Insurance isn’t offered in every state.

These are the states where Toggle offers renters insurance currently:

Arizona, Arkansas, California, Colorado, Georgia, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Minnesota, Michigan, Mississippi, Missouri, Ohio, Oklahoma, Oregon, Pennsylvania, South Carolina, Tennessee, Texas, Utah, Virginia and Wisconsin.

The good news is that you can drop your email and Toggle will keep you updated about when renters insurance arrives in your state.

You can also check the best renters insurance rates by state using the map below.

How can you cancel your Toggle Renters Insurance?

How do you cancel your Toggle Renters Insurance policy?

According to the official website:

"You may cancel your policy by logging in to your account and changing your Account Settings under the My Coverage page."

What we like about Toggle Renters Insurance is that everything is simple.

We must emphasize that you should look into renter's insurance so that you're covered and don't go without any protection.

Final thoughts on Toggle Renters Insurance.

That’s our Toggle Renters Insurance review. This is the most flexible renter's insurance policy that you'll find out there. You can customize every single aspect of your coverage.

If you're on a tight budget, you can easily find a renter's insurance policy that will match your unique lifestyle and situation.

Good luck with your hunt for the perfect renter's insurance policy.

Renters Insurance Starting at $5/month

No brokers, no paperwork, get a policy in seconds. Zero Hassle, zero paperwork, zero worry. Join now! Starting at $5/month.

It's free to apply!

Avoid! Avoid! Avoid! The entire claims process is a mess. I’m convinced that it’s because they hope that you get so frustrated that you drop your claim. Avoid this nightmare and pick a better company. One fhsf at least has telephone support.

Awful company. I am in the military and have move alot. Canceled when I moved out in June of 2021, and because I usually just pay off my credit card fully each month it was not until today that I just noticed they have been charging my credit card for six months since I moved and canceled the insurance policy. So I paid for $66 dollars for an invalid address and for nothing. I called but was put on hold for ten minutes only to be told by a machine to leave a message instead. I went to the website instead and chatted with a Joshua Lind, and he refused to give me a refund for those months even though he confirmed that I did inform Toggle I moved out and asked to cancel the policy in June, and it is now December of 2021. Bad business practices, unethical insurance company.