Are you fed up with being confused about how to invest your money? Have you thought about investing with Wealthsimple?

It can be very intimidating to figure out how to invest your money. You get “hot stock picks” from that drunk uncle, strangers on social media are telling you about some new business opportunity, and then you hear tales of those who made it big by day trading. You don’t even know where to start.

The good news is that there are investment tools out there that manage your money for you and make investing simple. Have you heard of Wealthsimple? I tested them out for you to see if it’s worth switching over. Check out this Wealthsimple review…

[As a Canadian investor, I know what it’s like to look out for the best tools. We’ve looked at Questrade in the past and there are many articles comparing Wealthsimple vs Questrade.]

I still remember going to the bank with my parents when I was a kid in the 90s and being stuck there for hours as they met with their financial advisor. Investing has come a long way since the 90s. Today it’s easier than ever to manage your own money or to put your investments on auto-pilot while you live your life.

You don’t even have to get out of bed. I do my best banking in my shorts on the couch as I scroll through Instagram with my morning coffee.

Enter Wealthsimple.

You may have seen headlines or advertising lately about Wealthsimple. You may have heard of friends or co-workers investing their money with Wealthsimple.

It looks like Wealthsimple is making a serious attempt at becoming your bank (from daily banking to investing your money) and investment portal (commission-free stock trading and cryptocurrency investing). As young professionals get fed up with banking fees and commissions on stock trades, it’s refreshing to see a new player emerge in this space.

What’s happening with WealthSimple in 2021?

A lot has changed since this Wealthsimple review was originally published in February of 2020.

Wealthsimple is now in the cryptocurrency space and they offer commission-free stock trading.

This seemed too good to be true when I first saw the initial advertising. Then I was able to confirm that it was true when I tested out these new features.

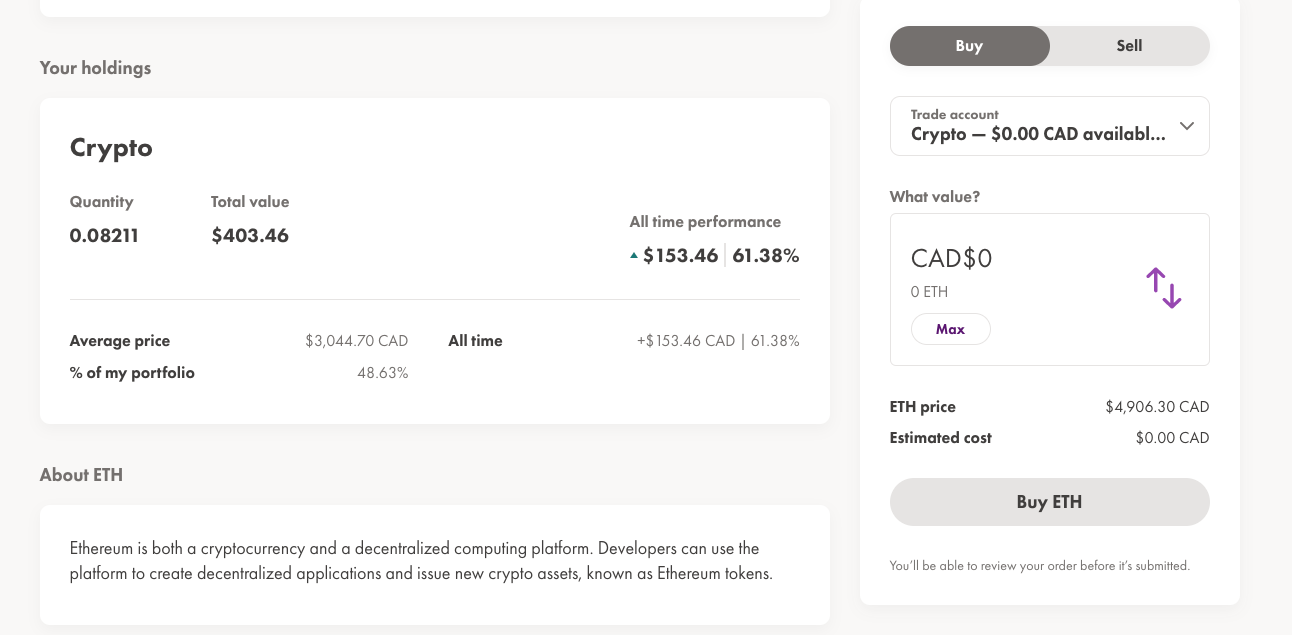

You can also purchase cryptocurrency in seconds through Wealthsimple now. You can send money from your bank account to your crypto account and then make an investment.

I was surprised by how quickly and easily I was able to purchase some stocks and cryptocurrency through Wealthsimple. I was lucky enough to purchase some Ethereum in April before it took off. I also tested out the commission-free stock trades option.

Keep on reading to find out more…

(It’s important to note that investing in cryptocurrency is risky. As I typed out this Wealthsimple review, the price of Ethereum went down.)

What’s the deal with investing your money with Wealthsimple? What are the pros and cons?

Let’s deep into the Wealthsimple review.

What makes Wealthsimple worth switching over to?

It’s investing-made-easy.

Money stresses most people out. The last thing we want to do is to study stocks and look at charts all day. Most of us just want to set it and forget it. You’re able to do that with Wealthsimple (we look at the sign up process later in this article).

On that note…

Wealthsimple does the work for you when it comes to investing.

“Personal finance is boring.”

I get it. Not everyone is into stocks and investing their own money.

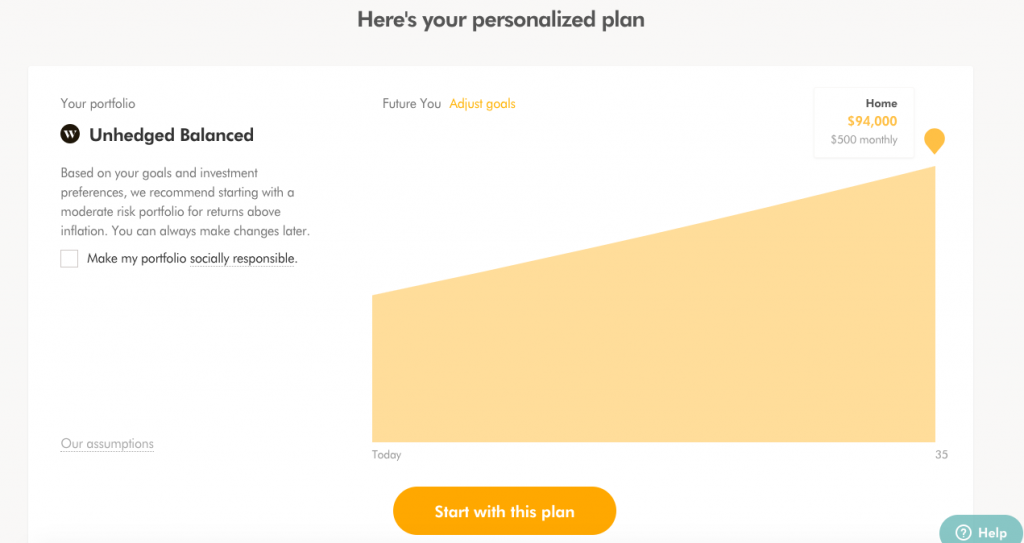

Wealthsimple will do the work for you. They ask you about what kind of investor you are, your goals, and when you want to reach your goals. From there, Wealthsimple will find the ideal portfolio for your situation so that you don’t have to guess or get stuck for another few months.

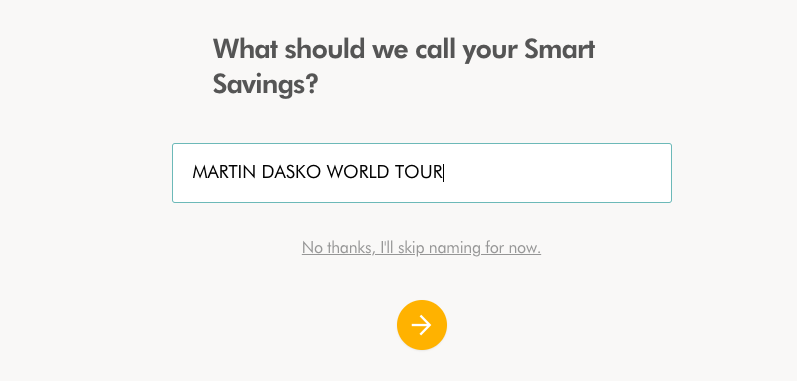

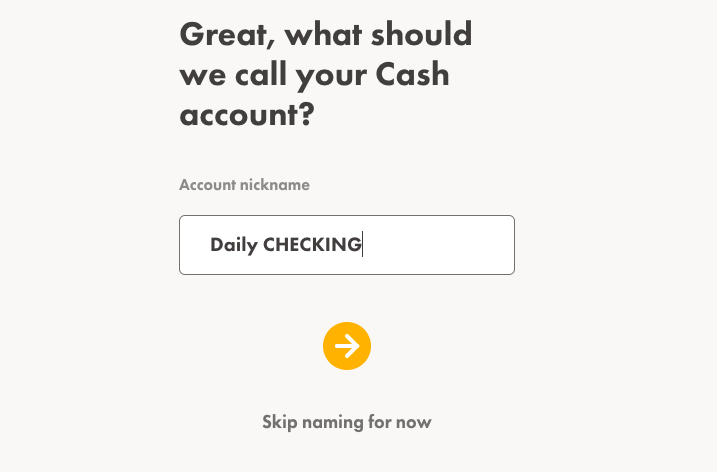

You have a visual reminder of your goals.

Saving for that house seems daunting or planning for that trip can feel pointless when you can’t even fathom how you’re going to make it happen. It’s easy to feel poor when you see your bank account after the expenses come out.

With Wealthsimple, you can set goals and you can name your accounts. For example:

This may seem a little silly at first glance, but personal finance can be very anxiety inducing. Naming your savings/investment account something clever can be the motivation that you need to save more and to focus on growing that side hustle or to just remember why you started saving in the first place.

I’ve always used account names to keep my eye on the prize. With Wealthsimple, you can set clear goals with a deadline. You don’t have to guess or fumble in the dark.

While I’m personally motivated by travel, you don’t have to be especially with everything that’s happening in the world. You can name your account anything that you want. You can also set your own unique goals based on what’s happening in your life.

It’s easy to set up an account with Wealthsimple.

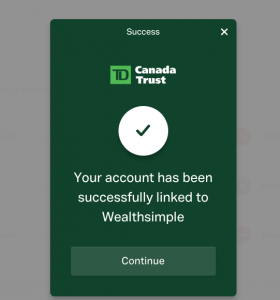

I hate paperwork and dealing with forms. Luckily, signing up with Wealthsimple was a hassle-free process. I did everything one evening on my laptop. I connected my main banking account and I was ready to go. I had my account funded within a few days.

Wealthsimple explains things for you.

When I first started investing in 2005, it was all pretty confusing and frustrating. I had to look everything up on my own and it felt like torture. As I went through the Wealthsimple platform, I noticed that they had videos explaining key concepts in basic terms. They have videos on how to retire, the rules of investing, picking stocks, and so on.

The fees are fair.

The Basic account (up to $100,000) comes with a 0.5% free. The Black account (deposits between $100,000 and $500,000) comes with a 0.4% fee. The Generation accounts (over $500,000) comes with a 0.4% fee.

Here are a few other benefits of Wealthsimple:

- No fees for inactive accounts.

- There’s no account minimum.

- You have access to human advisors.

- A mobile app that’s very user-friendly.

- They offer socially responsible investment options.

What about the setbacks of signing up with Wealthsimple?

- Transferring money between accounts is annoying.

- The currency exchange when purchasing U.S investments is hefty.

- The fees are a bit on the pricey end for some of the investments.

How do you get started with Wealtsimple?

Here’s the exact process for how you can get started with Wealthsimple in less than an hour.

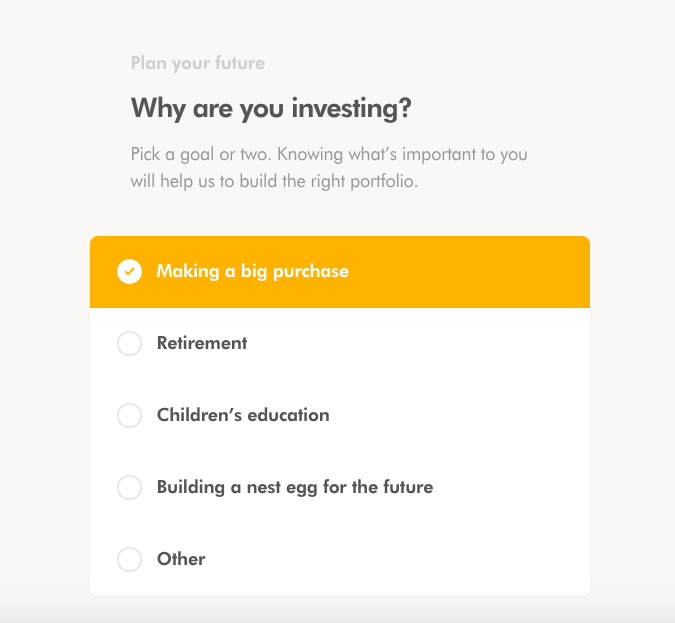

You go to the sign up page where they ask you about your goals and what kind of investor you are.

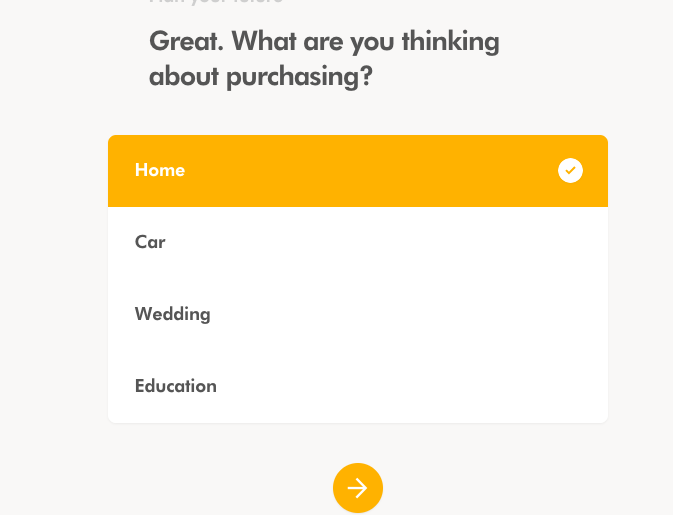

Why are you investing your money in the first place?

Most of us can’t save money for the sake of saving. We need a reason to do so. They list out a few common reasons to see what excites you.

For the sake of this article, I’m using the “big purchase” option as you likely may want to move out soon, save up for that place or plan that “small” wedding.

I chose home as this is the most common one.

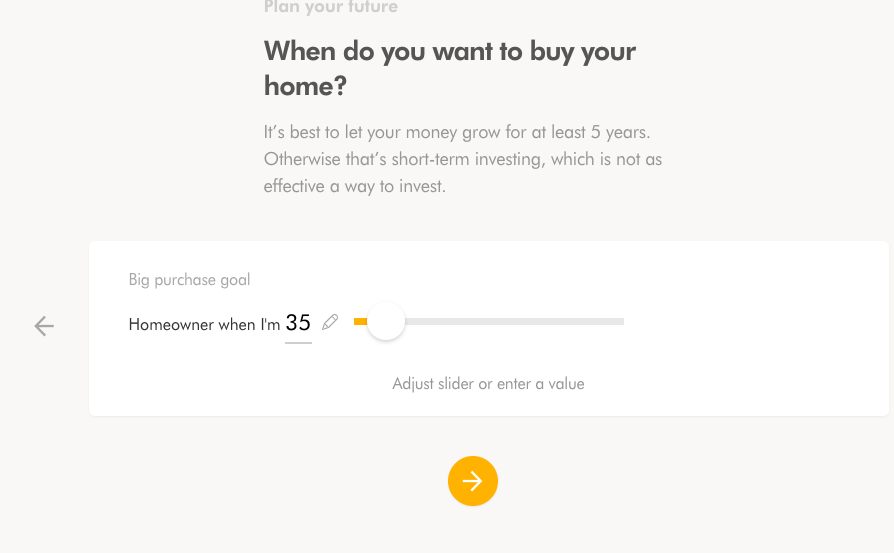

When do you want that home? This is an important aspect to look at because they want to see if this is something urgent or if you have time.

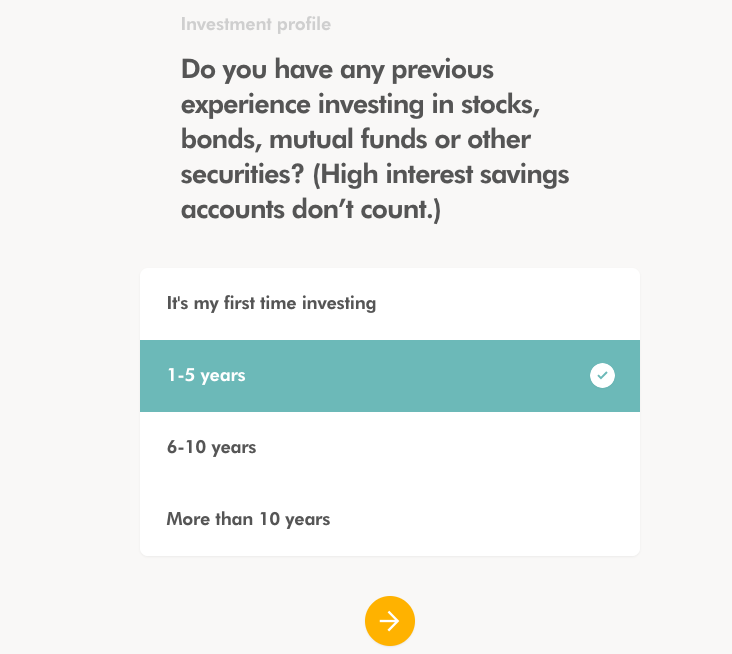

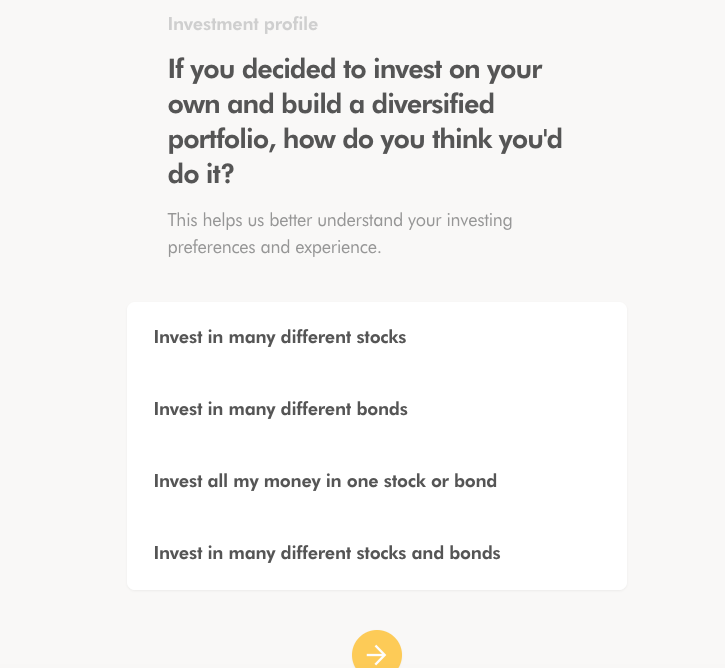

Do you have any experience with investing?

What kind of investing have you done? Be honest.

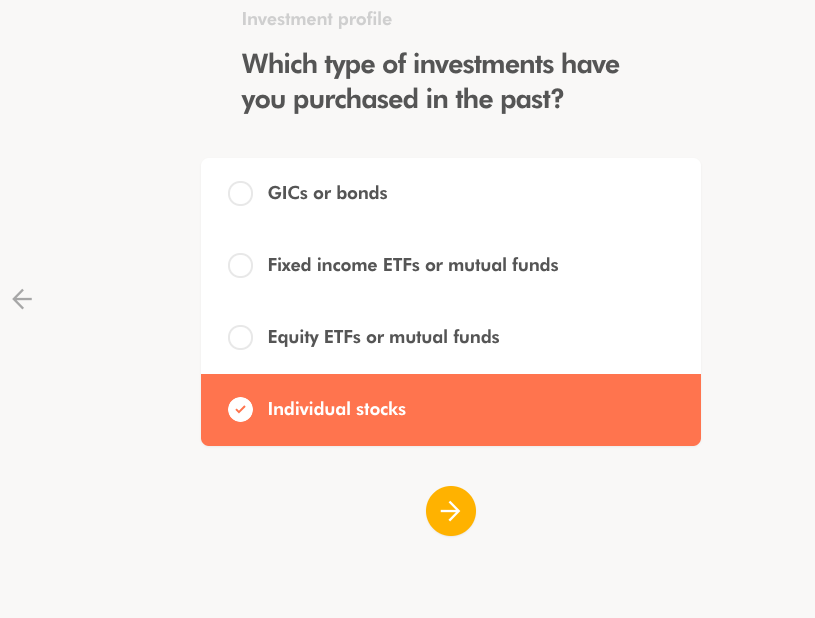

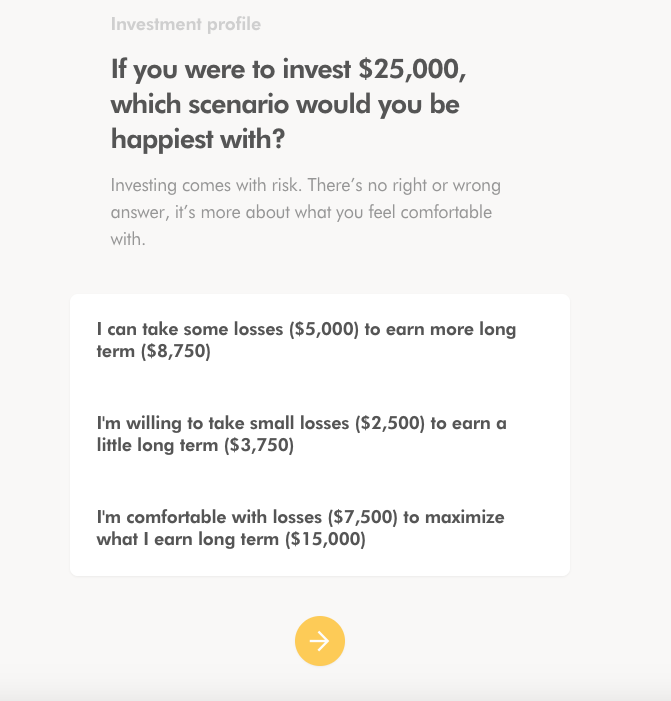

What kind of investor are you? This is done to see what kind of investments would be best suited for you because investing is personal. We all have different levels of risk tolerance.

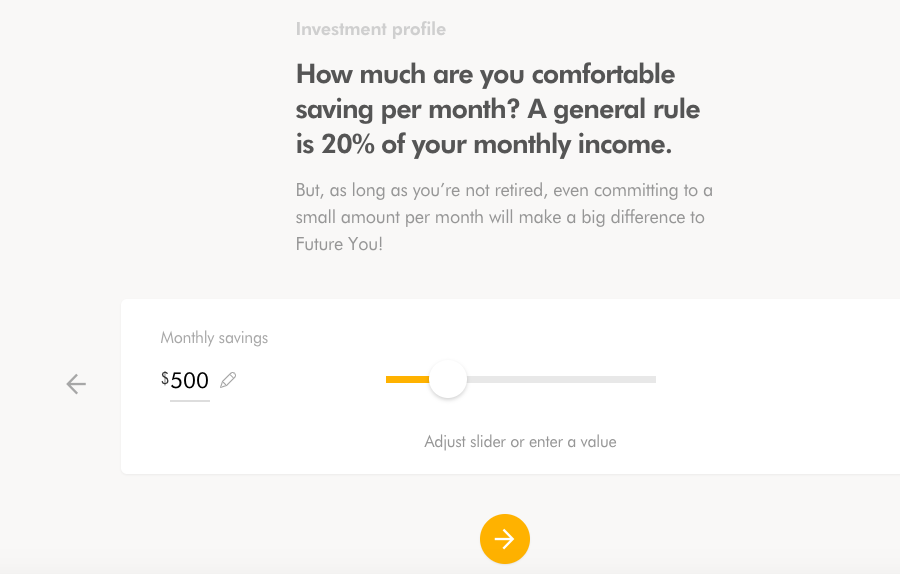

How much do you want to start saving?

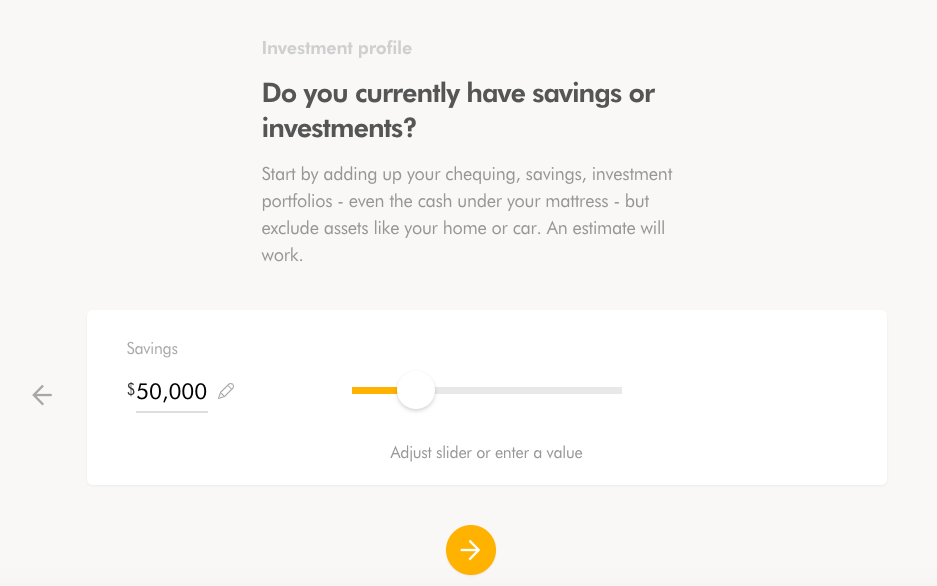

What are your savings like right now? We all start at different levels and that’s okay. It’s never too late or too early to start investing your money.

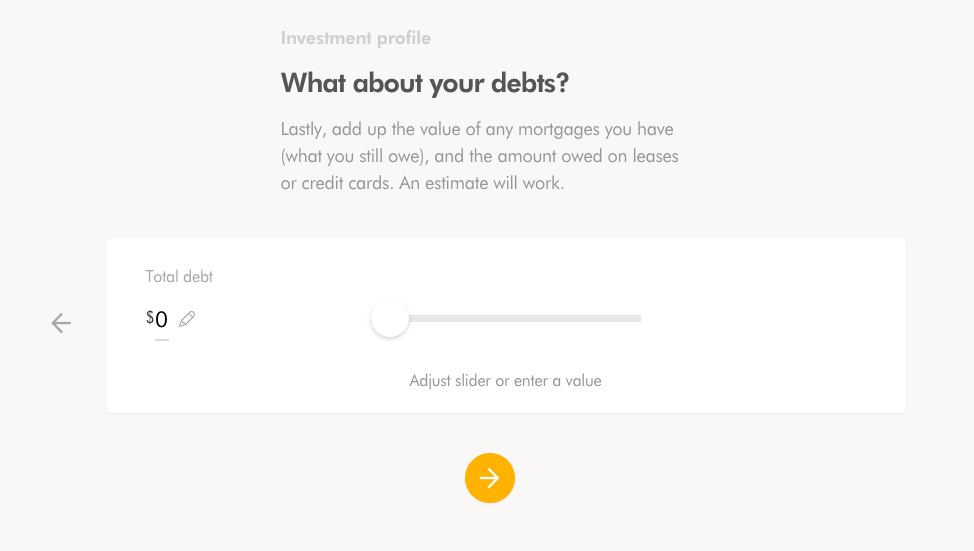

Do you even any debt? What’s your debt like? They look at this to help figure out your situation.

They ask a few questions to see how you handle risks.

Then you get a personalized plan based on your goals and what you’re willing to put away. You can play around with the numbers here. You can have the monthly deposit come out of your current banking account automatically.

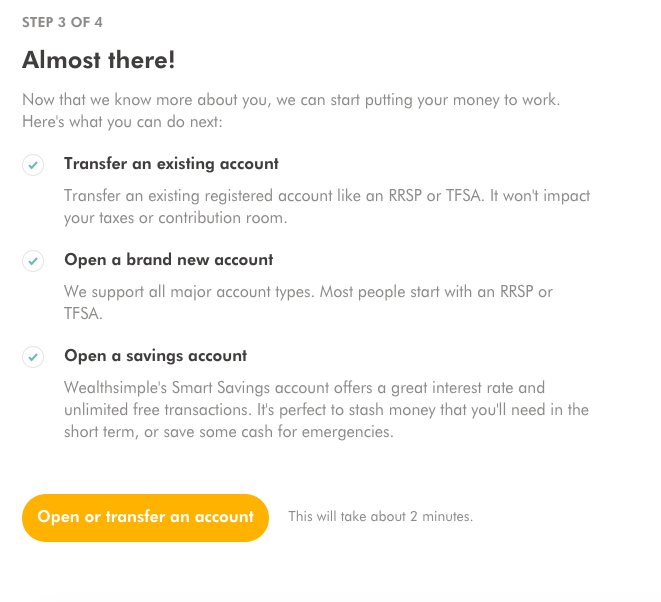

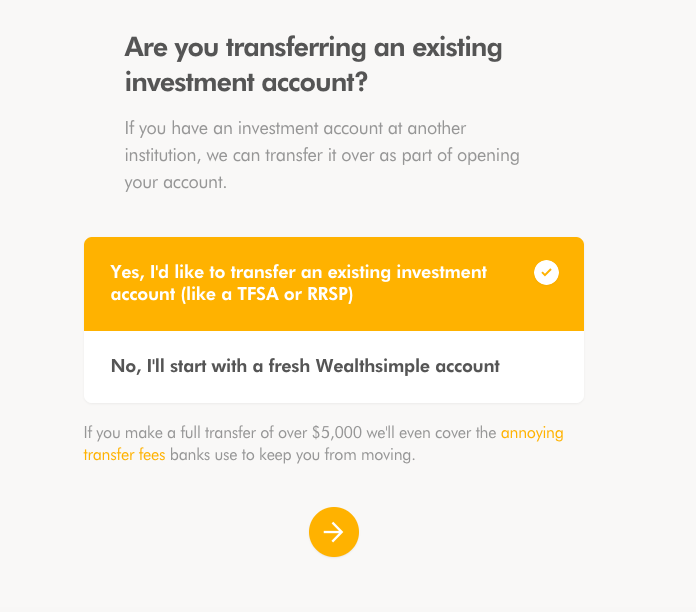

It’s time to figure out if you want to start fresh or transfer an account over.

The fees are covered if you want to transfer in an existing account.

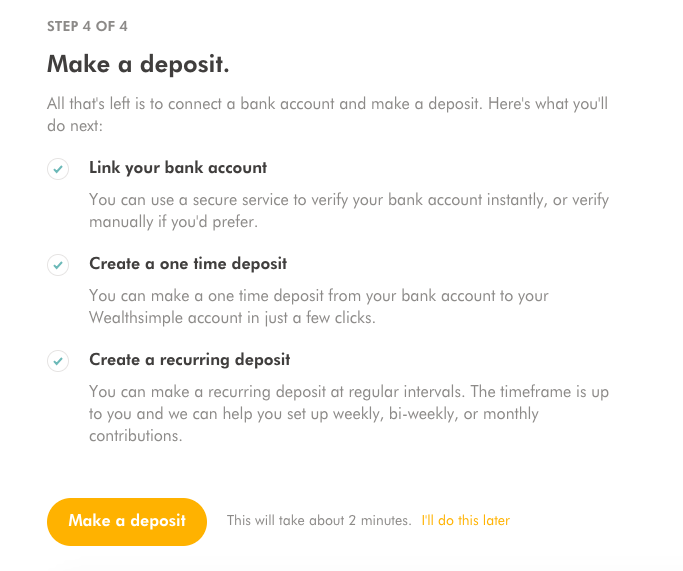

Now you send some money over.

The money is in.

Once your accounts are linked, it’s easy to transfer money over. This tool makes it easy and fun to watch your money grow.

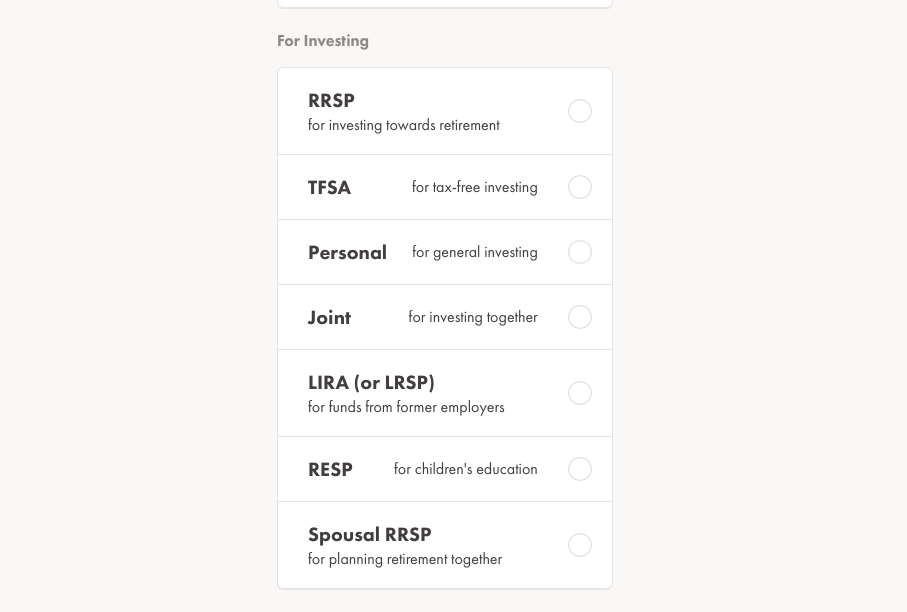

What kind of account are you looking to open up?

Here are your options for different accounts to open…

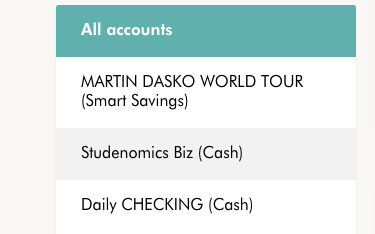

I created the Cash account as I completed this Wealthsimple review.

Here’s a summary of my accounts.

The Cash account is still fairly new, but these are the accounts that I’ll have setup with Wealthsimple moving forward.

[Click this link to sign up and have $10,000 managed for free in Canada.]

What should you do as a young professional looking to invest your money?

“I don’t know what to do with my money.”

I hear this at least once a day.

Here’s the scenario:

So you’re making decent money and you’re ready to start investing for the future. You know that you eventually want to buy a property or get married. You just don’t know what to do today.

Here’s what I would do…

- Setup an account with Wealthsimple and automate transfers for whenever you get paid so that you don’t have to do anything on your end. I don’t want you thinking about money 24/7.

- Keep on saving and investing until you’re happy with the balance.

- Take a few risks when you’re ready. When the time is ready you can cash out to buy that place or to try out other investment options.

How can you start investing your money in the stock market with Wealthsimple?

The good news is that you can dabble in the stock market and with cryptocurrency investing with Wealthsimple now without worrying about the hefty fees.

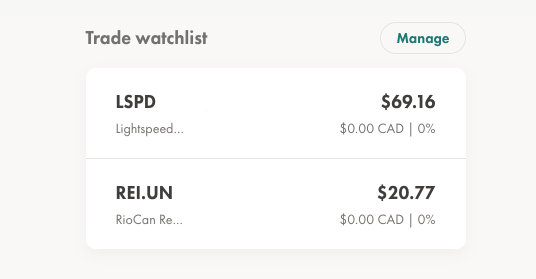

You can purchase individual stocks commission-free. You can even track these stocks if you’re not fully comfortable with investing yet.

I decided to put some money into my Wealthsimple account.

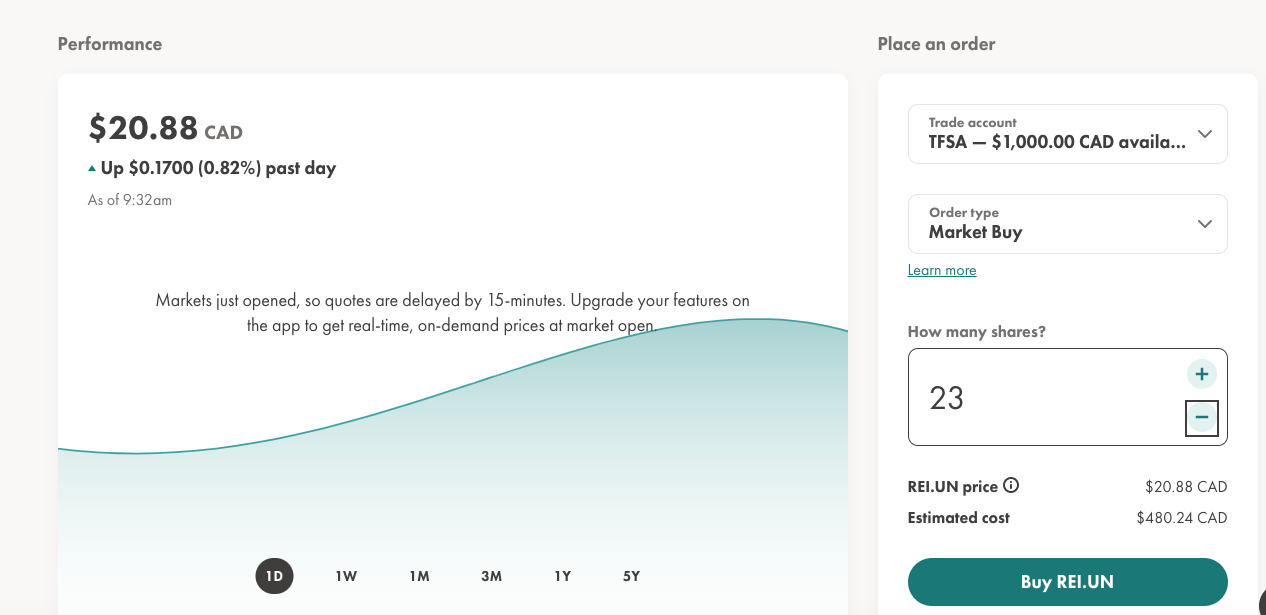

I opened up a TFSA account and I started with tracking a few stocks.

You can track until you’re comfortable with investing your money. The platform is always explaining the process to you every step of the way.

Here’s a message that Wealthsimple sent me prior to purchasing shares.

Then when you go to actually purchase shares, it’s a straight-forward process.

I was pretty impressed with how easy it was to purchase cryptocurrency or stocks with Wealthsimple.

What about Wealthsimple Cash?

Wealthsimple has entered the daily banking game with Wealthsimple Cash

What’s the deal with the new account? I originally wrote this article to look at the investing side of Wealthsimple. As I was testing out the service, they rolled out the new Cash account.

I’ve personally been burned with account fees and ATM fees many times. This new account is supposed to be a hybrid where you can earn interest on your daily banking account.

I’m obviously all for making more money off your money. I just need to point out two things:

- Don’t go chasing interest rates. You don’t want to open a new account every single time that you hear about a higher interest rate.

- You shouldn’t replace your daily banking account just yet. The card isn’t available yet. I wouldn’t make the full switch until the card is ready.

The goal is to keep on saving and investing until you have enough money to invest into something bigger (buying a business, purchasing a home, or something along those lines).

Here are a few articles that I’ve written on this topic:

- Confused about investing? Everything you could want to know.

- What you need to know about the stock market so that you don’t lose your pants.

- How does the stock market work?

Click this link to have $10,000 managed for free in Canada.

You work hard for your money. Let your money work for you with Wealthsimple.

Good advice. I had been with on bank for over 30 years, then decided they were not respecting my loyalty and started looking around.

I will check back in when my cash flow improves. Never too late to start saving.

Well said Vickie. It’s never too late.