“So I started a website about financial advice.”

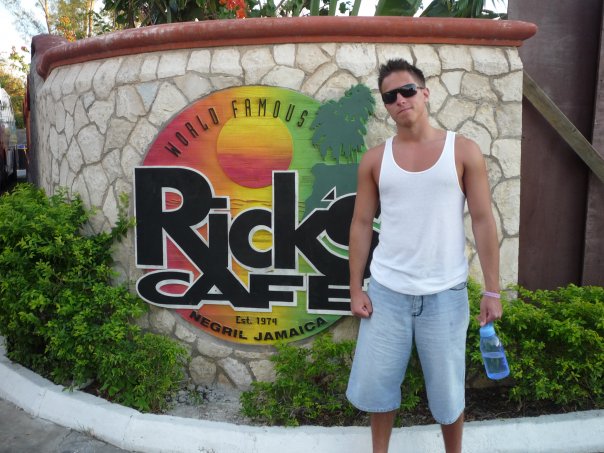

It was the end of 2008 and I was in Jamaica with my girlfriend at the time. I was 20 years old and I had life figured out. I finally launched my financial blog. I was ready to start sharing all of my wisdom with the world.

I didn’t actually have life figured out like I thought I did. I was studying business in college and I knew a little bit about investing money. I wasn’t sure what was going to happen next. Now I’m 30 years old and I cringe when I think about my earlier work on money. This article has 20 money lessons for everyone in their 20s.

There was a lot that I had to learn the hard way about money (and relationships — we’ll save that for another day though). I’m pretty content with how everything turned out as I wouldn’t trade my stories in for anything. I just want to save you some time if you’re reading this at 20 (or younger or older).

Now that I’m 30 I find myself hanging out with friends and readers who are as much as a decade younger than me. I give them the same advice when they ask for it. I decided to include my own personal lessons and stories that I had to figure out about personal finance through experience. I reached out to experts in the personal finance space to see what they wish they knew about money at 20.

This is a picture of me at the beginning of my 20s. I thought that I was too cool to smile. I would love to have a chat with this guy.

I tried something different for this article. I’m starting off with advice from friends before dropping my own tips to 20-year old Martin and anyone else in their 20s. I would love to hear from you in the comments about what you wish you knew about money at 20.

We did a video on why 30 is not the new 20…

What are 20 things about money that everyone should know in their 20s? What do we wish that we know about money at 20?

1. Pay attention to your lifestyle.

“I wish I paid more attention to *lifestyle design* and realized there were much more fun ways and opportunities to live and work than I did. I would have loved to become a minimalist much sooner and lived out of a house boat/RV/tiny home/etc before getting married and having a billion kids. Hell – I would have moved back with my parents for a few years too and banked money instead of just spending it all and trying to be an ‘adult!’ Haha… Adulting is overrated” — J. Money of Budgets Are Sexy.

2. Money is a tool.

“Money is simply a tool. It doesn’t have any more power than what you give it. It can be used to build wealth or dig yourself into debt.

The best way to get better with money is to manage what you have now. Eliminate debts, avoid impulse spending, and set a recurring plan for saving. Make it automatic and you’ll be ahead of most of your peers.” – LaTisha Styles of CreatingCoins.

3. You don’t have to look for the sexiest investment.

“Investing would have been much easier if I knew that low-cost passive index performs so well. All you have to do is focus on saving and investing as much as you can. I wasted a ton of time and energy trying to find better investments and index funds worker much better.” — Joe Udo of Retire by 40.

4. Have faith in yourself to make more money.

“If I could go back and give my 20s self some advice, it would be to have more faith in my ability to earn outside of my full-time day job. While I had some side hustles that did lead to great success in the long run, I could have been more aggressive working on my side income and reached faster success. It all worked out in the long run, but I could have shaved some time off of my cubicle years if I had know what was possible.” — Eric Rosenberg of Personal Profitability.

5. Stop worrying about what everyone thinks!

“From 22-26 I was out of control. Buying trays of shots at the local pool hall/club. Leasing a car with all the upgrades then adding a $1,000 stereo. Buying 400-disc DVD players. I guess I just wanted to be the one known for the cool stuff. Now I don’t give a crap about what anyone thinks or does and only worry about my family and few people I choose to get close. If I had developed that attitude earlier I could’ve saved myself a ton of money and hassle getting back on track financially!” — Eric J. Nisall, accountant and creator of Bookkeeping For Bloggers.

6. You need to be in charge of everything in your own life.

“The top thing I wish I’d known was that I need to be in charge of everything in my own life. I need to take ownership. I need to be proactive. If I don’t like something, I can’t wait for somebody else to fix it. I have to fix it myself. (Or accept the fact that I’m choosing to remain in my current situation.) Does that make sense?” — J.D. Roth of Get Rich Slowly.

7. Spend less than you earn.

“Financially, I wish I’d understood that the whole ‘spend less than you earn’ advice sounds stupid and simple, but it’s really all you need to know. The savings curve — MMM’s “shockingly simply math of early retirement” — is the ONLY thing you need to understand about money. When you look at that, when you really understand it and apply it to your life, everything becomes clear. Maybe not easy, but clear. The bigger the gap between your earning and spending, the quicker you achieve your financial goals. End of story.” — J.D.

8. Small efforts have a huge effort on your future.

“I wish I would have understood that a small amount could have such a HUGE impact later on in my life. But, even more than that, I wish I would have also understood that investing in general would be a domino effect that would lead me down a path of learning into other areas such as productivity, entrepreneurship and running a small business. That’s why when a 20 year-old starts investing for the first time, even if it’s $50 per month, I’m excited for their journey ahead. It’s going to be a blast! — Jeff Rose of Good Financial Cents.

Check out his video on the topic…

9. Commit to the gym.

I always dabbled in weights and MMA-style training but I never committed to anything. It wasn’t until I was 25 that I got serious about BJJ and weight lifting. There’s nothing better for your confidence and overall mood than training. The attitude and discipline that you pick up from the gym goes a long way in real life. Plus, it doesn’t hurt to be jacked. You can read up on my recent experiment with intermittent fasting for more.

10. The longest way there is sometimes the fastest.

There are no shortcuts. This isn’t just some corny motivational quote. It actually works. Don’t rush stuff that can’t be rushed. Don’t chase get rich quick schemes.

On that note, if it was that easy to get rich, why didn’t anyone else try this before you? I’ve seen this happen to good people. They get caught up in pyramid schemes. They start selling detox tea or some other useless product on social media to their friends and family. I don’t want to see this happen to you.

11. You should study successful people.

“That guy’s so lucky. His business took off and now he’s making money.”

WHAT?

It surprises me when I hear friends complaining about someone who’s successful. How could you bash someone for their positive results? Don’t be mad at them for doing something that you were afraid of doing.

Do you have any successful friends? Do you have access to friends who are ahead of everyone else?

Do whatever it takes to be around them. Don’t hang out with the same losers waiting in line at clubs. They’ll be there next week and the week after that.

12. Always invest in yourself.

If you make money off your business, put it right back into the business. Try to always invest in yourself.

What are easy ways to invest in yourself?

- Eat better.

- Take courses.

- Attend events in your field even when you want to party.

- Upgrade your skills.

In the moment this might seem like a hassle, but this usually pays off. Don’t worry if you can always afford to invest in yourself. Try to do it whenever possible.

13. Small wins lead to big wins.

I need to stress this point again. The small things can become the big things. The way you do anything is the way that you do everything.

This is almost impossible to accept at 20. Changing your mindset will change your bank account. I started putting aside $50 bi-weekly into a savings bond when I was 18. This grew to $13,418.95 and I treated myself to a trip around the world since I totally forgot about this account.

14. You have nothing to lose in your 20s.

I stressed too much about things falling apart in my 20s. That won’t happen. You have nothing to lose. The problem is that many young people only apply this advice to partying for some reason. This also applies to your career and finances.

Don’t be afraid of working on that project that could fail. Talk to the prettiest girl in the bar. Ask for that raise. Take some risks. You’ll be laughing off your failures in a few years anyways.

15. You don’t have to buy drinks for girls.

“Whatever you do, do NOT pay for the round.”

I remember it was 2010 and these two young ladies had the audacity to come to us to ask for drinks. I couldn’t believe it. They straight up asked for drinks. I don’t mind buying a girlfriend or a female friend a drink when we’re doing rounds. There’s zero chance of me buying a drink for a complete stranger.

The guy paid for the round and they walked away. Goodbye $30.

I wasn’t wiser than him. I just had gone through this before.

16. Build your own thing.

Freelancing is awesome. Having a job is great. Building your own thing is the best when it works out.

Generally speaking, it’s better to be in control of your future. This is easier to do with your own business. I’m not delusional about this either I don’t want you to max out your credit cards while you live with your mom. You can build your own business on the side.

17. Find a way to see to the world.

There’s so much happening around the world. Go and travel. Explore. Make the money work. Make this happen.

I traveled a decent amount in my 20s but I never relocated or took any major risks. My brothers are currently living in Australia and I’m pretty jealous.

It’s important to find a way to make the money work for travel in your 20s. I figured out how to cut back on everything else in life so that I could travel. I just wish that I found a way to do more long-term travel.

18. It’s not healthy to count someone else’s money.

“There’s the rich man!”

There’s a guy who always makes this passive aggressive comment every single time he sees me. I try to laugh it off.

Focus on your own finances.

We all have our own unique lives. I know for a fact that this guy places video games while I’m working. I know that he has made no effort to improve himself or to try to increase his income.

I’m all for competition, as long as it’s fun and healthy. Don’t go counting your friend’s money.

19. You’re going to get old/YOLO.

I struggle with the concept of YOLO (you only live once). This sounds like a terrible way to justify poor decisions. It’s actually a reminder that you need to get stuff done right now. You need to plan for being old. Old people get married and have kids. They also have to retire eventually. Don’t think that you’re going to be young forever.

Plan for the future. Learn about that boring retirement stuff.

20. Don’t let your Tinder mindset destroy everything good for you.

We have more options than ever as a society. It’s our lack of focus that hurts us. This impacts me and almost everyone that I speak to. I’ve seen so many friends jump around between ideas only to end up at nothing. There won’t always be another business around the corner. You won’t always have another shot. You have to capture what’s in front of you.

Those are 20 money lessons for everyone in their 20s. Thanks to my friends for helping me. It’s your turn to share your money lesson.

“I think your 20s are the hardest part of life. I mean, everyone goes on about how hard it is to be a teenager, but actually I think it’s tougher to be in your 20s because you’re expected to be a grownup and expected to earn your own living and be successful and I think you feel like a kid still.” — Nigel Cole

I thought my twenties were going to be the best part of my life… when I was 22. Now I’m about to turn 28 and have realized that my thirties are going to be WHERE IT’S AT! My life is one thousand times better now than it was 5-7 years ago. You make great points.

I also wish I had learned to invest in quality over buying the cheapest pieces of things. It can seem hard when you’re not making a lot of money, but I wish I had just gone the extra mile and splurged because I ended up trashing most of the original stuff I bought.

I was stressed about turning 30, but I’m really enjoying it and can’t wait to see what’s next.

I don’t think adulting is that overrated. It’s a part of everyone’s life, and living with your parents in your 20s generally isn’t very fun. Too many small clashes in the household.

Good point about living with parents. It just depends on the situation and the relationship with the family. I’m happiest when I go home once a week or so.